CO DR 2393 2009 free printable template

Show details

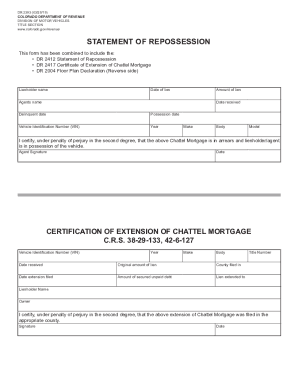

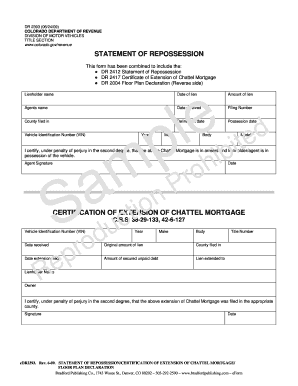

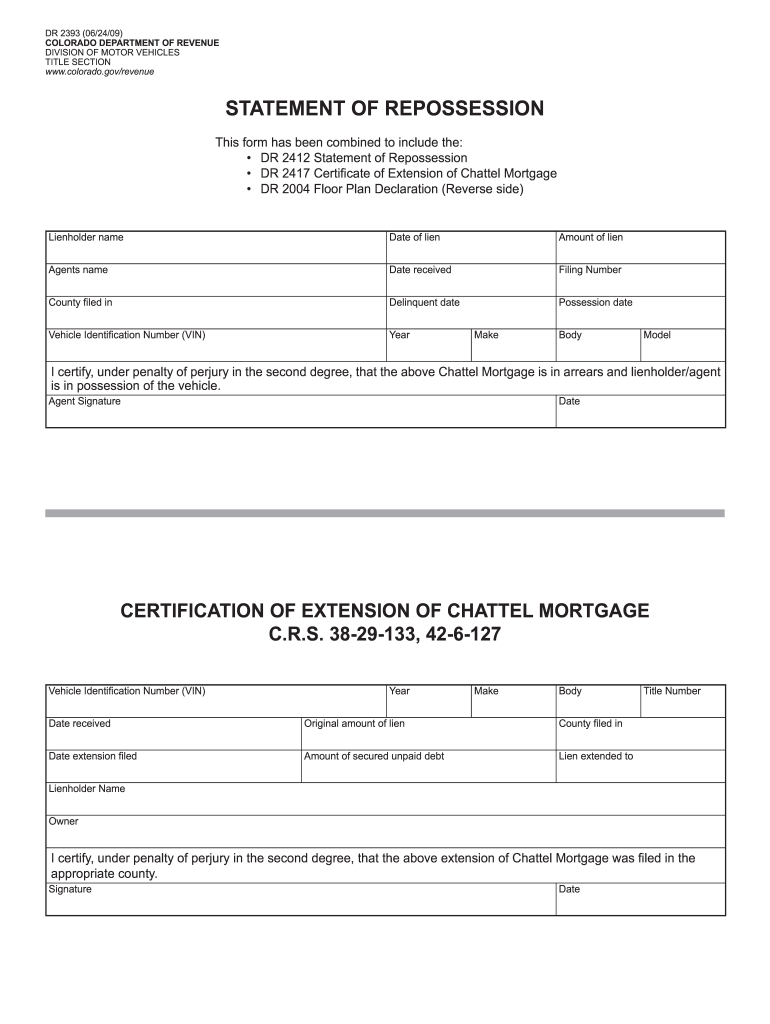

DR 2393 06/24/09 Colorado Department of Revenue division of Motor Vehicles title section www. colorado. gov/revenue statement of repossession This form has been combined to include the DR 2412 Statement of Repossession DR 2417 Certificate of Extension of Chattel Mortgage DR 2004 Floor Plan Declaration Reverse side Lienholder name Date of lien Amount of lien Agents name Date received Filing Number County filed in Delinquent date Possession date Vehicle Identification Number VIN Year Make Body...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO DR 2393

Edit your CO DR 2393 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO DR 2393 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CO DR 2393 online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CO DR 2393. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO DR 2393 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO DR 2393

How to fill out CO DR 2393

01

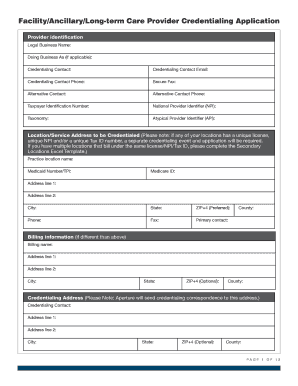

Obtain the CO DR 2393 form from the official website or local government office.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Provide any relevant case or account numbers in the designated fields.

04

Describe the purpose of the form in the appropriate section, detailing the specific request or information needed.

05

Review the form for accuracy, ensuring all required fields are completed.

06

Sign and date the form at the bottom.

07

Submit the completed form either electronically or by mail to the appropriate department.

Who needs CO DR 2393?

01

Individuals or businesses who need to formally request information or assistance from a Colorado government agency.

02

Taxpayers requiring documentation for tax-related inquiries.

03

Anyone involved in legal matters or requiring specific records from state or local authorities.

Fill

form

: Try Risk Free

People Also Ask about

How can I bounce back from a repossession?

Here are six steps to take. Speak to Your Lender. There are situations where a lender doesn't have the right to repossess your vehicle. Determine Whether You Can Get Your Car Back. Recover Personal Property. Pay Outstanding Debts. Make a Plan. Ask for Help.

