AR RCL317A 2014 free printable template

Show details

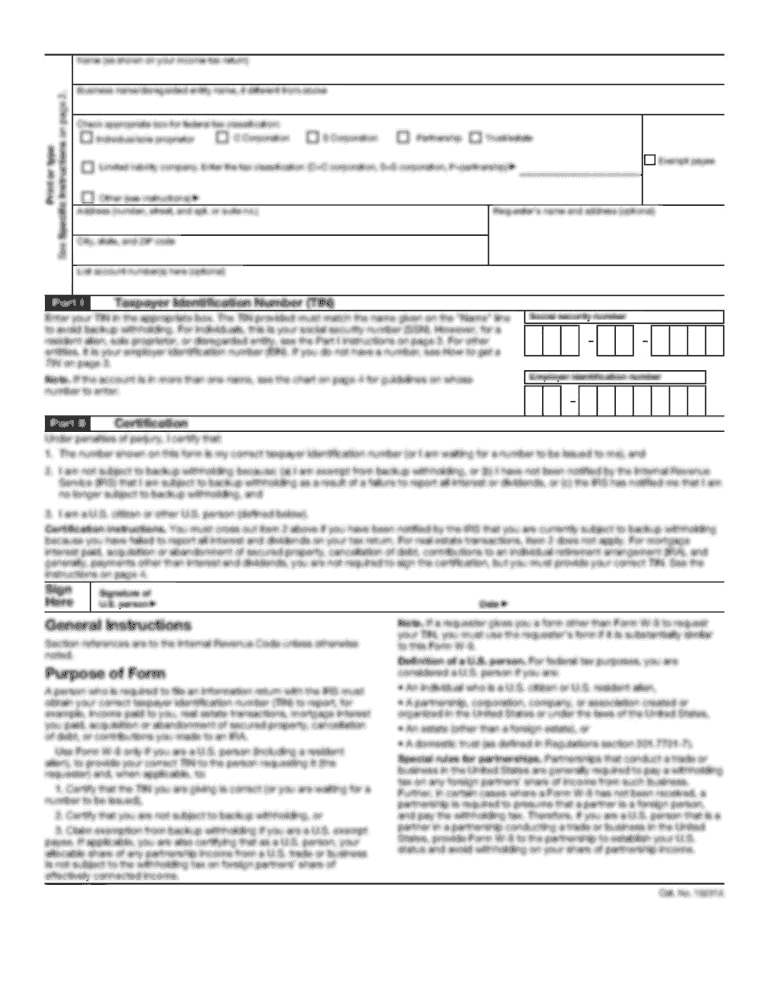

STATE OF COUNTY OF ss AFFIDAVIT OF SELF EMPLOYMENT EXEMPTION UNDER THE WORKERS COMPENSATION ACT I Printed Name being first duly sworn upon oath deposes and states the following I am applying for a contractor s license for my company through the State of Arizona s Registrar of Contractors office. I am aware that as a condition of licensure that my company must comply with the Workers Compensation Act. I am self-employed* Therefore I am not an employer subject to the provisions of A. R*S*...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AR RCL317A

Edit your AR RCL317A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AR RCL317A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AR RCL317A online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AR RCL317A. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR RCL317A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AR RCL317A

How to fill out AR RCL317A

01

Start with the header section and enter your name and contact information.

02

Fill in the date on which you are submitting the form.

03

Provide accurate details about the property involved, including the address.

04

Complete the section for identifying the type of application you are filing.

05

Sign and date the form at the bottom to certify that the information is correct.

Who needs AR RCL317A?

01

Individuals or entities filing for property tax exemption.

02

Property owners seeking financial relief on their assessed property value.

Fill

form

: Try Risk Free

People Also Ask about

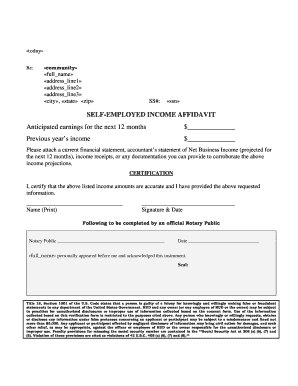

How do I document self-employment income?

There is no W-2 self-employed specific form that you can create. Instead, you must report your self-employment income on Schedule C (Form 1040) to report income or (loss) from any business you operated or profession you practiced as a sole proprietor in which you engaged for profit.

How do you prove income when paid cash?

Next, we'll take a look at 10 ways to show proof of income if paid in cash. #1: Create a Paystub. #2: Keep an Updated Spreadsheet. #3: Bookkeeping Software. #4: Always Deposit the Payment and Print Bank Records. #5: Put it in Writing. #6: Create Your Own Receipts. #7: Utilize Your Tax Documents. #8: Use an App.

Do you need a 1099 to file self-employment?

If you did not receive a 1099 form from your employer, you are still required to report your income on your tax return. You can do this by using Form 1040 Schedule C. This form is for self-employment income and expenses. You will need to provide your Social Security number and the EIN of your business if you have one.

How do I write an affidavit for EDD?

1:36 6:15 CA EDD: How To Write An Affidavit For PUA Unemployment - YouTube YouTube Start of suggested clip End of suggested clip For example my name is shelley's millions i'm 44. And reside at 1122 future millionaires lane losMoreFor example my name is shelley's millions i'm 44. And reside at 1122 future millionaires lane los angeles california 9002 8. Step 3 is to write a statement of truth.

What document proves self-employment?

If you're self-employed, you can show proof of income in the following ways: Use a 1099 form from your client showing how much you earned from them. Create a profit and loss statement for your business. Provide bank statements that show money coming into the account.

How do I document self employment?

Some ways to prove self-employment income include: Annual Tax Return (Form 1040) This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS. 1099 Forms. Bank Statements. Profit/Loss Statements. Self-Employed Pay Stubs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my AR RCL317A directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your AR RCL317A and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I modify AR RCL317A without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your AR RCL317A into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send AR RCL317A to be eSigned by others?

When your AR RCL317A is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

What is AR RCL317A?

AR RCL317A is a form used by certain taxpayers in Arkansas to report business income and expenses.

Who is required to file AR RCL317A?

Taxpayers who are engaged in business activities and meet specific filing thresholds are required to file AR RCL317A.

How to fill out AR RCL317A?

To fill out AR RCL317A, obtain the form from the Arkansas Department of Finance and Administration, then complete all required sections, including business details, income, and expenses.

What is the purpose of AR RCL317A?

The purpose of AR RCL317A is to accurately report the financial performance of a business for tax purposes in the state of Arkansas.

What information must be reported on AR RCL317A?

Information that must be reported on AR RCL317A includes business name, type of business, income earned, expenses incurred, and any applicable deductions.

Fill out your AR RCL317A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AR rcl317a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.