AR DFA K-1 2014 free printable template

Show details

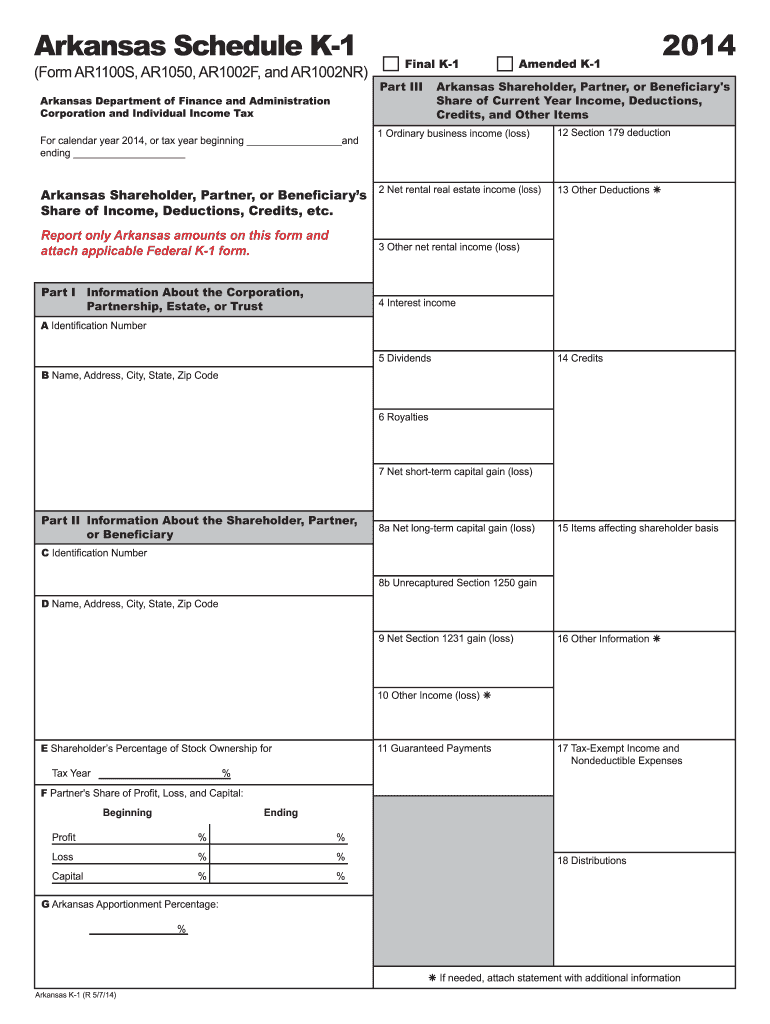

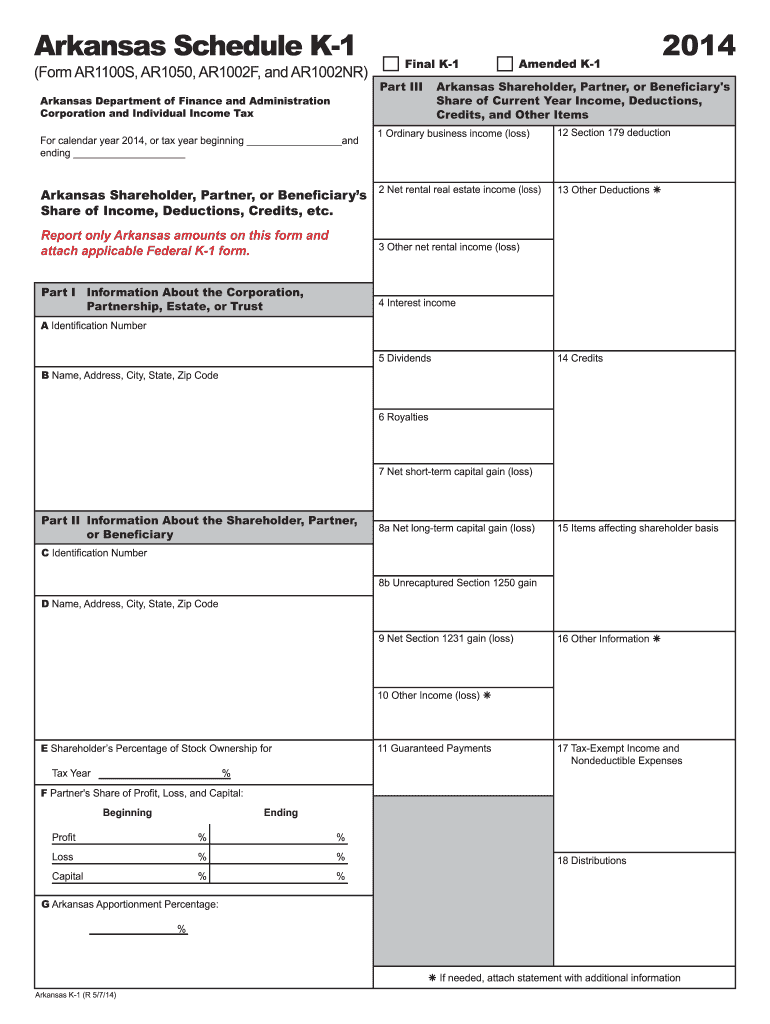

Click Here to Print Document Arkansas Schedule K-1 (Form AR1100S, AR1050, AR1002F, and AR1002NR) Arkansas Department of Finance and Administration Corporation and Individual Income Tax For calendar

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign arkansas schedule k-1 2014

Edit your arkansas schedule k-1 2014 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arkansas schedule k-1 2014 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR DFA K-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out arkansas schedule k-1 2014

How to fill out AR DFA K-1

01

Obtain the AR DFA K-1 form from the Arkansas Department of Finance and Administration website or your tax professional.

02

Enter the name, address, and identification number of the taxpayer in the designated fields.

03

Provide the tax year for which the K-1 is being filed.

04

List each partner's share of income, deductions, and credits as allocated in the partnership agreement on the appropriate lines.

05

Include any other necessary information related to the partnership or LLC as required by the form.

06

Review the completed form for accuracy to ensure all necessary information has been included.

07

Submit the form to the Arkansas Department of Finance and Administration by the specified deadline.

Who needs AR DFA K-1?

01

Anyone who is a partner in a partnership or an owner of an LLC that has income or losses in Arkansas needs to fill out the AR DFA K-1.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is AR DFA K-1?

AR DFA K-1 is a tax form used in Arkansas to report the income, deductions, and credits of partnerships and certain other pass-through entities to their partners, members, or shareholders.

Who is required to file AR DFA K-1?

Entities such as partnerships, limited liability companies (LLCs) taxed as partnerships, and S corporations are required to file AR DFA K-1 for each partner or shareholder to report their share of income and deductions.

How to fill out AR DFA K-1?

To fill out AR DFA K-1, the entity must provide its information at the top of the form, followed by the partner's or shareholder's details, then report the allocated amounts for income, deductions, credits, and other relevant financial information according to the instructions provided.

What is the purpose of AR DFA K-1?

The purpose of AR DFA K-1 is to inform Arkansas tax authorities and the individual partners or shareholders of their respective shares of the entity's income, deductions, and credits, which they must report on their personal tax returns.

What information must be reported on AR DFA K-1?

AR DFA K-1 must report the partner's name, address, and tax identification number, the entity's income, deductions, credits, and other pertinent financial details specific to the partner or shareholder's share.

Fill out your arkansas schedule k-1 2014 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arkansas Schedule K-1 2014 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.