Can my car be repossessed if I have paid more than half?

In line with the 'thirds rule', if you've paid more than half of your hire purchase loan, your car finance repossession rights take effect, and your lender cannot repossess your vehicle without following the proper processes. However, you can return your vehicle to the dealership at any point after you've paid half.

Will my car get repossessed if I miss one payment?

In California, the lender may repossess your car as soon as you default on the loan, even if the payment is just one day late.

How far behind on car payment before repo?

Most lenders won't begin repossession until you've missed three or more payments. Although there usually is a grace period between 60 and 90 days, a more staunch lender has the right to give notice of repossession for even one missed payment.

How do I fix my credit after car repossession?

Pay all your bills on time – One of the simplest and most effective ways to improve your credit score after a repossession is to pay every bill on time. If missed payments are what lead to your vehicle repo in the first place, then showing an improvement in payment history can really turn things around.

Will my car be repossessed if I miss one payment?

In California, the lender may repossess your car as soon as you default on the loan, even if the payment is just one day late.

How do you get around a repossession?

6 ways to avoid repossession Stay in contact with your lender. Keep your lender up to date on your situation, ability to make payments and overall finances. Request a loan modification. Repossession is a significant risk for the lender, too. Get current on the loan. Sell the car. Refinance your loan. Surrender your car.

How late can I be on my car payment?

When is a car payment considered late? Most auto loans have a 10 day grace period on payments, meaning you can make a payment within 10 days of the agreed-upon monthly due date without the payment being considered late.

Can you settle a repo car debt?

You can pay the deficiency in full, make payment arrangements with the lender to pay the debt over time, or negotiate a settlement. In some cases, it might be best to do nothing; in others, you might want to consider bankruptcy.

Does a repossession stay on your credit if you pay it off?

If the account in question is closed due to charge-off, repossession or voluntary surrender, it will remain part of your credit report for seven years from the original missed payment that led up to that derogatory status.

Can a repossession be reversed?

Your rights after repossession vary depending on your state law. In some states there are laws granting a right to reinstate after repossession. These laws usually provide for a time period after repossession in which you can get your vehicle back by making up any existing overdue payments and the cost of repossession.

How long before they repo a car Colorado?

This notice is sometimes called a right to cure notice. You must cure the default within 20 days after the date of the notice. If you don't catch up on your car payments, your lender can repossess your car on the 21st day. Under Colorado law, borrowers are only entitled to one right to cure notice every 12 months.

How many years does a repo stay on your credit?

Vehicle repossessions (repos) generally result from falling behind on your car payments and can severely impact your credit, as well as your ability to get a loan in the future. How long do repos stay on your credit exactly? The answer is seven years, starting on the date you stopped paying the loan.

How many car payments can you miss before repo?

Most lenders won't begin repossession until you've missed three or more payments. Although there usually is a grace period between 60 and 90 days, a more staunch lender has the right to give notice of repossession for even one missed payment.

What happens if you miss too many car payments?

A lot of bad things can happen when you stop paying your car loan. Each month you miss a payment lowers your credit score. If you can't resume payments and get caught up, your car can be repossessed. Worse, you could still owe money on your former car after you no longer have it.

Should I pay off a repossession?

In most states, you have to pay the entire car loan balance in order to get your car back after repossession. But you might have other options. Whether you have to pay the entire balance of your car loan to get your car back after repossession depends on where you live and the terms of your car loan agreement.

Can a repo be removed from credit report?

If a repossession is entirely valid and accurate, the only way you could get it removed (other than waiting seven years) is if you can negotiate with your lender to remove the item from your credit report in exchange for paying the debt in full.

How fast can a car be repossessed?

Generally, cars are repossessed once payments are 90 days in default, though technically they can do it with one missed payment. Lenders do not need a court order to start the repossession process – they can shift into gear as soon as you miss a payment. Lenders would prefer not to repossess your car.

What do you say to avoid a repossession?

You can avoid repossession by reinstating or refinancing the loan, selling/surrendering your car, or contacting your lender to ask for other options. If you're having issues handling your car loan or other debt, bankruptcy might be a good option for you.

How many days past due before repossession?

When you sign an auto loan, you take on the legal responsibility to make monthly payments on time and keep adequate insurance. If you become delinquent or late on the payment by more than 30 days, or if you don't have adequate insurance, the lender has the right to retrieve or repossess their property (your car).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit CO DR 2393 from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your CO DR 2393 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Where do I find CO DR 2393?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the CO DR 2393 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I execute CO DR 2393 online?

With pdfFiller, you may easily complete and sign CO DR 2393 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

What is CO DR 2393?

CO DR 2393 is a form used in Colorado for reporting certain information related to tax filings.

Who is required to file CO DR 2393?

Individuals or entities that engage in specific activities subject to reporting requirements in Colorado must file CO DR 2393.

How to fill out CO DR 2393?

To fill out CO DR 2393, provide the required information accurately in each section of the form, and ensure that the form is signed and dated.

What is the purpose of CO DR 2393?

The purpose of CO DR 2393 is to collect relevant data for tax compliance and enforcement in the state of Colorado.

What information must be reported on CO DR 2393?

The information that must be reported includes personal details, financial information, and any relevant tax-related data as specified in the form guidelines.

Fill out your CO DR 2393 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO DR 2393 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.