Get the free 740 - Kentucky Individual Income Tax Return - Form 42A740 - revenue ky

Instructions and Help about 740 - kentucky individual

How to edit 740 - kentucky individual

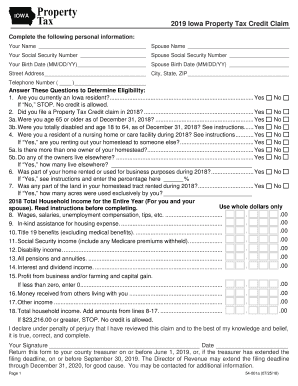

How to fill out 740 - kentucky individual

Latest updates to 740 - kentucky individual

All You Need to Know About 740 - kentucky individual

What is 740 - kentucky individual?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

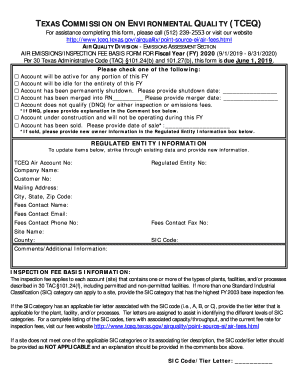

Components of the form

Form vs. Form

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about 740 - kentucky individual

What should I do if I discover an error after filing the 740 - Kentucky individual?

If you find an error on your 740 - Kentucky individual after submission, you should file an amended return as soon as possible. Use the appropriate amendment form and provide clear documentation of the changes. It’s important to correct any inaccuracies to ensure accurate tax records.

How can I track the status of my 740 - Kentucky individual after filing?

To verify the status of your filed 740 - Kentucky individual, you can use the Kentucky Department of Revenue's online tracking system. Enter your information as requested, and you will be able to check if your form has been received and is being processed.

What are common reasons for the e-file rejection of the 740 - Kentucky individual?

E-file rejections for the 740 - Kentucky individual often occur due to incorrect Social Security numbers, mismatched information with federal records, or missing required fields. Review the rejection codes provided to identify and resolve the specific issues.

Are there special considerations for filing the 740 - Kentucky individual on behalf of a nonresident?

When filing the 740 - Kentucky individual for a nonresident, ensure that you meet the specific requirements for their residency status and any applicable tax obligations. You may need to provide additional documentation or indicate that the taxpayer is a nonresident to accurately reflect their filing situation.

What should I do if I receive an audit notice related to my 740 - Kentucky individual?

If you receive an audit notice for your 740 - Kentucky individual, carefully read the instructions provided. Gather all relevant documentation to support your claims and prepare to respond by the specified deadline. Consider consulting a tax professional for guidance on how to handle the audit.