CO DR 0204 2014 free printable template

Show details

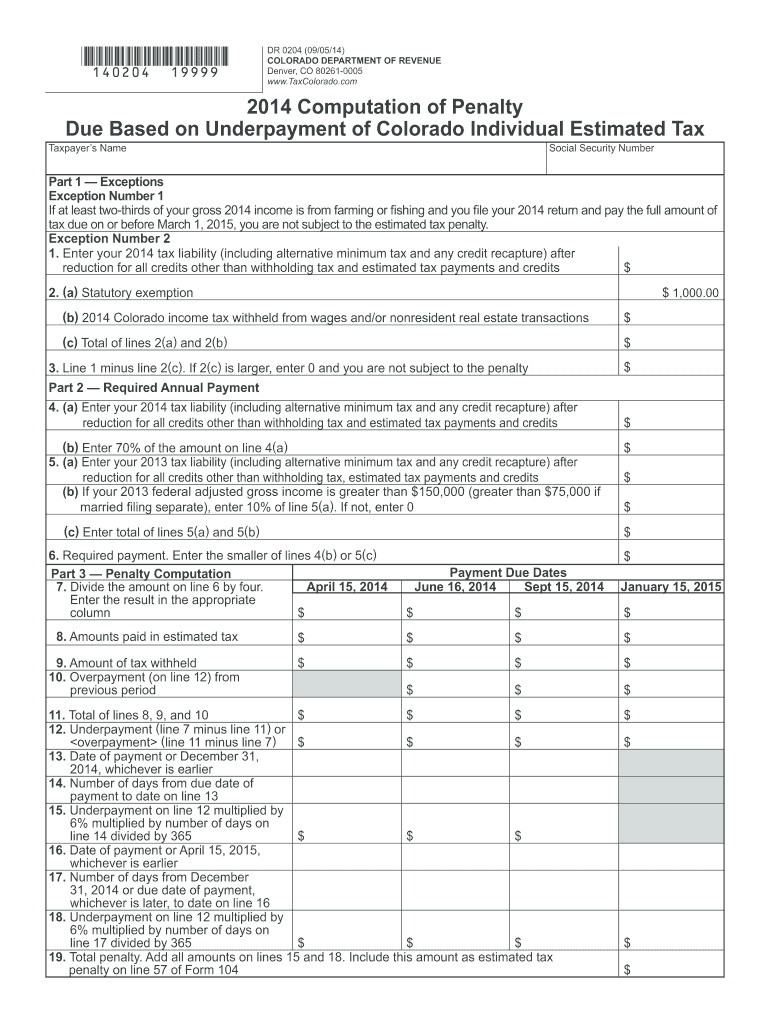

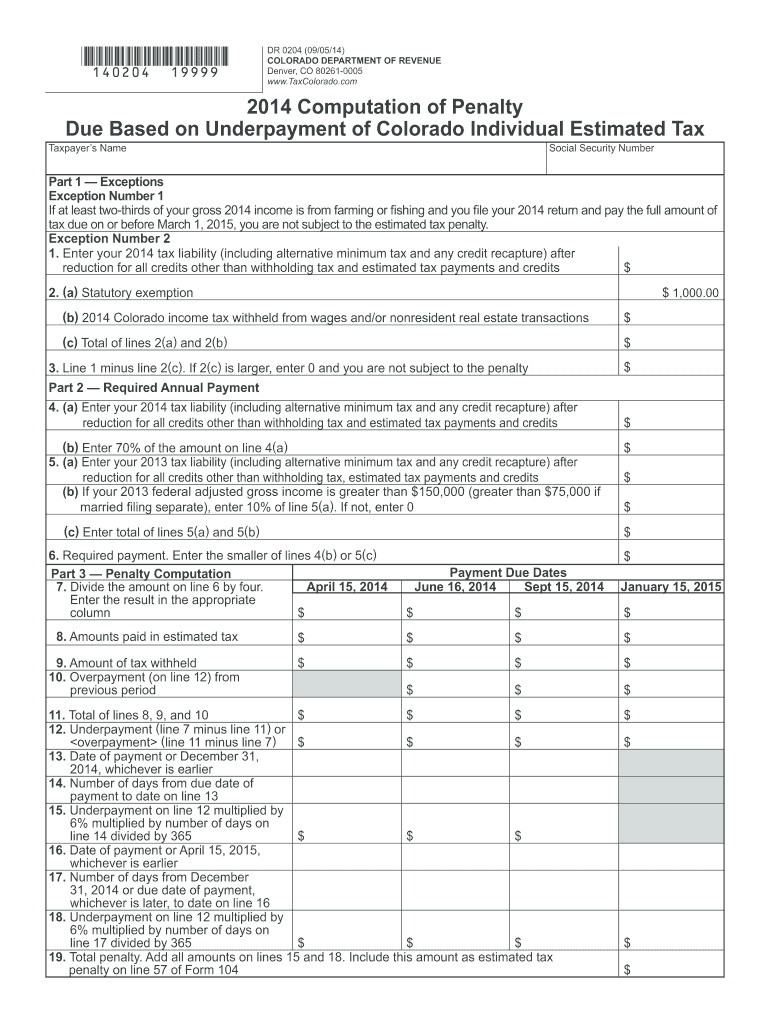

*140204 19999* DR 0204 (09/05/14) COLORADO DEPARTMENT OF REVENUE Denver, CO 80261-0005 www.TaxColorado.com 2014 Computation of Penalty Due Based on Underpayment of Colorado Individual Estimated Tax

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO DR 0204

Edit your CO DR 0204 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO DR 0204 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CO DR 0204 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CO DR 0204. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO DR 0204 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO DR 0204

How to fill out CO DR 0204

01

Obtain the CO DR 0204 form from the official website or your local court.

02

Begin by filling out your personal information in the designated fields including your name, address, and contact details.

03

Provide the relevant case information as prompted, including case number and court details.

04

Clearly state the purpose of the form and include any supporting documentation if required.

05

Review the form for accuracy and completeness to ensure all necessary sections are filled out correctly.

06

Sign and date the application at the bottom of the form.

07

Submit the completed form to the appropriate court or agency either in person or by mail.

Who needs CO DR 0204?

01

Individuals involved in a legal case or proceedings in Colorado who need to submit a specific request or application to the court.

02

Lawyers representing clients in need of filing certain motions or documentation specific to their cases.

03

Parties seeking modifications, responses, or other relevant legal communications regarding their case.

Fill

form

: Try Risk Free

