Get the free FORM 504 2014 Application for Extension

Show details

ITE (This is NOT an extension of time for payment of tax. Do NOT use this form to remit franchise tax) (See Instructions), 2014 ending For the year January 1 December 31, or other taxable year beginning

We are not affiliated with any brand or entity on this form

Instructions and Help about form application

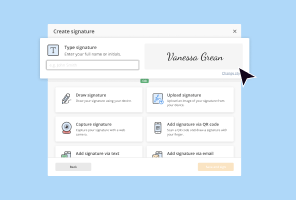

How to edit form application

How to fill out form application

Instructions and Help about form application

How to edit form application

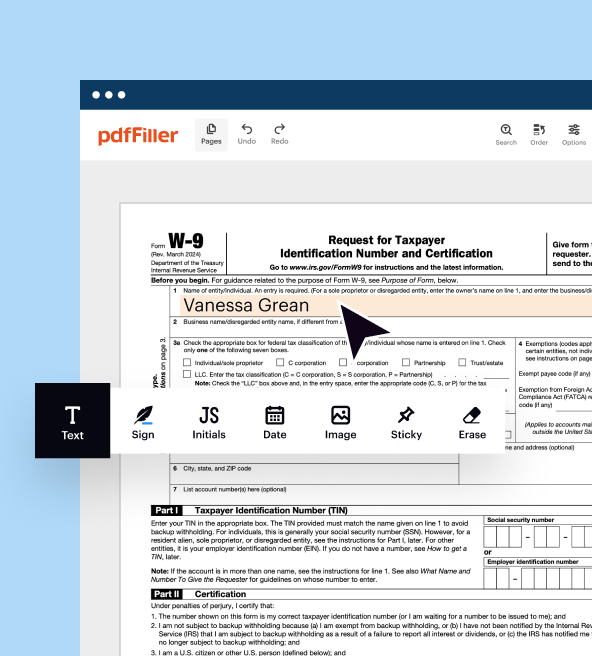

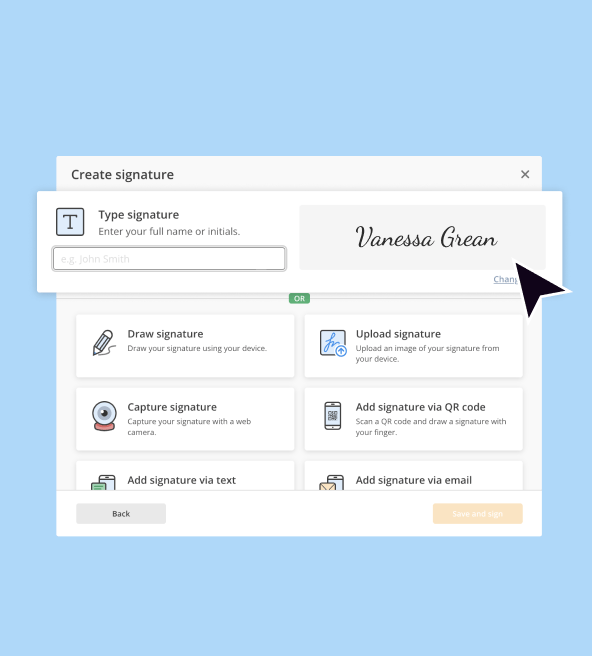

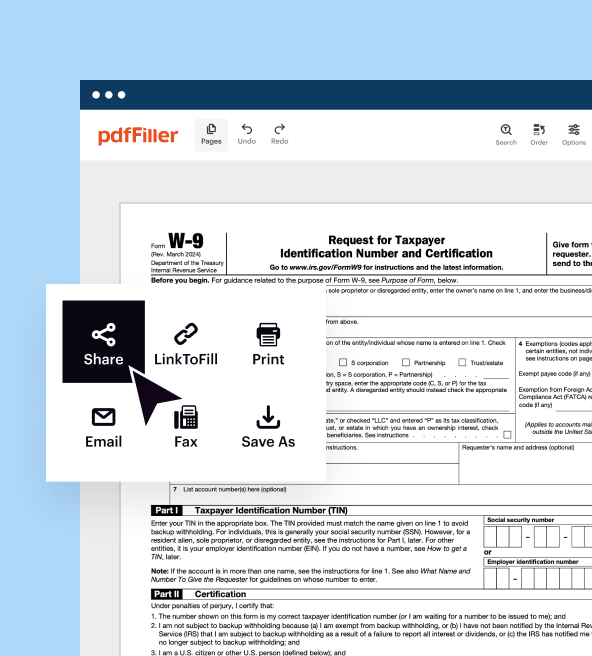

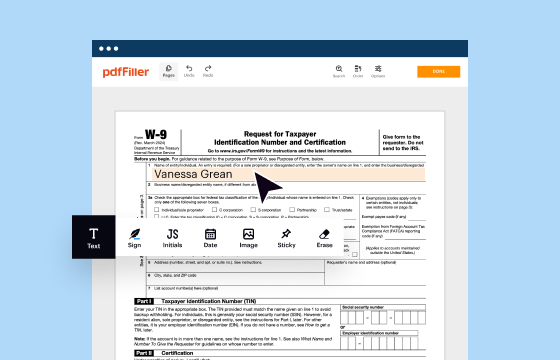

To edit form application, use pdfFiller's intuitive editing tools. Start by uploading the form to the pdfFiller platform. Utilize the editor to make corrections or add necessary information directly onto the document.

Once edits are complete, save the changes to ensure all modifications are preserved. This helps in maintaining an accurate record for future reference.

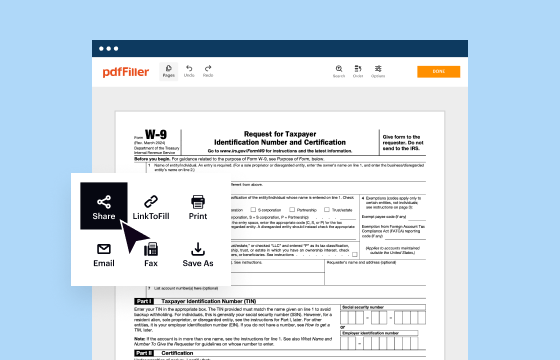

How to fill out form application

Filling out form application involves several steps to ensure accurate submission. Begin by gathering all required information, including personal identification details and any relevant tax documents.

Next, carefully follow the instructions presented on the form, ensuring you fill out each section accurately. Double-check all entries for correctness before finalizing your submission.

01

Step 1: Gather necessary personal information.

02

Step 2: Complete each section of the form as instructed.

03

Step 3: Review for errors and make necessary corrections.

Latest updates to form application

Latest updates to form application

There are no significant updates to form 504 for the current tax year. It is important to remain aware of any changes announced by the IRS in upcoming tax seasons.

All You Need to Know About form application

What is form application?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About form application

What is form application?

Form application is a tax form used by specific entities that report certain payments and transactions to the IRS. This form collects critical information necessary for compliance with U.S. tax laws.

