Get the free fillable certified payroll form

Show details

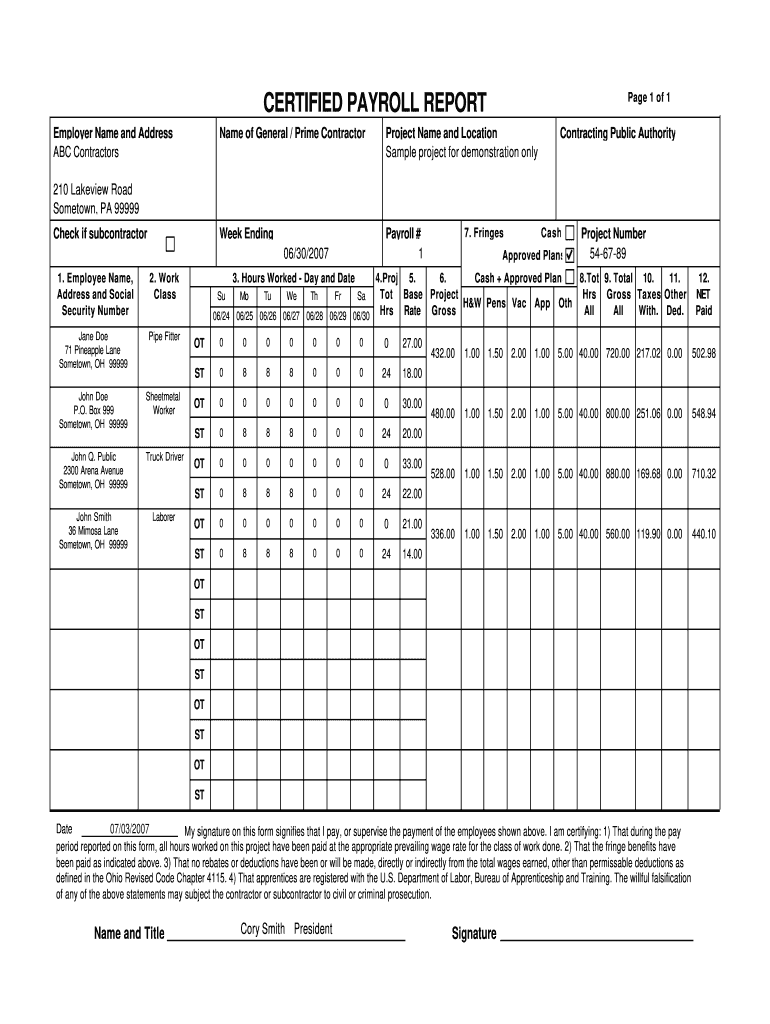

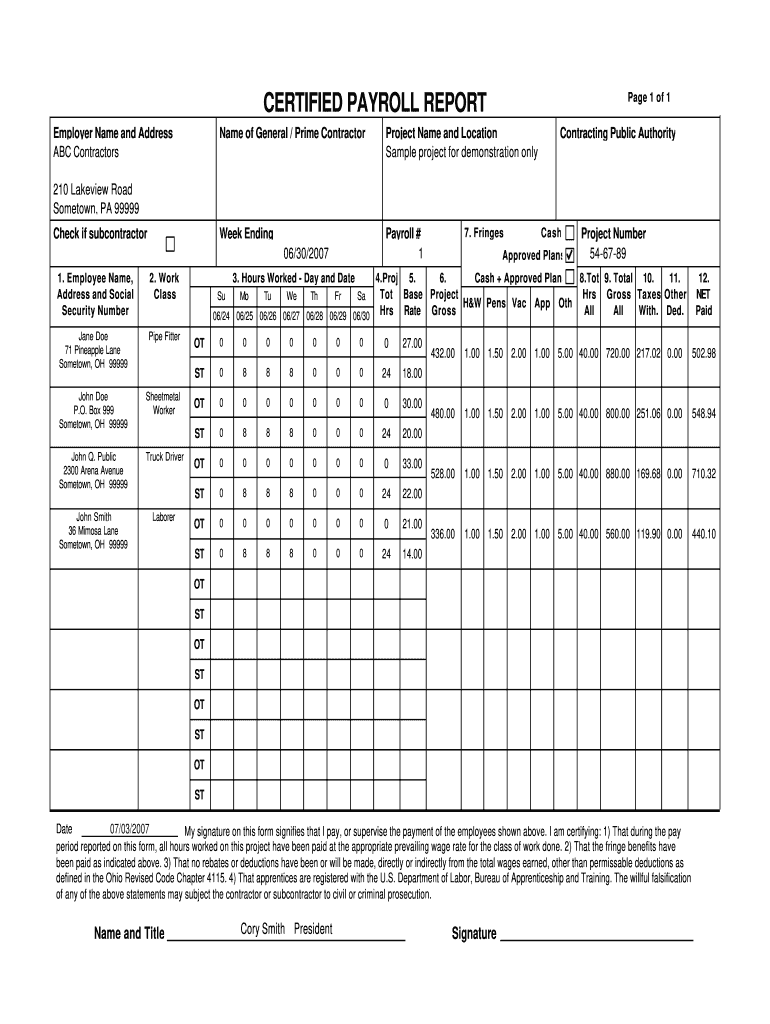

This document is used to report payroll information for employees working on a public works project, ensuring compliance with prevailing wage laws.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certified payroll form pdf

Edit your pdffiller form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your printable certified payroll form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit certified payroll pdf online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit certified payroll template form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certified payroll form

How to fill out certified payroll:

01

Obtain the necessary forms from the regulating agency or department.

02

Fill in the company information, including name, address, and identification number.

03

Enter the project information, such as project name, location, and contract number.

04

List all employees working on the project, including their names, job titles, and social security numbers.

05

Provide detailed information about the hours worked by each employee, including start and end times, and any breaks taken.

06

Calculate the wages earned by each employee for the specific time period.

07

Include any deductions or withholdings, such as taxes or union dues.

08

Total the wages and deductions for each employee and calculate the net pay.

09

Provide the required supporting documentation, such as certified pay rates, prevailing wage classifications, and fringe benefit payments.

10

Submit the completed certified payroll form to the appropriate agency or department on time.

Who needs certified payroll:

01

Government-funded projects often require certified payroll.

02

Contractors and subcontractors working on public works projects may need to submit certified payroll.

03

Some private projects may also require certified payroll if contract provisions or regulations dictate it.

04

It is best to consult with the contracting agency or project owner to determine if certified payroll is needed for a specific project.

Fill

certified payroll forms

: Try Risk Free

People Also Ask about certified payroll fillable form

What is the difference between a certified payroll and regular payroll?

What is the difference between certified payroll and standard payroll? Standard payroll is the process you use to pay your employees. Certified payroll is a report you submit to a government agency certifying that you have paid your employees for the previous week ing to prevailing wage laws.

Does Paychex do certified payroll?

Ideal for employers with union employees and Certified Payroll projects: HCM TradeSeal extends Paychex to support union Certified Payroll needs.

Can QuickBooks do certified payroll?

Step 5: Create a certified payroll report Sign into QuickBooks as the Primary Administrator. Make sure you're in single-user mode. Go to Reports, then select Employees & Payroll. Select More Payroll Reports in Excel, then Certified Payroll Report.