People Also Ask about

Does Colorado require estimated tax payments?

Generally, an individual or married couple filing jointly must remit Colorado estimated tax payments if their total Colorado tax liability, less withholding and credits, exceeds $1,000. For more information, visit the Individual Income Tax Estimated Payments web page.

Can I choose not to pay estimated taxes?

Do you expect your federal income tax withholding to amount to at least 90 percent of the total tax that you will owe for this tax year? If so, then you're in the clear, and you don't need to make estimated tax payments.

Is estimated tax payment mandatory?

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Who must file a Colorado nonresident return?

A nonresident is required to file a Colorado income tax return if they: are required to file a federal income tax return, and. had taxable Colorado-sourced income.

How do I automatically pay estimated taxes?

To make estimated tax payments online, first establish an account with the IRS at the EFTPS website. Once you have an EFTPS account established, you can schedule automatic withdrawals for your quarterly estimated taxes, specifying the amounts and the dates of the payments.

How do I pay my estimated tax payments 2022?

The IRS provides various methods for making 2022 quarterly estimated tax payments: You may credit an overpayment on your 2021 tax return to your 2022 estimated tax; You may mail your payment with payment voucher, Form 1040-ES; You may pay by phone or online (refer to Form 1040-ES instructions);

What is Colorado form 104?

Colorado Form 104 – Personal Income Tax Return for Residents. Colorado Form 104PN – Personal Income Tax Return for Nonresidents and Part-Year Residents. Colorado Form 104CR – Individual Credit Schedule.

What qualifies for the pension income deduction?

