CO DoR 104 2005 free printable template

Show details

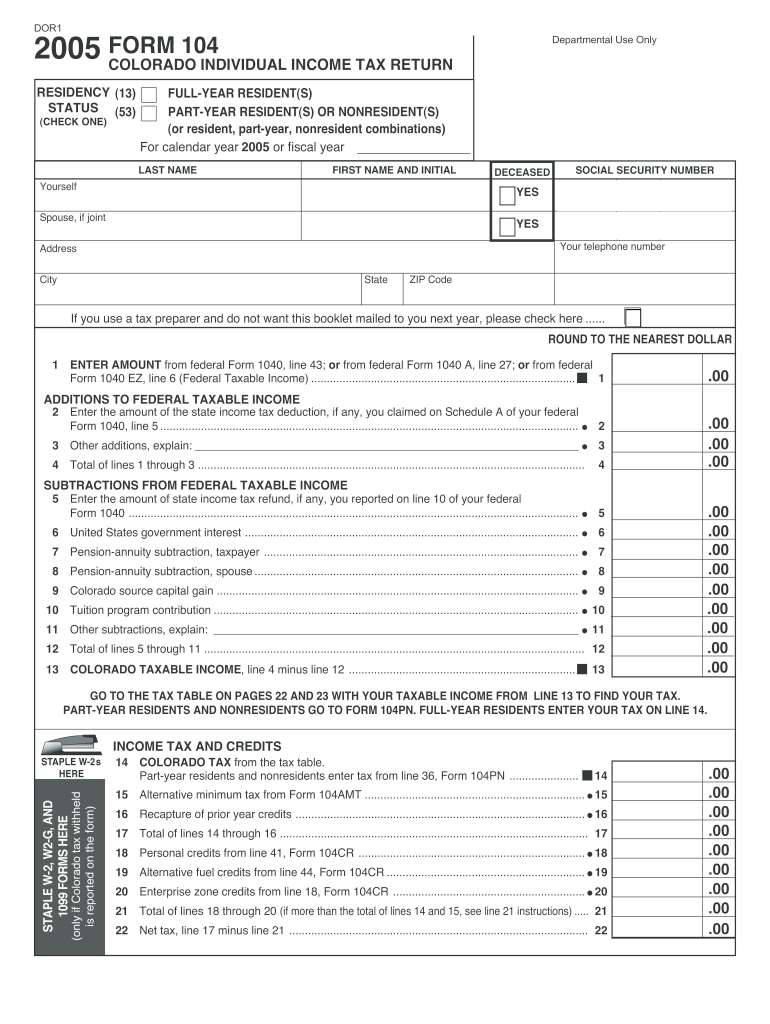

DOR1 2005 FORM 104 COLORADO INDIVIDUAL INCOME TAX RETURN RESIDENCY (13) STATUS (53) (CHECK ONE) Departmental Use Only FULL-YEAR RESIDENT(S) PART-YEAR RESIDENT(S) OR NONRESIDENT(S) (or resident, part-year,

pdfFiller is not affiliated with any government organization

Instructions and Help about CO DoR 104

How to edit CO DoR 104

How to fill out CO DoR 104

Instructions and Help about CO DoR 104

How to edit CO DoR 104

To edit CO DoR 104, you can use tools that allow you to fill out and modify PDF documents. Editing the form involves using a PDF editor to input your information correctly. Ensure that all changes comply with current tax regulations and accurately reflect your financial situation.

How to fill out CO DoR 104

To fill out CO DoR 104, follow these steps:

01

Download the form from the Colorado Department of Revenue website or use a PDF editor like pdfFiller.

02

Enter your identification information, including your name, address, and taxpayer identification number.

03

Fill in the relevant financial information based on your income and other tax obligations.

04

Review your entries for accuracy before submitting the form.

About CO DoR previous version

What is CO DoR 104?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CO DoR previous version

What is CO DoR 104?

CO DoR 104 is the Colorado Individual Income Tax Return form used by residents to report their personal income. This form is essential for calculating the taxes owed to the state of Colorado based on an individual's earnings for a given tax year. It is crucial for compliance with state income tax laws.

What is the purpose of this form?

The purpose of CO DoR 104 is to collect tax information from individuals filing their income tax returns in Colorado. This allows the state to assess the amount of tax owed based on the filer’s reported income and deductions. Accurate completion of this form ensures compliance with state tax laws and avoids penalties.

Who needs the form?

Residents of Colorado who earn income are typically required to file CO DoR 104. This includes individuals with wages, self-employment income, dividends, and interest. If you meet the income thresholds set by the state, you must file this form to declare your income and calculate your tax liability.

When am I exempt from filling out this form?

You may be exempt from filing CO DoR 104 if your income falls below a certain threshold set by the Colorado Department of Revenue. Additionally, if you are a dependent and your income is not taxable, you may not need to file. Always check current guidelines to determine your eligibility for exemptions.

Components of the form

CO DoR 104 consists of several key components necessary for accurate tax reporting. These include personal identification details, income sections for wages, self-employment earnings, and adjustments, as well as deductions and credits available to reduce taxable income. Each section must be completed thoroughly to ensure proper tax calculations.

What are the penalties for not issuing the form?

Failure to file CO DoR 104 by the due date can lead to penalties imposed by the Colorado Department of Revenue. These may include late filing fees, interest on unpaid taxes, and potential legal ramifications. It is important to file on time to avoid additional financial burdens.

What information do you need when you file the form?

When filing CO DoR 104, gather all necessary information, including your Social Security number, income statements (W-2s, 1099 forms), and any documentation of deductions or credits. This ensures accurate reporting and compliance with state tax regulations, resulting in a smooth filing process.

Is the form accompanied by other forms?

In some cases, CO DoR 104 may be accompanied by other forms or schedules, such as those for claiming specific deductions or credits. It is essential to check the Colorado Department of Revenue’s guidelines to determine if any additional documentation is required for your individual tax situation.

Where do I send the form?

CO DoR 104 should be submitted to the Colorado Department of Revenue. You can mail your completed form or, if available, submit it electronically through a tax preparation platform. Ensure you use the correct mailing address if you choose to send a paper form to avoid delays in processing.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

pdf filler has allowed me to easily upload and edit pdf documents...as the technology improves it will be a standard use software for most users.

Where has PDFfiller been my whole life?!?! LOVE IT!

See what our users say