What is the purpose of this form?

The primary purpose of form 504 is to document specific financial transactions that must be reported for tax purposes. It ensures that individuals and businesses comply with federal tax obligations.

Who needs the form?

Entities required to file form 504 include certain businesses and organizations that meet specific criteria outlined by the IRS. Typically, these may include partnerships, corporations, and certain non-profit organizations that engage in required financial transactions.

When am I exempt from filling out this form?

Exemptions from filling out form 504 may apply based on the type of payment or the entity involved. If entities do not meet the IRS criteria for reporting specific transactions, they may not be required to file this form.

Components of the form

The components of form 504 include sections for identifying the payer and payee, the details of the payments made, and any additional information requested by the IRS. Each section must be completed carefully to ensure accurate reporting.

What are the penalties for not issuing the form?

Failure to issue form 504 when required may result in penalties imposed by the IRS. Potential penalties can include fines, interest on unpaid taxes, and scrutiny during audits, making it essential to comply with all reporting requirements.

What information do you need when you file the form?

When filing form 504, gather the following information: the payer's name, address, tax identification number, the payee's information, and details regarding the amounts being reported. This documentation is necessary to accurately complete the form.

Is the form accompanied by other forms?

Form 504 may need to be submitted along with other IRS forms depending on the type of transaction being reported. Always check to see if additional forms are necessary to ensure complete and compliant submission.

Where do I send the form?

The destination for submitting form 504 varies based on the payer's location and the specified guidelines from the IRS. Always verify the correct mailing address on the IRS website or in the form instructions to ensure timely processing.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.