If you were 65 or older in the year, pension income includes: Income from a superannuation or pension fund. Annuity income out of a RRSP or a Deferred Profit Sharing Plan (DPSP) Income from a Registered Retirement Income Fund (RRIF)

What is form DR 0104?

DR 0104 - Individual Income Tax Return (form only) DR 0104AD - Subtractions from Income Schedule.

Who is exempt from Colorado state income tax?

The standard deduction in Colorado is $12,550 for single taxpayers and $25,100 for married filers. The state does not have personal exemptions.Colorado personal income tax rates: Table. Colorado personal income tax ratesTax rateSingleMarried, filing jointly4.55%Greater than $0Greater than $01 more row • Dec 6, 2021

When can I pay 2022 estimated taxes?

So, for example, if you didn't have any taxable income in 2022 until August, you don't have to make an estimated tax payment until September 15. At that point, you can either pay your entire estimated tax by the September 15 due date or pay it in two installments by September 15 and January 17.

What is pension and annuity exclusion?

If some contributions to your pension or annuity plan were previously included in gross income, you can exclude part of the distributions from income. You must figure the tax-free part when the payments first begin. The tax-free part generally remains the same each year, even if the amount of the payment changes.

Can I pay estimated taxes at any time?

You can do this at any time during the year. Remember, the schedule set by the IRS is a series of deadlines. You can always make a payment before a set date, and you can cover your entire liability in one payment if you want to. You don't have to divide up what you might owe into a series of four quarterly payments.

What qualifies for the Colorado pension and annuity exclusion?

Colorado allows a pension/annuity subtraction for: Taxpayers who are at least 55 years of age as of the last day of the tax year. Beneficiaries of any age (such as a widowed spouse or orphan child) who are receiving a pension or annuity because of the death of the person who earned the pension.

Are quarterly tax payments mandatory?

Do you have to pay estimated taxes quarterly? ing to the IRS, you don't have to make estimated tax payments if you're a U.S. citizen or resident alien and you had no tax liability for the previous full tax year. And you probably don't have to pay estimated taxes unless you have untaxed income.

Who generally does not need to pay estimated taxes?

When can I avoid paying estimated taxes? If you expect to owe less than $1,000 in income tax this year after applying your federal income tax withholding, you don't have to make estimated tax payments.

Which pension is exempt from income tax?

Yes. The amount received on Commutation of Pension is exempt under following conditions: (i) Any payment in commutation of pension received under the Civil Pension (Commutation) Rules of Central Govt., or under any similar scheme.

Can I pay estimated taxes all at once?

Many people wonder, “can I make estimated tax payments all at once?” or pay a quarter up front? Because people might think it's a nuisance to file taxes quarterly, this is a common question. The answer is no.

How do I pay estimated taxes for next year?

If you don't pay enough tax by the due date of each payment period, you may be charged a penalty even if you're due a refund when you file your income tax return at the end of the year. You may send estimated tax payments with Form 1040-ES by mail, pay online, by phone or from your mobile device using the IRS2Go app.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find CO DR 0204?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific CO DR 0204 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How can I edit CO DR 0204 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing CO DR 0204.

How do I complete CO DR 0204 on an Android device?

Use the pdfFiller Android app to finish your CO DR 0204 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is CO DR 0204?

CO DR 0204 is a form used for reporting certain financial and operational details in compliance with state regulations in Colorado.

Who is required to file CO DR 0204?

Entities that engage in specific activities regulated by the state of Colorado, including corporations, partnerships, and some non-profit organizations, are typically required to file CO DR 0204.

How to fill out CO DR 0204?

To fill out CO DR 0204, you need to provide required financial and operational information, ensuring all entries are accurate and complete, and then submit it through the prescribed method, usually electronically or by mail.

What is the purpose of CO DR 0204?

The purpose of CO DR 0204 is to ensure transparency and compliance with the state's financial and operational standards, allowing regulatory authorities to monitor and assess the activities of the reporting entities.

What information must be reported on CO DR 0204?

The information that must be reported on CO DR 0204 typically includes financial statements, operational data, and any other specific information mandated by state regulations relevant to the entity's activities.

Fill out your CO DR 0204 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO DR 0204 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.