WI Form 9-2009 free printable template

Show details

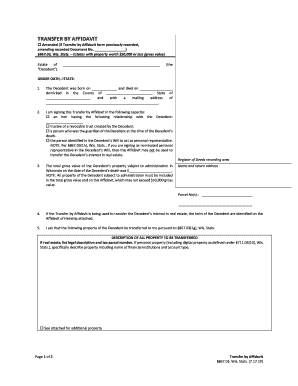

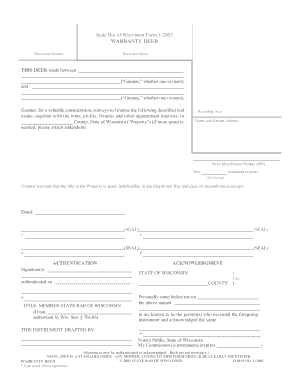

State Bar of Wisconsin Form 9-2009 DESIGNATION OF TOD BENEFICIARY Under Wis. Stat. 705. 15 Document Number THIS DESIGNATION is made by described real estate located in DANE attach Exhibit A if more space is needed collectively Owner of the following County State of Wisconsin the Property Recording Area Name and Return Address Owner transfers the Property without probate upon death of the sole owner or upon the last to die of multiple owners to the following TOD beneficiary without warranties...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign wi transfer on death deed form

Edit your 2009 wisconsin 9 fillable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state of wisconsin form 9 2009 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tod form wisconsin online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit wisconsin form 9 2009. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

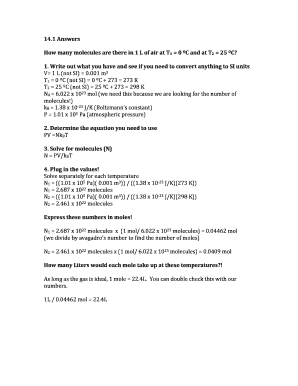

How to fill out wisconsin state bar form 9 2009

How to fill out WI Form 9

01

Obtain the WI Form 9 from your local Department of Workforce Development or download it from their official website.

02

Fill out the identification section with your personal details, including your name, address, and Social Security number.

03

Provide information regarding the employment you are claiming benefits for, including the employer's name and address.

04

Specify the dates of your employment and the reason for separation from the job.

05

Complete the additional sections as required, which may include information about any income or other benefits.

06

Review the form to ensure all information is accurate and complete.

07

Sign and date the form at the designated areas.

08

Submit the completed form via the specified method (mail or online) as outlined by the Department of Workforce Development.

Who needs WI Form 9?

01

Individuals who have recently been laid off, terminated, or experienced a reduction in hours and are seeking unemployment benefits in Wisconsin.

02

Workers who wish to claim Employment and Training programs or similar benefits.

Fill

wisconsin tod form

: Try Risk Free

People Also Ask about transfer on death deed wisconsin

How can I get TOD?

You can create a TOD Deed simply by moving real estate from your name only into your Beneficiary's name as a TOD. The property remains yours and you continue to control it until you pass away, at which point the deed automatically transfers to the name of your Beneficiary.

Which is better TOD or beneficiary?

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

What are the disadvantages of a transfer on death deed?

TOD/POD disadvantages: these accounts pass directly to the beneficiary and do not go through probate, if the executor does not have enough probate assets to pay the debts of the estate, creditors are entitled to claim some non- probate assets, including TOD accounts.

How do I fill out a transfer on a death deed in Wisconsin?

A Wisconsin TOD deed must include: The name of the property owner or owners whose interest a TOD deed will transfer; The TOD beneficiary's name; and. A statement that the transfer only becomes effective upon the owner's death.

What are the advantages of a transfer on death deed in Wisconsin?

Pros and Cons of a TOD Deed: Such deferral of transferring the property to the trust may make management, including sale of the real estate, less cumbersome while the owner is alive and still allows the owner's trust to control all of the assets of the owner's estate, upon the owner's death, without probate.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit wi tod deed form online?

The editing procedure is simple with pdfFiller. Open your wisconsin designation of tod beneficiary form 9 2009 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit form 9 2009 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your wisconsin tod deed form, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I edit wi transfer on death deed on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute wisconsin transfer on death deed form from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is WI Form 9?

WI Form 9 is a tax form used in Wisconsin for reporting various tax-related information, primarily concerning the withholding of income tax.

Who is required to file WI Form 9?

Employers in Wisconsin who are required to report withheld income tax from employee wages must file WI Form 9.

How to fill out WI Form 9?

To fill out WI Form 9, you need to provide employer information, report employee wages, and detail the amount of state income tax withheld. Follow the instructions specific to the form for accuracy.

What is the purpose of WI Form 9?

The purpose of WI Form 9 is to report the amount of Wisconsin income tax that has been withheld from employees' wages to the state.

What information must be reported on WI Form 9?

WI Form 9 requires reporting of the employer's identification information, total wages paid to employees, total state income tax withheld, and other relevant tax information.

Fill out your WI Form 9 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Designation Of Tod Beneficiary Form Wisconsin is not the form you're looking for?Search for another form here.

Keywords relevant to tod deed wisconsin

Related to wisconsin transfer on death form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.