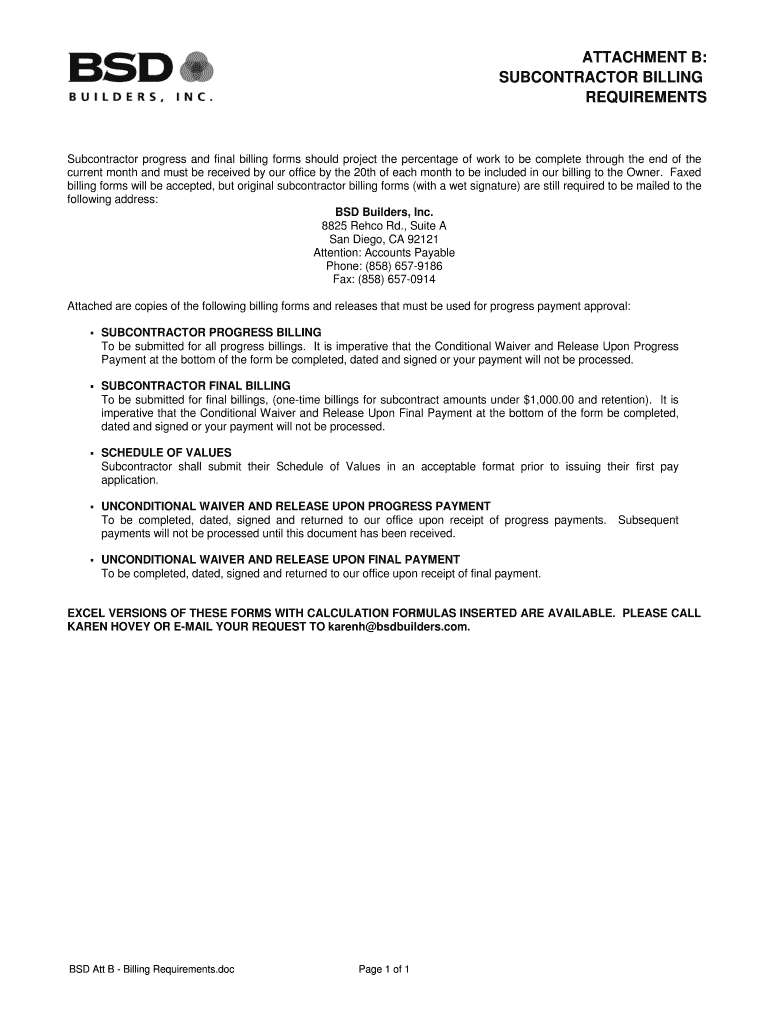

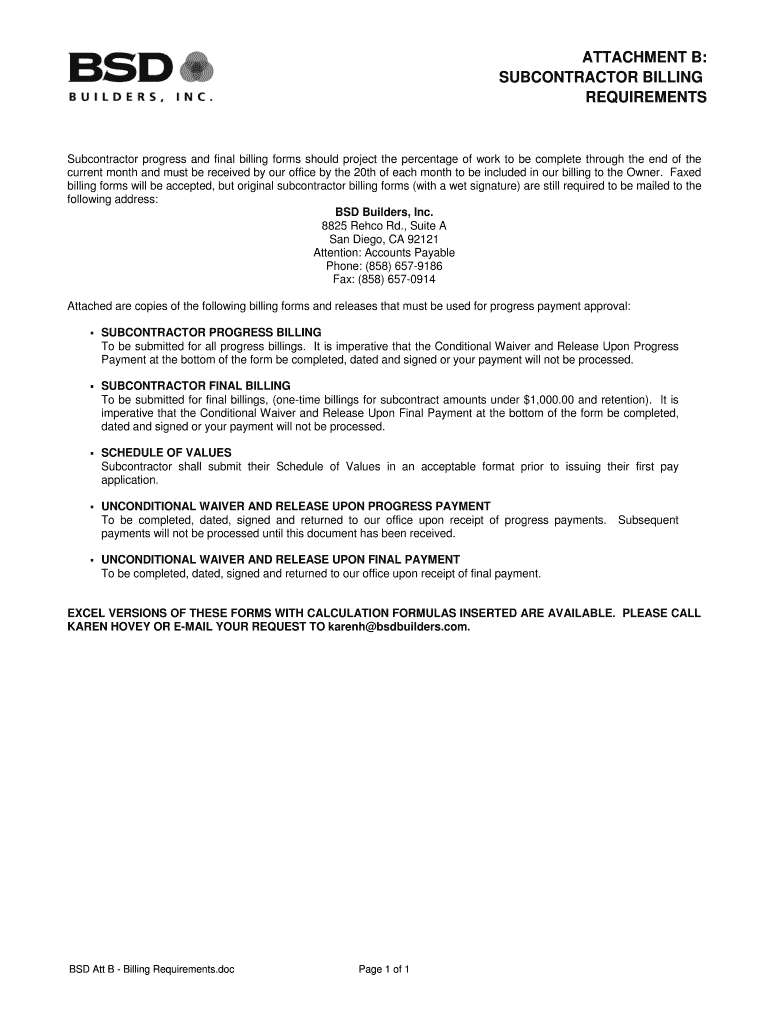

Get the free ATTACHMENT B: SUBCONTRACTOR BILLING REQUIREMENTS

Show details

This document outlines the requirements for subcontractor billing, including the submission of progress and final billing forms, deadlines, and necessary waivers. It includes templates for progress

