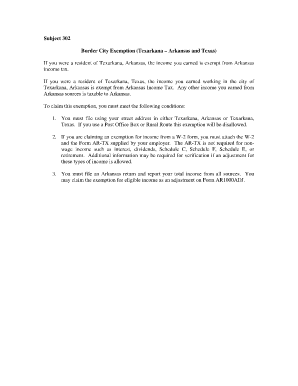

Get the free ar tx border city exemption form

Show details

17 NOTE Do not enter amounts from categories that are not printed on this form. See instructions for additional information. AR1000ADJ R 8/8/14 AR1000ADJ INSTRUCTIONS LINE 1. AR1000ADJ Click Here to Print Document CLICK HERE TO CLEAR FORM ARKANSAS INDIVIDUAL INCOME TAX SCHEDULE OF ADJUSTMENTS Social Security Number Name INSTRUCTIONS Full Year Resident Filers - Complete columns A and B if using filing status 4 married filing separately on the same...

We are not affiliated with any brand or entity on this form

Instructions and Help about ar tx border city

How to edit ar tx border city

How to fill out ar tx border city

Instructions and Help about ar tx border city

How to edit ar tx border city

To edit the ar tx border city tax form, you will want to gather all relevant information that needs updating. Once completed, utilize pdfFiller’s editing tools to revise the form. Make sure to save the changes and, if necessary, print a copy for your records.

How to fill out ar tx border city

Filling out the ar tx border city tax form requires careful attention to detail. Start by gathering all required financial documents such as income statements and expense receipts. Clearly and accurately enter your financial information, ensuring that all figures align with your records. Review the completed form for any errors before submission.

Latest updates to ar tx border city

Latest updates to ar tx border city

Stay informed about the latest updates to the ar tx border city tax form by frequently checking the official state tax website or the IRS updates. Changes may include new guidelines, filing procedures, or relevant deadlines that could affect your compliance and tax obligations.

All You Need to Know About ar tx border city

What is ar tx border city?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About ar tx border city

What is ar tx border city?

The ar tx border city tax form is a specific document required by municipalities within the Texas-Arkansas border area. This form assists local tax authorities in assessing the tax obligations of residents and businesses operating in these regions.

What is the purpose of this form?

The primary purpose of the ar tx border city tax form is to report income and assess local taxes. It ensures that individuals and businesses comply with local tax laws, thereby providing necessary funding for community services and infrastructure. Accurate completion of this form helps avoid penalties and ensures the correct amount of taxes is paid.

Who needs the form?

Individuals and businesses operating within the ar tx border city region are required to fill out this form. This includes residents reporting their income as well as businesses generating revenue. Any person or entity that engages in taxable activities within this jurisdiction must adhere to filing requirements.

When am I exempt from filling out this form?

You may be exempt from filling out the ar tx border city tax form if your income falls below a specific threshold or if you qualify for certain deductions under local tax law. Additionally, specific classifications of non-profit organizations might also be exempt, provided they meet defined criteria.

Components of the form

The ar tx border city tax form typically contains sections for personal information, income reporting, allowable deductions, and tax calculation. Ensure each section is completed accurately to prevent delays in processing your return. Each component serves a distinct purpose in determining your tax obligations.

Due date

The due date for submitting the ar tx border city tax form generally aligns with local filing deadlines. Typically, this is within a few months after the end of the tax year, often on April 15 for individual filers. Be sure to check local regulations for specific dates and changes each tax year.

What are the penalties for not issuing the form?

Failing to issue the ar tx border city tax form can result in various penalties, including fines and interest on unpaid taxes. The penalties may vary based on the duration of the delay and the amount owed. It’s crucial to file on time to avoid these financial repercussions.

What information do you need when you file the form?

When filing the ar tx border city tax form, you will need personal identification information, income details, records of expenses and deductions, and any supporting documents for claims made on the form. Having this information organized ahead of time will facilitate smooth and accurate filing.

Is the form accompanied by other forms?

Depending on your income sources and deductions, the ar tx border city tax form may need to be accompanied by additional schedules or forms. Commonly, you may need to include forms related to business income, investment income, or specific deductions that apply to your situation.

Where do I send the form?

The completed ar tx border city tax form should be sent to the designated local tax authority. This may be a city office or a regional tax center, depending on local regulations. Verify the submission address on the tax authority’s website to ensure your form is sent to the correct location.

See what our users say