Canada BSF267 E 2009 free printable template

Show details

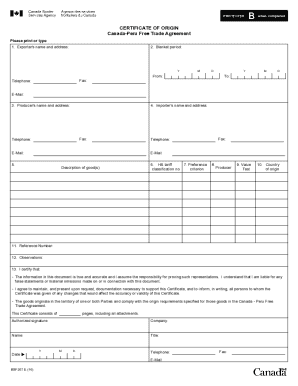

Restore Instructions (English) CERTIFICATE OF ORIGIN Canada-Peru Free Trade Agreement (instructions on reverse) PROTECTED (when completed) B Please print or type 1. Exporter's name and address: Help

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada BSF267 E

Edit your Canada BSF267 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada BSF267 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada BSF267 E online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada BSF267 E. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada BSF267 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada BSF267 E

How to fill out Canada BSF267 E

01

Obtain a copy of the Canada BSF267 E form from the official website or authorized locations.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide details about the goods you are bringing into Canada, including descriptions and values.

04

Indicate the purpose of your visit to Canada and your intended duration of stay.

05

Check the box for any exemptions or declarations that apply to you, if necessary.

06

Review the form for accuracy, ensuring all sections are completed correctly.

07

Sign and date the form where indicated.

Who needs Canada BSF267 E?

01

Individuals traveling to Canada with goods or items that need to be declared.

02

Anyone bringing personal belongings or goods valued over a specific threshold into Canada.

03

Travelers who are entering Canada for an extended stay or relocation.

Fill

form

: Try Risk Free

People Also Ask about

What paperwork do I need to ship from US to Canada?

There are four documents which you must include with every shipment when exporting goods into Canada: Canada Customs Invoice, or a Commercial Invoice. Bill of Lading. Manifest or Cargo Control Document.

Do I need a certificate of origin for Canada?

As a general rule, the importer must have the proof of origin established by the free trade agreement with them to claim the associated preferential tariff treatment. However, there are exceptions to this requirement for casual goods and low value commercial goods.

What is a certificate of origin Canada?

Certificates of origin (COs) are legal documents that declare the origin of a product. When you export goods to an overseas customer, you must include a certificate of origin with your shipment.

Do I need a certificate of origin to ship to Canada?

As a general rule, the importer must have the proof of origin established by the free trade agreement with them to claim the associated preferential tariff treatment. However, there are exceptions to this requirement for casual goods and low value commercial goods.

What is the certificate of origin for the US to Canada?

What is the NAFTA Certificate of Origin? The NAFTA Certificate of Origin is used by the United States, Canada, and Mexico to determine if imported goods are eligible to receive reduced or eliminated duty as specified by the NAFTA.

Do I need a certificate of origin to ship to Canada from USA?

Under the United States–Mexico–Canada Agreement (USMCA), importers will no longer be required to complete the formal “Certificate of Origin” document required under NAFTA. However you can use an optional Certificate of Origin format.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get Canada BSF267 E?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the Canada BSF267 E in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in Canada BSF267 E without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing Canada BSF267 E and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit Canada BSF267 E on an Android device?

The pdfFiller app for Android allows you to edit PDF files like Canada BSF267 E. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is Canada BSF267 E?

Canada BSF267 E is a form used to report international transactions and income to the Canada Revenue Agency (CRA) for tax compliance purposes.

Who is required to file Canada BSF267 E?

Individuals or entities that engage in certain international transactions or have foreign income must file Canada BSF267 E.

How to fill out Canada BSF267 E?

To fill out Canada BSF267 E, you need to provide details about your international transactions, including income, expenses, and any applicable foreign currency conversions.

What is the purpose of Canada BSF267 E?

The purpose of Canada BSF267 E is to ensure that the Canada Revenue Agency is aware of international income and transactions to assess tax obligations accurately.

What information must be reported on Canada BSF267 E?

The information that must be reported on Canada BSF267 E includes the nature of the transactions, amounts involved, parties involved, and any foreign tax credits or deductions.

Fill out your Canada BSF267 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada bsf267 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.