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign attachment b subcontractor billing

Edit your attachment b subcontractor billing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your attachment b subcontractor billing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit attachment b subcontractor billing online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit attachment b subcontractor billing. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out attachment b subcontractor billing

How to fill out ATTACHMENT B: SUBCONTRACTOR BILLING REQUIREMENTS

01

Start with the project name and number at the top of the form.

02

Fill in the date when the billing is submitted.

03

Enter the subcontractor's name and contact information.

04

Provide the invoice number and date of the invoice.

05

List the descriptions of the work completed according to the contract.

06

Itemize the costs associated with each work description.

07

Include necessary documentation such as receipts, timesheets, and progress reports.

08

Complete the total amount due for the work performed.

09

Sign and date the completed form before submitting it.

Who needs ATTACHMENT B: SUBCONTRACTOR BILLING REQUIREMENTS?

01

Subcontractors who are billed for work done on a project.

02

Contractors managing subcontractors who require formal billing documentation.

03

Project managers overseeing budget and expense tracking within the project.

Fill

form

: Try Risk Free

People Also Ask about

What form do I give a subcontractor?

Form 1099-NEC and independent contractors.

What paperwork do I need to hire a subcontractor?

If you decide to hire independent contractors, you'll need to collect the following documentation: Form W-9. Forms W-8BEN or W-8BEN-E. Form 1099-NEC. Form SS-8. Independent contractor agreement. Confidentiality agreement (NDA) Non-compete agreement. Non-solicitation agreement.

What are the three types of subcontractors?

There are 3 kinds of subcontractors in the construction industry Nominated subcontractors. Domestic subcontractors. Named subcontractors.

Do you have to give a 1099 to a subcontractor?

A subcontractor is a worker who is not your employee. You give a Form 1099 to a subcontractor showing the amounts you paid him. The subcontractor is responsible for keeping his or her own records and paying his or her own income and self-employment taxes.

What is the payment clause for a subcontractor?

PIP clause: A risk-transferring provision The condition of payment to the subcontractor is payment by the owner to the contractor for the subcontractor's work. If the owner fails to pay the contractor, then under a PIP clause, the contractor has no obligation to pay its subcontractor.

How do you charge a subcontractor?

In general, a rate should be based on a few specific details. It should include you or your crew's hourly rate, the cost of materials, any overhead expenses, and some amount of profit. But when many contractors start out, they only take into account hourly rates and the cost of materials.

What paperwork do I need for a subcontractor?

All subcontractors should be providing you with an IRS W9 form. This documentation lets you know the type of company the subcontractor is (corporation, LLC, sole proprietor, etc), as well as their tax identification number or Social Security number if they are an individual.

What do subcontractors need to provide?

All subcontractors should be providing you with an IRS W9 form. This documentation lets you know the type of company the subcontractor is (corporation, LLC, sole proprietor, etc), as well as their tax identification number or Social Security number if they are an individual.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ATTACHMENT B: SUBCONTRACTOR BILLING REQUIREMENTS?

ATTACHMENT B: SUBCONTRACTOR BILLING REQUIREMENTS is a document that outlines the necessary guidelines and procedures that subcontractors must follow when submitting their billing information for services rendered.

Who is required to file ATTACHMENT B: SUBCONTRACTOR BILLING REQUIREMENTS?

Subcontractors who are engaged in providing services or goods under a contract that includes specific billing requirements are required to file ATTACHMENT B.

How to fill out ATTACHMENT B: SUBCONTRACTOR BILLING REQUIREMENTS?

To fill out ATTACHMENT B, subcontractors should enter their billing details clearly, including the scope of work completed, hours worked, materials used, and any other specific information requested in the form.

What is the purpose of ATTACHMENT B: SUBCONTRACTOR BILLING REQUIREMENTS?

The purpose of ATTACHMENT B is to ensure that subcontractors provide consistent and accurate billing information, facilitating easier review and approval processes by the primary contractor.

What information must be reported on ATTACHMENT B: SUBCONTRACTOR BILLING REQUIREMENTS?

Information that must be reported includes the subcontractor's name, invoice number, project name, detailed description of work performed, billing dates, itemized costs, and any additional documentation that supports the billing request.

Fill out your attachment b subcontractor billing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Attachment B Subcontractor Billing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.