Get the free INTERSPOUSAL TRANSFER GRANT DEED - Starcrest Escrow, Inc.

Show details

RECORDING REQUESTED BY: AND WHEN RECORDED MAIL TO: SPACE ABOVE THIS LINE FOR RECORDER'S USE INTERSEXUAL TRANSFER GRANT DEED (Excluded from reappraisal under California Constitution Act 13 A 1.ET.seq.)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign interspousal transfer grant deed

Edit your interspousal transfer grant deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your interspousal transfer grant deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing interspousal transfer grant deed online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit interspousal transfer grant deed. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out interspousal transfer grant deed

How to fill out interspousal transfer grant deed:

01

Obtain the necessary form: Start by obtaining the appropriate interspousal transfer grant deed form. You can usually find this form at your local county recorder's office or online on the official website.

02

Identify the grantor and the grantee: The grantor is the spouse who currently owns the property, while the grantee is the other spouse who will be receiving the property. Clearly identify both parties by providing their full legal names and addresses.

03

Describe the property: Provide an accurate description of the property being transferred. This includes the property address, legal description, and APN (Assessor's Parcel Number).

04

Sign and notarize: Both the grantor and the grantee must sign the interspousal transfer grant deed in the presence of a notary public. Make sure to include the date of signing.

05

Complete the Preliminary Change of Ownership Report (PCOR): In most states, you will need to complete a PCOR form alongside the grant deed. This form is used to report the change of ownership to the county assessor's office.

06

Record the deed: Take the signed and notarized deed, along with the PCOR if required, to the county recorder's office. Pay the recording fee and have the deed officially recorded. This step is essential to ensure the transfer is legally recognized.

Who needs an interspousal transfer grant deed?

01

Married couples looking to transfer property between spouses: An interspousal transfer grant deed is specifically used when a spouse wants to transfer ownership of a property to their spouse. This deed allows for the transfer to occur without triggering a reassessment for property tax purposes in many states.

02

Couples in community property states: In community property states, such as California, Arizona, and Texas, property acquired during the marriage is typically considered joint community property. An interspousal transfer grant deed can be useful for transferring ownership of community property between spouses while maintaining its community property status.

03

Couples seeking to avoid reassessment: One of the main reasons for using an interspousal transfer grant deed is to avoid triggering a reassessment of the property for property tax purposes. By using this deed, the transfer is often exempt from reassessment, allowing the receiving spouse to retain the property tax basis of the transferring spouse.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find interspousal transfer grant deed?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific interspousal transfer grant deed and other forms. Find the template you need and change it using powerful tools.

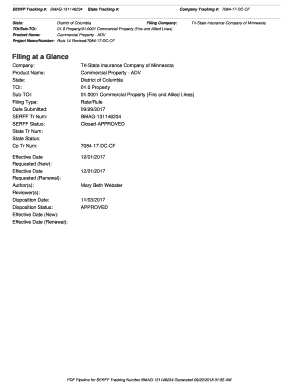

How do I edit interspousal transfer grant deed in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your interspousal transfer grant deed, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the interspousal transfer grant deed in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your interspousal transfer grant deed in minutes.

What is interspousal transfer grant deed?

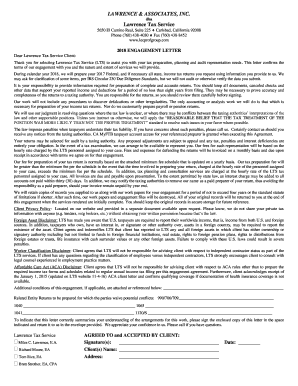

An interspousal transfer grant deed is a legal document used to transfer ownership of property between spouses without the exchange of money. It typically ensures that the property remains within the marriage and may be utilized for various reasons, including estate planning or simplifying title transfers.

Who is required to file interspousal transfer grant deed?

Generally, either spouse can file an interspousal transfer grant deed. However, it is common for the transferring spouse to sign and file the deed in order to legally document the change in ownership.

How to fill out interspousal transfer grant deed?

To fill out an interspousal transfer grant deed, start by including the names of both spouses, the legal description of the property, and any consideration (even nominal) if desired. Both spouses must sign the deed, and it may need to be notarized before being filed with the appropriate county office.

What is the purpose of interspousal transfer grant deed?

The purpose of an interspousal transfer grant deed is to formally transfer property ownership between spouses. This deed is often used to simplify the ownership processduring marriage and support estate planning by allowing one spouse to retain control over property without court intervention.

What information must be reported on interspousal transfer grant deed?

The interspousal transfer grant deed must include the names of both spouses, the legal description of the property being transferred, the indicated consideration (if any), signatures of both spouses, and typically a notarization. Additionally, any applicable tax information should be included.

Fill out your interspousal transfer grant deed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Interspousal Transfer Grant Deed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.