Get the free SCHEDULES D&E (FORM 40) Alabama Department of Revenue Schedule D Net Profit or Loss ...

Show details

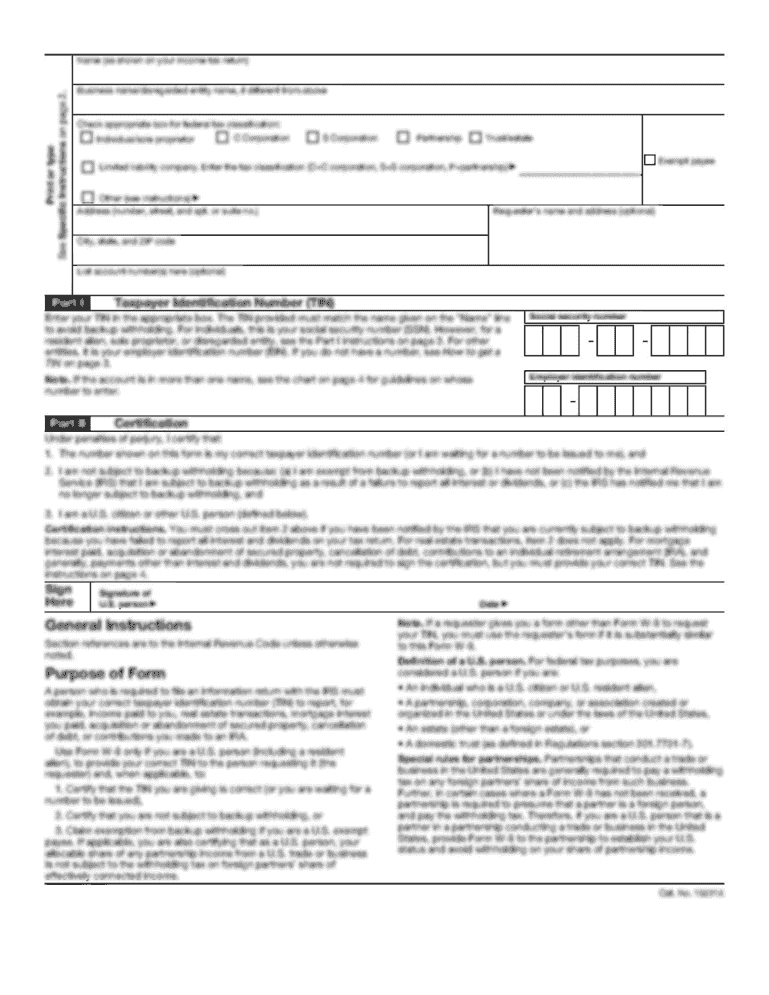

*XX0005401283* SCHEDULES DO E (FORM 40) Alabama Department of Revenue Schedule D Net Profit or Loss 2013 (Schedule E is on back) ATTACH TO FORM 40 SEE INSTRUCTIONS FOR SCHEDULES D AND E Name(s) as

We are not affiliated with any brand or entity on this form

Instructions and Help about schedules de form 40

How to edit schedules de form 40

How to fill out schedules de form 40

Instructions and Help about schedules de form 40

How to edit schedules de form 40

To edit schedules de form 40, use tools that allow electronic modifications. You can upload the form to a platform like pdfFiller, which provides options to fill in text fields, edit existing information, and add signatures. After completing your changes, you can save and download the updated version for your records.

How to fill out schedules de form 40

Filling out schedules de form 40 requires attention to detail and understanding of tax terms. First, gather all necessary information regarding your income, deductions, and relevant tax credits. Then systematically proceed through the form's sections, ensuring to enter accurate figures and double-check calculations for errors.

Latest updates to schedules de form 40

Latest updates to schedules de form 40

Stay informed about the latest updates to schedules de form 40 by checking the IRS website regularly or subscribing to IRS updates. Updates may reflect changes in tax law, including adjustments to income thresholds or new credits. Awareness of these changes is essential for accurate tax filing.

All You Need to Know About schedules de form 40

What is schedules de form 40?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About schedules de form 40

What is schedules de form 40?

Schedules de form 40 is an IRS tax form used by individual taxpayers to report their income, claim deductions, and calculate their tax liability. This form is essential for accurately reporting taxable income during tax season and helps taxpayers meet their legal obligations to the IRS.

What is the purpose of this form?

The purpose of schedules de form 40 is to provide a comprehensive report of your financial status for the previous tax year. It allows the IRS to assess your tax liability based on your reported income and claimed deductions, ensuring compliance with federal tax laws.

Who needs the form?

Individuals who earn income in the United States and are subject to federal income taxes must complete schedules de form 40. This includes employees, self-employed individuals, and those receiving other forms of income. Failure to file this form when required could lead to penalties.

When am I exempt from filling out this form?

You may be exempt from filling out schedules de form 40 if your income falls below a certain threshold set by the IRS, or if you meet specific criteria such as being a dependent, or not having any taxable income. However, it is advisable to consult with a tax professional concerning your unique situation to ensure compliance.

Components of the form

Schedules de form 40 consists of several sections, including income reporting, deduction claims, and tax credit applications. Each section is designed to capture relevant financial data, ensuring a complete overview of your tax situation. Accurate and honest reporting in each part is crucial for compliance.

What are the penalties for not issuing the form?

Failing to file schedules de form 40 or submitting an inaccurate form can result in penalties, which may include fines or additional tax liability. The IRS may also impose interest on any unpaid taxes, compounding the financial implications. It's imperative to file accurately and on time to avoid these consequences.

What information do you need when you file the form?

When filing schedules de form 40, you will need your Social Security number, income documentation such as W-2s or 1099s, information on any deductions you plan to claim, and details on tax credits. Ensuring you have this information on hand will help streamline the filing process.

Is the form accompanied by other forms?

Schedules de form 40 can often be filed alongside other forms, such as schedules for itemized deductions or forms for specific tax credits. You may also need to include supporting documentation if you claim certain deductions or credits. Be sure to review IRS guidelines to determine necessary accompanying forms.

Where do I send the form?

Upon completing schedules de form 40, you should send it to the appropriate IRS address based on your state of residence and the nature of your filing. Consult the IRS website or the form instructions for specific mailing addresses to ensure your form reaches the correct department without delay.

See what our users say