Get the free it1040ez form 2014 - tax ohio

Show details

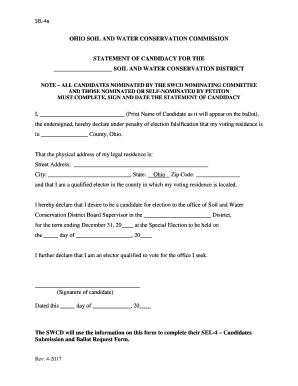

Only if joint return If deceased check box Your rst name M. I. Enter school district for this return see pages 45-50. SD Last name Spouse s rst name only if married ling jointly Rev. 11/14 Individual Income Tax Return for Full-Year Ohio Residents Use only black ink. Taxpayer Social Security no. required If deceased IT 1040EZ Mailing address for faster processing use a street address City State Ohio county rst four letters ZIP code Home address...

We are not affiliated with any brand or entity on this form

Instructions and Help about it1040ez form 2014

How to edit it1040ez form 2014

How to fill out it1040ez form 2014

Instructions and Help about it1040ez form 2014

How to edit it1040ez form 2014

Editing the it1040ez form 2014 can be accomplished using tools like pdfFiller, which allows you to make necessary changes electronically. To edit the form, upload the document to pdfFiller, then utilize the editing features to correct or update any information. Ensure you save the changes before proceeding with filing.

How to fill out it1040ez form 2014

Filling out the it1040ez form 2014 involves several key steps to ensure accuracy. Begin by gathering all necessary tax documents, including W-2 forms and other income statements. Follow these steps for completion:

01

Download the form from the IRS website or access it through pdfFiller.

02

Fill out your personal information, including your name, address, and Social Security number.

03

Report your income, adjustments, and any tax withheld.

04

Complete the section for tax credits and calculate your total tax liability.

05

Sign and date the form before submission.

Latest updates to it1040ez form 2014

Latest updates to it1040ez form 2014

There are no significant updates specific to the it1040ez form 2014. It is always advisable to consult the IRS website for any updates relevant to tax forms or regulations.

All You Need to Know About it1040ez form 2014

What is it1040ez form 2014?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About it1040ez form 2014

What is it1040ez form 2014?

The it1040ez form 2014 is a simplified individual income tax return used by U.S. taxpayers. This form allows eligible individuals to report their annual income and calculate their tax obligations in a straightforward manner.

What is the purpose of this form?

The primary purpose of the it1040ez form 2014 is to facilitate the tax filing process for taxpayers with uncomplicated financial situations. This form is designed to streamline the reporting of income, tax calculations, and potential tax refunds, making it easier for eligible taxpayers to fulfill their tax obligations.

Who needs the form?

Eligible taxpayers who earn a basic level of income and meet specific criteria should use the it1040ez form 2014. Typically, this includes individuals with no dependents, those with a taxable income of less than $100,000, and individuals who do not itemize deductions.

When am I exempt from filling out this form?

You are exempt from filing the it1040ez form if your income exceeds $100,000, if you claim dependents, or if you receive income from sources like interest, dividends, or rental properties. Additionally, if you owe special taxes, such as the Alternative Minimum Tax (AMT), you cannot use this form.

Components of the form

The it1040ez form 2014 comprises several sections requiring taxpayer details, income reporting, tax calculation, and refund information. Key components include personal information, total income, adjusted gross income, and the calculation of taxes owed or refunds due.

Due date

The due date for submitting the it1040ez form 2014 was April 15, 2015. If you missed this deadline, consider filing back taxes as soon as possible to avoid further penalties or interest.

What are the penalties for not issuing the form?

Failing to file the it1040ez form by the due date can result in a failure-to-file penalty. The IRS typically imposes a penalty of 5% of your unpaid taxes for each month the return is late, up to a maximum of 25%. Additionally, interest will accrue on any taxes owed.

What information do you need when you file the form?

When filing the it1040ez form 2014, you will need your Social Security number, W-2 forms from employers, and total income information. You should also have details on any tax withheld, along with data for any qualifying tax credits.

Is the form accompanied by other forms?

The it1040ez form 2014 does not require accompanying forms unless you are claiming specific credits or deductions that necessitate additional documentation. Typically, no additional forms are needed for straightforward filers adhering to the guidelines.

Where do I send the form?

To file the it1040ez form 2014, you send it to the appropriate IRS address based on your state of residence. The addresses are provided in the form's instructions, which can typically be found on the IRS website or via pdfFiller when filing the form electronically.

See what our users say