What is LCP certified payroll?

LCPcertified is a cloud-based certified payroll software application designed to simplify the complexity of generating reports for prevailing wage projects.

What is the difference between payroll and certified payroll?

Certified Payroll is a company's accounting of everything paid out under a contract performed for a government client, while Wrap-Up Payroll is what a company has to report to their Workers Compensation Carrier for the state in which they are doing the work.

Will QuickBooks do certified payroll?

Sign into QuickBooks as the Primary Administrator. Make sure you're in single-user mode. Go to Reports, then select Employees & Payroll. Select More Payroll Reports in Excel, then Certified Payroll Report.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my certified payroll forms excel format in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign payroll pdf and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit payroll form straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing no work performed certified payroll form right away.

How do I fill out printable payroll sheets using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign printable payroll form and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is certified payroll?

Certified payroll is a weekly payroll report that contractors are required to submit to the government for projects funded by federal or state funds. This report verifies that workers are paid at least the minimum wage and the prevailing wage for their work.

Who is required to file certified payroll?

Contractors and subcontractors working on federally funded or federally assisted projects, as well as projects covered under prevailing wage laws, are required to file certified payroll.

How to fill out certified payroll?

To fill out certified payroll, you typically must complete a form listing all employees working on the project, their hours worked, the wages paid, and ensure that your report adheres to the required format (often using the WH-347 form).

What is the purpose of certified payroll?

The purpose of certified payroll is to ensure compliance with labor laws, protect workers' rights, confirm that employees are being paid fairly for their work, and provide transparency in the use of public funds.

What information must be reported on certified payroll?

Certified payroll reports must include the employee's name, address, Social Security number, work classification, the number of hours worked each day, the rate of pay, deductions, total wages paid for the week, and any fringe benefits provided.

Fill out your certified payroll form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certified Payroll Sheet is not the form you're looking for?Search for another form here.

Keywords relevant to workers compensation payroll reporting form

Related to payroll sheet pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.