IRS Form 8889 Instructions 2013 free printable template

Show details

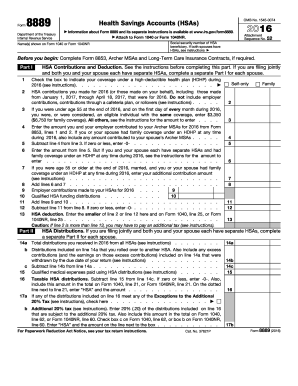

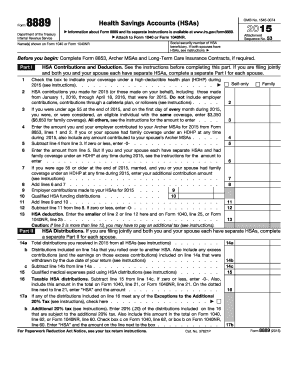

Department of the Treasury Internal Revenue Service Instructions for Form 8889 Health Savings Accounts HSAs Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments related to Form 8889 and its instructions such as legislation enacted after they were published go to www.irs.gov/form8889. General Instructions Purpose of Form Use Form 8889 to Report health savings ...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Form 8889 Instructions

Edit your IRS Form 8889 Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Form 8889 Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS Form 8889 Instructions online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS Form 8889 Instructions. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Form 8889 Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Form 8889 Instructions

How to fill out IRS Form 8889 Instructions

01

Obtain IRS Form 8889 from the IRS website or a tax preparation service.

02

Fill out Part I: Report Health Savings Account (HSA) contributions for the year.

03

Complete Part II for distributions taken from the HSA, reporting them accurately.

04

If applicable, fill out Part III for any HSA transactions that require additional tax calculations.

05

Transfer the totals from Form 8889 to the appropriate sections of your main tax return (Form 1040).

06

Double-check all entries for accuracy before submission.

Who needs IRS Form 8889 Instructions?

01

Any individual who is an account holder of a Health Savings Account (HSA).

02

Taxpayers who made contributions to an HSA during the tax year.

03

Individuals who took distributions from their HSA for qualified medical expenses.

04

People who received any HSA funding distributions from an employer or another source.

Fill

form

: Try Risk Free

People Also Ask about

What happens if you fail the testing period for HSA?

Testing period. If you fail to remain an eligible individual during the testing period, for reasons other than death or becoming disabled, you will have to include in income the total contributions made to your HSA that wouldn't have been made except for the last-month rule.

What is reported on Form 8889?

File Form 8889 to: Report health savings account (HSA) contributions (including those made on your behalf and employer contributions).

Who needs to fill out Form 8889?

If, during the tax year, you are the beneficiary of two or more HSAs or you are a beneficiary of an HSA and you have your own HSA, you must complete a separate Form 8889 for each HSA.

Do I need to include Form 8889?

You must always file a Form 8889 in any year you or an employer contributes money to your HSA or you make withdrawals from the account. The deduction you calculate on Form 8889 is taken on the first page of your income tax return.

What is the last month rule for 8889?

Last-month rule. If you are an eligible individual on the first day of the last month of your tax year (December 1 for most taxpayers), you are considered to be an eligible individual for the entire year, so long as you remain an eligible individual during the testing period as discussed below.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IRS Form 8889 Instructions?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific IRS Form 8889 Instructions and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit IRS Form 8889 Instructions in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your IRS Form 8889 Instructions, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit IRS Form 8889 Instructions on an Android device?

You can make any changes to PDF files, such as IRS Form 8889 Instructions, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is IRS Form 8889 Instructions?

IRS Form 8889 Instructions provide guidance on how to complete Form 8889, which is used to report health savings account (HSA) contributions, distributions, and deductions.

Who is required to file IRS Form 8889 Instructions?

Individuals who have a health savings account (HSA) and who made contributions to or received distributions from that account during the tax year are required to file IRS Form 8889.

How to fill out IRS Form 8889 Instructions?

To fill out IRS Form 8889, taxpayers should provide information on contributions made to the HSA, distributions taken from the account, and any required adjustments for the tax year as outlined in the instructions.

What is the purpose of IRS Form 8889 Instructions?

The purpose of IRS Form 8889 Instructions is to guide taxpayers in accurately reporting HSA-related transactions and ensuring compliance with tax regulations.

What information must be reported on IRS Form 8889 Instructions?

The information that must be reported on IRS Form 8889 includes total HSA contributions, distributions from the HSA, any excess contributions, and information regarding qualified medical expenses.

Fill out your IRS Form 8889 Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Form 8889 Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.