Get the free to File a DC Franchise - otr cfo dc

Show details

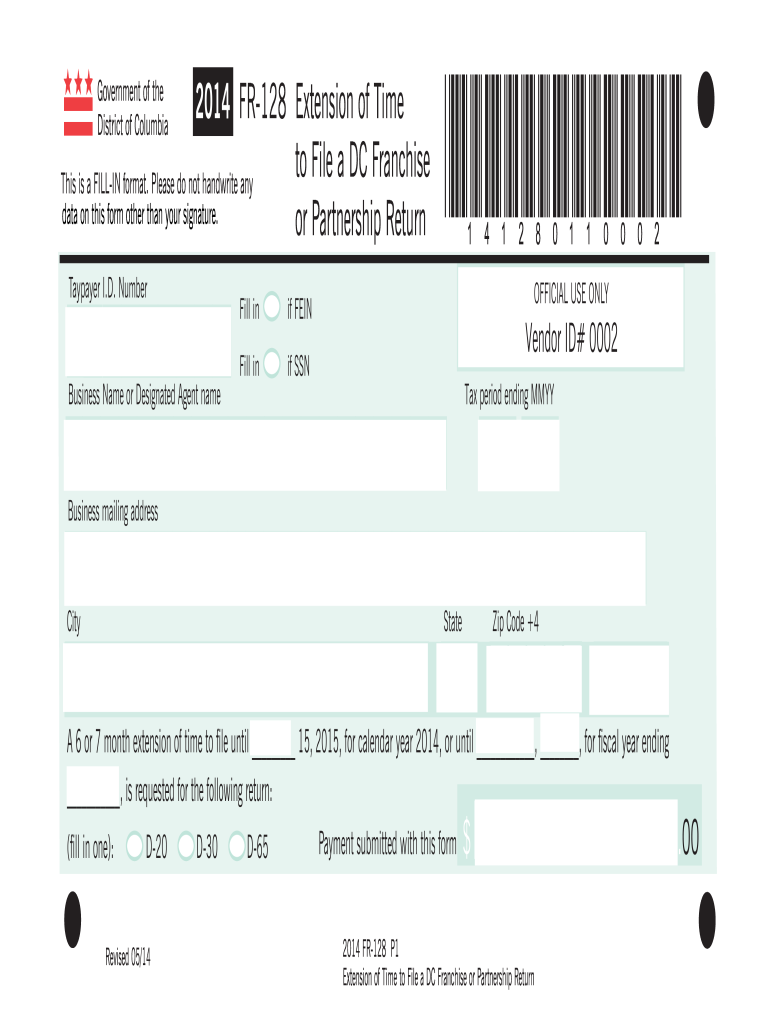

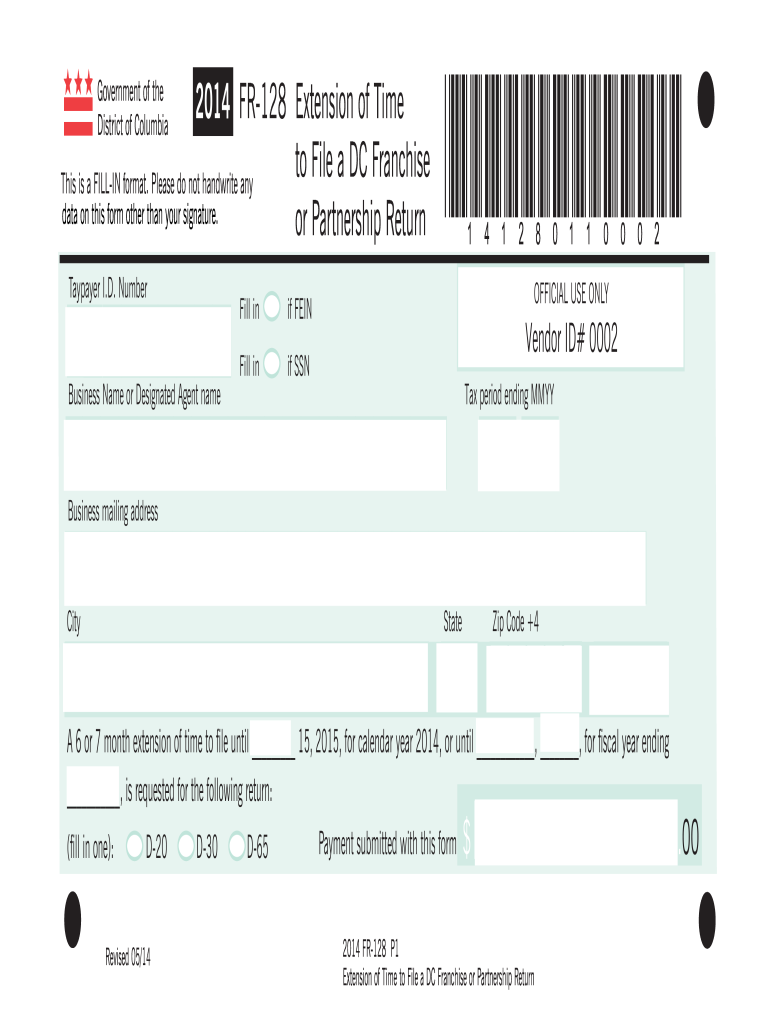

2014 FR-128 Extension of Time to File a DC Franchise This is a FILL-IN format. Please do not handwrite any data on this form other than your signature. Or Partnership Return Government of the District

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign to file a dc

Edit your to file a dc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your to file a dc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing to file a dc online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit to file a dc. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

Who must file DC form D 30?

Generally, an unincorporated business, with gross income (Line 11) more than $12,000 from District sources, must file a D-30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

What is a D-40B form?

Any non-resident of DC claiming a refund of DC income tax with- held or paid by estimated tax payments must file a D-40B. A non-resident is anyone whose permanent home was outside DC during all of 2022 and who did not maintain a place of abode in DC for a total of 183 days or more during 2022.

What is the d40 tax form?

What is a d40? If you need to change or amend an accepted Washington, D.C. State Income Tax Return for the current or previous Tax Year you need to complete Form D-40. Form D-40 is used for the Tax Return and Tax Amendment.

Does DC have a non resident tax?

If you are not a resident of DC you must file a Form D-4A with your employer to establish that you are not subject to DC income tax withholding. You qualify as a nonresident if: Your permanent residence is outside DC during all of the tax year and you do not reside in DC for 183 days or more in the tax year.

Who needs to file a DC return?

You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. You maintained a place of abode in DC for a total of 183 days or more even if your permanent home was outside of DC;

Who pays DC franchise tax?

Corporations must report income as follows: Net income of corporations in the District on a combined reporting basis. Corporations must pay a minimum tax as follows: $250 minimum tax, if DC gross receipts are $1 million or less. $1000 minimum tax, if DC gross receipts are more than $1 million.

Who must file DC franchise tax?

The unincorporated business franchise tax (Form D-30) must be filed by any D.C. business that is unincorporated, which includes partnerships, sole proprietorships, and joint ventures, so long as such a business derives rental income or any other income from D.C. sources in excess of $12,000 per year.

