GA Application for Basic Homestead Exemption - Fulton County 2015 free printable template

Show details

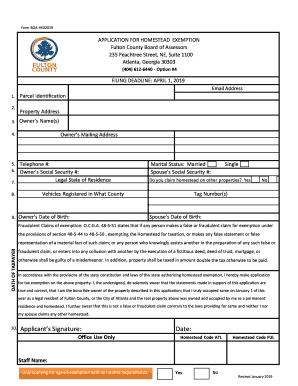

Form HEX2015-bw. CP HOMESTEAD EXEMPTION FILING DEADLINE: APRIL 1, 2015, Fulton County Board of Assessors 141 Pryor Street, S.W. Suite 1029A Atlanta, GA. 30303 (404) 612 6440 Option #4 APPLICATION

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign GA Application for Basic Homestead Exemption

Edit your GA Application for Basic Homestead Exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your GA Application for Basic Homestead Exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing GA Application for Basic Homestead Exemption online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit GA Application for Basic Homestead Exemption. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA Application for Basic Homestead Exemption - Fulton County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out GA Application for Basic Homestead Exemption

How to fill out GA Application for Basic Homestead Exemption - Fulton

01

Visit the Fulton County Board of Assessors website to download the GA Application for Basic Homestead Exemption.

02

Read the application instructions carefully before filling out the form.

03

Provide accurate personal information, including your name, address, and contact details.

04

Indicate whether you are the owner of the property and provide the deed book and page number.

05

Affirm that the property is your primary residence by signing the declaration on the form.

06

Attach required documentation, such as proof of age (if applicable) and income information.

07

Double-check all the information for accuracy before submitting.

08

Submit the completed application to the Fulton County Board of Assessors by mail or in person.

Who needs GA Application for Basic Homestead Exemption - Fulton?

01

Homeowners in Fulton County who are seeking a reduction in property taxes on their primary residence.

02

Individuals who have recently purchased a home and want to apply for property tax exemptions.

03

Senior citizens and disabled individuals who meet specific eligibility criteria for exemptions.

Fill

form

: Try Risk Free

People Also Ask about

How do I check my homestead exemption in Florida?

Homestead Application Status Check Enter either the confirmation code (Example: BPRVXWJM) from your hold slip OR application ID (Example: 99684) from your copy of the application. Next, enter Applicant Name. Last, click “Check Status” to see the status of your application.

How much does homestead exemption save you in Texas?

As of May 22, 2022, the Texas residential homestead exemption entitles the homeowner to a $40,000 reduction in value for school tax purposes. Counties, cities, and special taxing districts may offer homestead exemptions up to 20% of the total value. Most counties in North Texas do offer this 20% reduction.

What documents do I need for homestead exemption in Florida?

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.

How do I check my homestead exemption status in Florida?

Homestead Application Status Check Enter either the confirmation code (Example: BPRVXWJM) from your hold slip OR application ID (Example: 99684) from your copy of the application. Next, enter Applicant Name. Last, click “Check Status” to see the status of your application.

Do both owners have to apply for homestead exemption in Florida?

Married Couples Failing to Apply for Exemptions Together Both spouses should sign the application for exemption. If one spouse dies and the surviving spouse did not sign the original homestead application then the homestead exemption may be lost unless further application is made by the surviving spouse.

Can only one spouse apply for homestead exemption in Florida?

However, to be eligible for the homestead exemption, the owner must be a permanent resident of Florida and have a present intent of living at the property. Additionally, the owner must apply for the exemption. Generally, a married couple is entitled to only one homestead exemption.

What is needed for homestead exemption in Texas?

To qualify for the general residence homestead exemption an individual must have an ownership interest in the property and use the property as the individual's principal residence. An applicant is required to state that he or she does not claim an exemption on another residence homestead in or outside of Texas.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my GA Application for Basic Homestead Exemption in Gmail?

GA Application for Basic Homestead Exemption and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit GA Application for Basic Homestead Exemption on an iOS device?

Create, modify, and share GA Application for Basic Homestead Exemption using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Can I edit GA Application for Basic Homestead Exemption on an Android device?

You can make any changes to PDF files, like GA Application for Basic Homestead Exemption, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is GA Application for Basic Homestead Exemption - Fulton?

The GA Application for Basic Homestead Exemption - Fulton is a form that homeowners in Fulton County, Georgia, must complete to qualify for a property tax exemption on their primary residence. This exemption reduces the taxable value of the property, resulting in lower property taxes.

Who is required to file GA Application for Basic Homestead Exemption - Fulton?

Homeowners who reside in Fulton County and want to claim the Basic Homestead Exemption on their primary residence are required to file the GA Application for Basic Homestead Exemption.

How to fill out GA Application for Basic Homestead Exemption - Fulton?

To fill out the GA Application for Basic Homestead Exemption, applicants must complete the form provided by the Fulton County Tax Assessor's office, providing details about their property, ownership, and residency status. It may require documentation such as proof of identity and ownership.

What is the purpose of GA Application for Basic Homestead Exemption - Fulton?

The purpose of the GA Application for Basic Homestead Exemption - Fulton is to allow qualifying homeowners to receive a reduction in property taxes on their primary residence, thereby providing financial relief for property owners.

What information must be reported on GA Application for Basic Homestead Exemption - Fulton?

The GA Application for Basic Homestead Exemption requires homeowners to report information such as the property address, the name of the owner(s), the date of occupancy, and any other relevant details that prove their eligibility for the exemption.

Fill out your GA Application for Basic Homestead Exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

GA Application For Basic Homestead Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.