Get the free same day taxpayer worksheet example

Show details

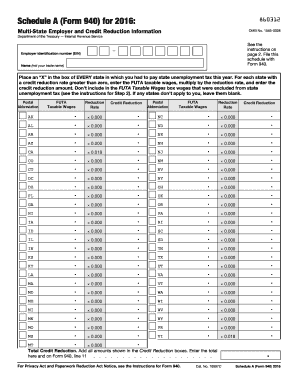

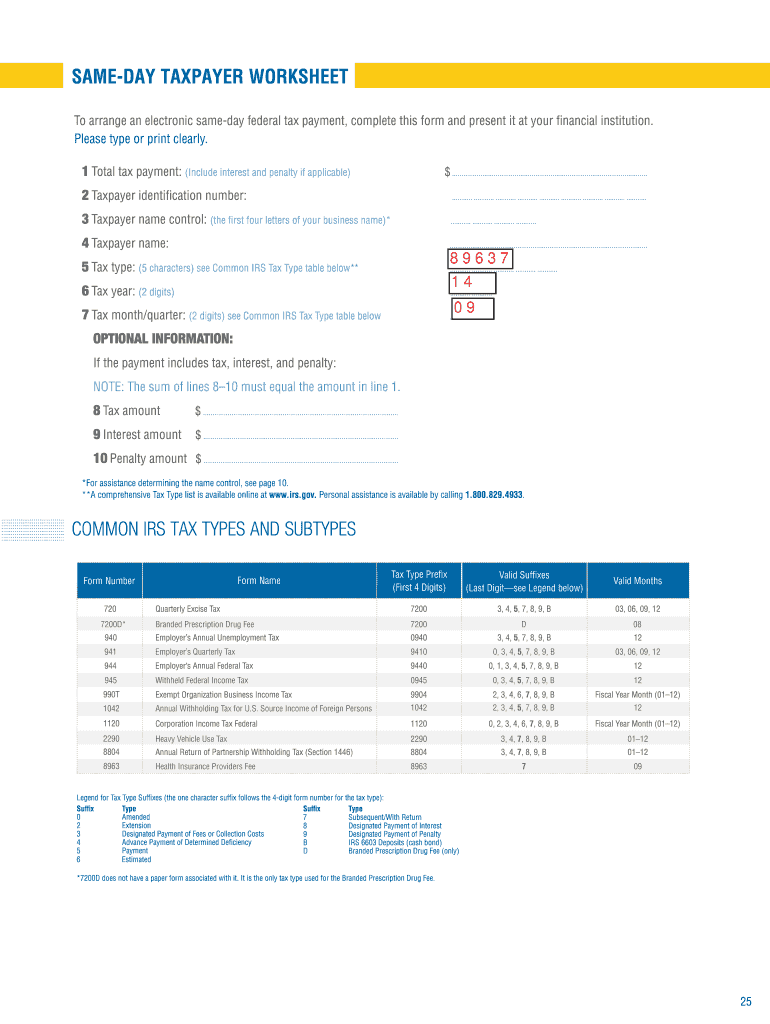

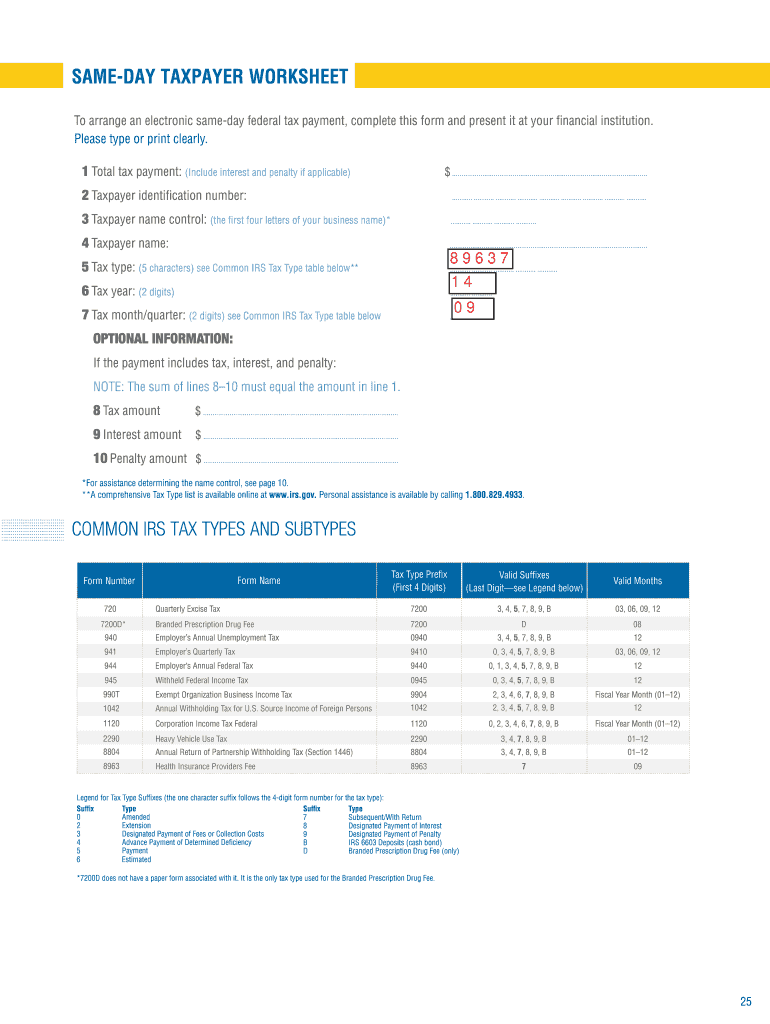

SAME-DAY TAXPAYER WORKSHEET To arrange an electronic same-day federal tax payment, complete this form and present it at your ?financial institution. Please type or print clearly. 1 Total tax payment:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign same day payment worksheet form

Edit your same day taxpayer worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your same day wire taxpayer worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing same day taxpayer worksheet online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit same day taxpayer worksheet. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out same day taxpayer worksheet

01

To fill out the same day taxpayer worksheet, start by gathering all relevant documentation such as income statements, receipts, and any other supporting documents.

02

Next, carefully read through the instructions provided on the worksheet to understand the required information and the specific format in which it should be provided.

03

Begin filling out the worksheet by entering your personal information, including your name, address, and social security number.

04

Proceed to the income section of the worksheet and input all sources of income, including wages, self-employment earnings, and any other taxable income.

05

Deductions and expenses can be claimed next. This may include deductions for business expenses, medical expenses, and charitable contributions, among others. Consult the worksheet instructions for specific guidelines on which deductions are allowed.

06

Complete any additional sections or lines on the worksheet as specified by the instructions. This may include provisions for alternative minimum tax or credits.

07

Double-check all entered information to ensure accuracy and completeness.

08

Once the worksheet is filled out, review it once more before submitting it with your tax return. Consider seeking professional advice or using tax software to ensure accuracy.

Who needs same day taxpayer worksheet?

01

Individuals who have the need to file their taxes on the same day, typically because of imposed deadlines or personal circumstances.

02

Taxpayers who have multiple sources of income and various deductions to claim, making their tax situation more complex.

03

Self-employed individuals or small business owners who need to calculate their estimated tax and take into account business expenses and deductions.

04

Taxpayers who want to ensure that they are meeting their tax obligations accurately and efficiently by using the designated worksheet.

05

Anyone who wants to organize their tax information in a systematic manner before preparing their tax return.

Fill

form

: Try Risk Free

People Also Ask about

Can I still get a refund if no federal taxes were withheld?

It's possible. If you do not have any federal tax withheld from your paycheck, your tax credits and deductions could still be greater than any taxes you owe. This would result in you being eligible for a refund. You must file a tax return to claim your refund.

