Get the free otc 974

Show details

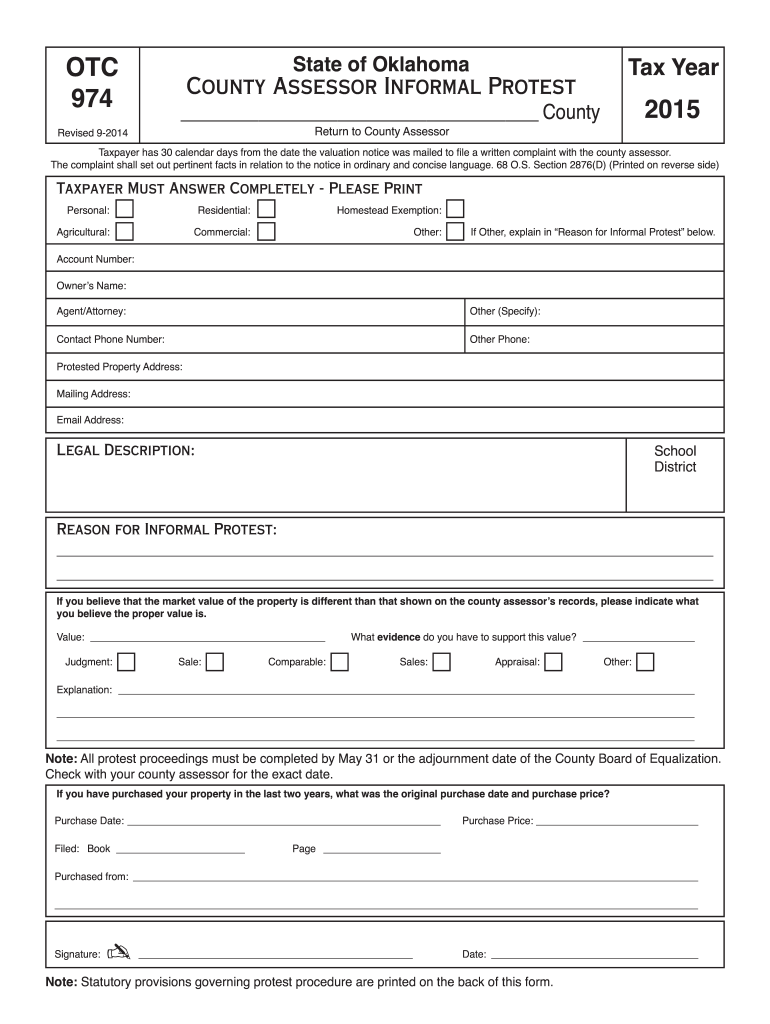

OTC 974 Revised 9-2014 State of Oklahoma Tax Year County 2015 County Assessor Informal Protest Return to County Assessor Taxpayer has 30 calendar days from the date the valuation notice was mailed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign otc 974

Edit your otc 974 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your otc 974 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit otc 974 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit otc 974. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out otc 974

How to fill out otc 974:

01

Start by obtaining the OTC 974 form from a local pharmacy or healthcare provider.

02

Carefully read the instructions on the form to ensure you understand the information required.

03

Begin by providing your personal details, such as your full name, date of birth, and contact information.

04

Next, provide information about your medical condition or reason for needing the OTC 974. It's important to be specific and include any relevant details.

05

If applicable, include information about any medications you are currently taking or have taken in the past for the same condition. This can help healthcare professionals evaluate your eligibility for the OTC 974.

06

Make sure to answer all the questions on the form accurately and honestly. Double-check your responses for any errors or omissions.

07

Once you have completed the form, sign it and date it.

08

Submit the filled-out OTC 974 form according to the instructions provided, whether it's through mail, in-person, or online.

09

Keep a copy of the completed form for your records.

Who needs OTC 974:

01

Individuals who are seeking over-the-counter medication for a specific medical condition may need the OTC 974 form.

02

People who have tried other non-prescription treatments without success may also require the OTC 974.

03

Healthcare professionals may recommend the OTC 974 to patients who need a specific medication that is not available without a prescription.

04

It is important to consult with a healthcare provider to determine if the OTC 974 is necessary and appropriate for your specific situation.

Fill

form

: Try Risk Free

People Also Ask about

How much does a Homestead Exemption save you in Oklahoma?

Homestead Exemption is an exemption of $1,000 of the assessed valuation. This can be a savings of $75 to $125 depending on which area of the county you are located.

Can assessor come on my property without permission in Oklahoma?

An assessor will not enter your house or dwelling unless they have specific permission.

At what age do you stop paying property taxes in Oklahoma?

Head-of-household (as defined below) must be age 65 or older prior to January 1, of current year. Head-of-household must be an owner of and occupy the Homestead property on January 1, of current year. Gross household income (as defined below) cannot exceed the current H.U.D.

How do I protest property taxes in Oklahoma?

Informal protest forms are available in our office, on the website, or online through the Oklahoma Tax Commission. A County Assessor Informal Protest Form OTC 974 (PDF) must be completed and returned by mail, fax, email, or in-person to the Assessor's office no later than 30 days after Change of Value notices are sent.

Do people over 65 pay property taxes in Oklahoma?

Senior citizens (65 and Older) earning $85,300 or less are eligible for the Senior Valuation Freeze which can reduce your property tax bill over time. This will freeze the taxable, or assessed value, of your residential property.

Who qualifies for Homestead Exemption in Oklahoma?

Homestead Exemption is granted to the homeowner who resides in the property on a permanent basis on January 1. The deed or other evidence of ownership must be executed on or before January 1 and filed in the County Clerk's office on or before February 1.

At what age do you stop paying property taxes in Oklahoma?

The property owner must be age 65 or over as of January 1st to qualify. Gross household income from the preceding year does not exceed the 2023 maximum income qualification of $85,300. This includes income from all sources (including all persons occupying the home), except gifts.

What is the senior homestead exemption in Oklahoma?

Any person 65 years of age or older or any totally disabled person, who is head of household, was a resident of this state during the entire preceding calendar year and whose gross household income does not exceed $12,000 is qualified for the program and may apply.

How to protest property taxes and win Texas?

At an informal protest, you simply need to present data on your home to your appraisal district. In most cases, you can simply visit your appraisal district office and wait to meet with an appraiser. The number one recommendation for winning an informal protest is simple – be kind.

Do you have to file Homestead Exemption every year in Oklahoma?

FACTS TO REMEMBER 1. New Homestead Exemptions are filed by March 15th to be applied for the current tax year. 2. Additional Homestead Exemptions must be renewed every year between January 1 and March 15.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my otc 974 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign otc 974 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Where do I find otc 974?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific otc 974 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How can I edit otc 974 on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing otc 974, you can start right away.

What is OTC 974?

OTC 974 is a form used by certain organizations to report specific types of transactions, typically related to tax obligations or compliance.

Who is required to file OTC 974?

Organizations or individuals who engage in transactions that meet the criteria specified by tax regulations or state requirements are required to file OTC 974.

How to fill out OTC 974?

To fill out OTC 974, one must gather the required information, carefully complete each section of the form following the instructions provided, and submit it to the appropriate tax authority.

What is the purpose of OTC 974?

The purpose of OTC 974 is to ensure compliance with tax laws by providing a structured format for reporting relevant transactions to tax authorities.

What information must be reported on OTC 974?

Information that must be reported on OTC 974 may include transaction details, the parties involved, amounts, dates, and any other supporting documentation as required by the form's instructions.

Fill out your otc 974 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Otc 974 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.