Who must file a DC nonresident return?

Any non-resident of DC claiming a refund of DC income tax with- held or paid by estimated tax payments must file a D-40B. A non-resident is anyone whose permanent home was outside DC during all of 2022 and who did not maintain a place of abode in DC for a total of 183 days or more during 2022.

How to file DC franchise tax return?

To successfully make this application: Mail your completed FR-120 to the Office of Tax Revenue. Include any D-20 taxes owed. Include your FEIN and tax year with any payment. Include a DC Form QHTC-CERT if your business is considered a Qualified High Technology Company.

How do I file a DC tax extension online?

You have the following options to file a D.C. tax extension: Pay all or some of your Washington, D.C. income taxes online by submitting Form FR-127 via: MyTax. DC. Paying your D.C. taxes online on time will be considered a D.C. tax extension and you do not have to mail in Form FR-127.

Who must file DC franchise tax return?

The unincorporated business franchise tax (Form D-30) must be filed by any D.C. business that is unincorporated, which includes partnerships, sole proprietorships, and joint ventures, so long as such a business derives rental income or any other income from D.C. sources in excess of $12,000 per year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find to file a dc?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific to file a dc and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for signing my to file a dc in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your to file a dc and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I edit to file a dc on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing to file a dc right away.

What is to file a dc?

Filing a dc refers to submitting a Declaration of Conformity document.

Who is required to file to file a dc?

Manufacturers and importers are required to file a dc.

How to fill out to file a dc?

To file a dc, manufacturers and importers must complete the required form with accurate information.

What is the purpose of to file a dc?

The purpose of filing a dc is to declare that a product meets the relevant regulatory requirements.

What information must be reported on to file a dc?

The Declaration of Conformity document typically includes product information, testing results, and compliance details.

Fill out your to file a dc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

To File A Dc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.