Can you make same day EFTPS payments?

You may be able to do a same-day wire from your financial institution. Contact your financial institution for availability, cost, and cut-off times.

Are you exempt from federal withholding yes or no?

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

What happens if you didn't have federal taxes withheld?

If your employer didn't withhold the correct amount of federal tax, contact your employer to have the correct amount withheld for the future. When you file your return, you'll owe the amounts your employer should have withheld during the year as unpaid taxes.

Why was no federal income tax withheld from my paycheck?

Q: Why wasn't federal income tax withheld on a paycheck? A: Sometimes the IRS calculates that $0 taxes need to be withheld from a paycheck—this most often happens when you're not earning enough in gross wages for taxes to be withheld.

How do I fill out a tax payment check?

Make sure your check or money order includes the following information: Your name and address. Daytime phone number. Social Security number (the SSN shown first if it's a joint return) or employer identification number. Tax year. Related tax form or notice number.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send same day taxpayer worksheet to be eSigned by others?

Once you are ready to share your same day taxpayer worksheet, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make changes in same day taxpayer worksheet?

The editing procedure is simple with pdfFiller. Open your same day taxpayer worksheet in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my same day taxpayer worksheet in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your same day taxpayer worksheet right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is same day taxpayer worksheet?

The same day taxpayer worksheet is a form used by taxpayers to report their income and tax information on the same day they file their tax returns, often to expedite the processing and avoid delays.

Who is required to file same day taxpayer worksheet?

Taxpayers who are filing their returns on the same day and need to provide comprehensive details about their income and deductions may be required to fill out the same day taxpayer worksheet.

How to fill out same day taxpayer worksheet?

To fill out the same day taxpayer worksheet, gather your income documents, deductions, and other financial information. Complete each section of the form as instructed, ensuring that all entries are accurate and complete.

What is the purpose of same day taxpayer worksheet?

The purpose of the same day taxpayer worksheet is to facilitate the timely reporting of tax information and to streamline the filing process for taxpayers who need to file their returns on the same day.

What information must be reported on same day taxpayer worksheet?

Information that must be reported includes total income, deductions, credits, and any other relevant tax information necessary for accurate tax assessment.

Fill out your same day taxpayer worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Same Day Taxpayer Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.