MA DoR IFTA-1 2015 free printable template

Show details

Make check payable to Commonwealth of Massachusetts. Mail to IFTA Operations Unit P. O. Box 7027 Boston MA 02204. Phone 617-887-5080. Form IFTA-1 Instructions Application Instructions All information must be printed on the Application. Additional. Check this box if currently licensed for 2015 and need additional decals. Rev* 6/14 Form IFTA-1 2015 International Fuel Tax Agreement Massachusetts License Application Department of Revenue Registration period January 1 2015 through December 31 2015...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA DoR IFTA-1

Edit your MA DoR IFTA-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA DoR IFTA-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MA DoR IFTA-1 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MA DoR IFTA-1. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA DoR IFTA-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA DoR IFTA-1

How to fill out MA DoR IFTA-1

01

Obtain the MA DoR IFTA-1 form from the official website or your local Department of Revenue office.

02

Fill in the identification section with your name, address, and business details.

03

Provide your IFTA ID number in the designated field.

04

List the type of fuel used in your vehicles.

05

Enter the total miles traveled in each jurisdiction during the reporting period.

06

Record the total gallons of fuel purchased in each jurisdiction.

07

Calculate the net fuel use and the taxable gallons for each jurisdiction.

08

Double-check all entries for accuracy.

09

Sign and date the form before submission.

10

Submit the completed form to the MA Department of Revenue by the deadline.

Who needs MA DoR IFTA-1?

01

Motor carriers operating vehicles over a certain weight threshold.

02

Businesses that transport goods across state lines.

03

Companies required to report fuel usage for tax purposes.

04

Any entity seeking to comply with IFTA regulations for interstate travel.

Fill

form

: Try Risk Free

People Also Ask about

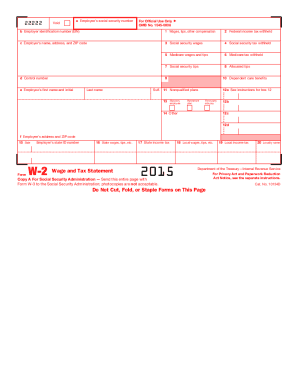

What forms do I need to file taxes in Massachusetts?

You may need the following: Copies of last year's federal and state tax returns. Personal information including: Records of your earnings (W-2 forms from each employer or 1099-MISC forms if you're a contractor) Records of interest and dividends from banks (1099 forms: 1099-INT, 1099-DIV, etc.)

What are the two basic forms you need to file your taxes?

What Tax Forms Do I Need to File Taxes? Form 1040: This is the form that you fill out to file your IRS tax return. W-2: If you work for an employer, you can expect to receive a W-2, which shows how much you earned last year and how much was deducted for taxes and any other withholding.

Which forms should you use to file your tax return?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What is form MA 1?

Form 1 Massachusetts Resident Income Tax Return.

What is form ma?

Form MA: Application for Municipal Advisor Registration Form MA-I: Information Regarding Natural Persons Who Engage in Municipal Advisory Activities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the MA DoR IFTA-1 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your MA DoR IFTA-1 in seconds.

How can I fill out MA DoR IFTA-1 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your MA DoR IFTA-1. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I fill out MA DoR IFTA-1 on an Android device?

Use the pdfFiller mobile app and complete your MA DoR IFTA-1 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is MA DoR IFTA-1?

MA DoR IFTA-1 is the Massachusetts Department of Revenue's form used for reporting International Fuel Tax Agreement (IFTA) activities. It is designed for licensed carriers who operate commercial vehicles and need to report fuel use and mileage across different jurisdictions.

Who is required to file MA DoR IFTA-1?

carriers with an IFTA license who operate qualified motor vehicles in Massachusetts or other jurisdictions and who need to report fuel usage and miles traveled for tax calculation purposes.

How to fill out MA DoR IFTA-1?

To fill out MA DoR IFTA-1, the filer should provide information on total miles driven, fuel purchased, and jurisdiction details. It's important to ensure accuracy in reporting to avoid penalties.

What is the purpose of MA DoR IFTA-1?

The purpose of MA DoR IFTA-1 is to provide a transparent and standardized method for motor carriers to report fuel use and pay fuel taxes on a unified basis across the participating jurisdictions.

What information must be reported on MA DoR IFTA-1?

The information that must be reported on MA DoR IFTA-1 includes the total miles driven in each jurisdiction, total fuel purchases by jurisdiction, tax-paid gallons, and any exemptions claimed.

Fill out your MA DoR IFTA-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA DoR IFTA-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.