FRS H-3 2011-2025 free printable template

Show details

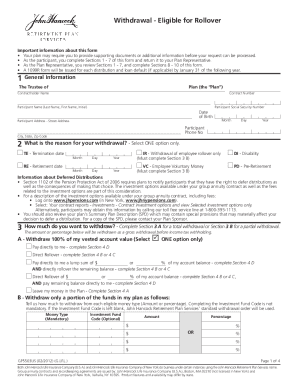

H-3. Model form for credit score disclosure exception for loans secured by one to four units of residential real property Name of Entity Providing the Notice Your Credit Score and the Price You Pay

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form credit score

Edit your credit disclosure document form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 100517669 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit score disclosure exception notice online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit h3 model disclosure form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out h 3 model disclosure form

How to fill out FRS H-3

01

Start by obtaining the FRS H-3 form from the relevant agency's website or office.

02

Read the instructions provided for the form carefully to understand the requirements.

03

Fill out your personal information at the top of the form, including your name, address, and contact details.

04

In the next section, provide details related to your financial situation as required on the form.

05

Ensure that you have all necessary supporting documents ready to attach, such as income statements or asset documentation.

06

Review each section to make sure all information is accurate and complete.

07

Sign and date the completed form at the designated area.

08

Submit the form according to the instructions, whether electronically or via mail.

Who needs FRS H-3?

01

The FRS H-3 form is needed by individuals or entities applying for financial assistance or benefits related to specific programs.

02

It is typically required for participants in certain social service programs or financial aid applicants.

Fill

john hancock site pdffiller com site blog pdffiller com

: Try Risk Free

People Also Ask about

What are the disclosure requirements?

Disclosure requirements allow media and public to examine campaign funding. These requirements allow interested parties, such as the media and the public, to examine records otherwise hidden from them. The result is closer scrutiny of facts and figures and of the relationships between political actors.

What are the required credit card disclosures?

Credit card disclosure must include a list of fees associated with your card. Some common credit card fees include annual fees, cash advance fees, foreign transaction fees, often called a "currency conversion" fee. Other fees include late payment fees, over-the-limit fees, and returned payment fees.

What is a credit score disclosure?

A Credit Score Disclosure alerts a consumer of their FICO scores, defines what a FICO is, informs how FICO scores affect their access to consumer credit and provides contact information for the bureaus.

What is required in a credit disclosure?

The Fair Credit and Charge Card Disclosure Act (FCCCDA), enacted in 1988, requires financial institutions and businesses to disclose vital information when issuing new credit cards. A card issuer must disclose interest rates, grace periods and all fees, such as cash advances and annual fees.

Is a credit score disclosure required?

What Types of Credit Scores Must Be Disclosed? A creditor must disclose “the credit score used by the person in making the credit decision” on a risk-based pricing notice. “Credit score” has the same meaning used in §609(f)(2)(a) of the FCRA.

What are 6 things a credit card companies must disclose?

Total of payments, Payment schedule, Prepayment/late payment penalties, If applicable to the transaction: (1) Total sales cost, (2) Demand feature, (3) Security interest, (4) Insurance, (5) Required deposit, and (6) Reference to contract.

What do the disclosure terms of a credit offer include?

Lenders must provide a full disclosure of all of the loan's terms in the credit agreement. That can include the annual interest rate (APR), how the interest is applied to outstanding balances, any fees associated with the account, the duration of the loan, the payment terms, and any consequences for late payments.

What is a credit score disclosure exception notice?

The credit score exception notice (model forms H-3, H-4, H-5) is a disclosure that is provided in lieu of the risk-based-pricing notice (RBPN, which are H-1, H-2, H-6 & H-7). The RBPN is required any time a financial institution provides different rates based on the credit score of the applicant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute FRS H-3 online?

Filling out and eSigning FRS H-3 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit FRS H-3 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your FRS H-3 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I complete FRS H-3 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your FRS H-3. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is FRS H-3?

FRS H-3 is a financial reporting schedule used by certain entities to report their financial activities and status to regulatory authorities.

Who is required to file FRS H-3?

Entities that meet specific criteria set forth by regulatory authorities are required to file FRS H-3, typically including financial institutions and certain corporations.

How to fill out FRS H-3?

To fill out FRS H-3, entities must collect relevant financial data, complete the required sections of the form accurately, and submit it by the designated deadline.

What is the purpose of FRS H-3?

The purpose of FRS H-3 is to ensure transparency in financial reporting, allowing regulatory authorities to assess the financial health and compliance of reporting entities.

What information must be reported on FRS H-3?

FRS H-3 requires reporting of financial statements, details on income and expenses, assets and liabilities, and any other information specified by regulatory guidelines.

Fill out your FRS H-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FRS H-3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.