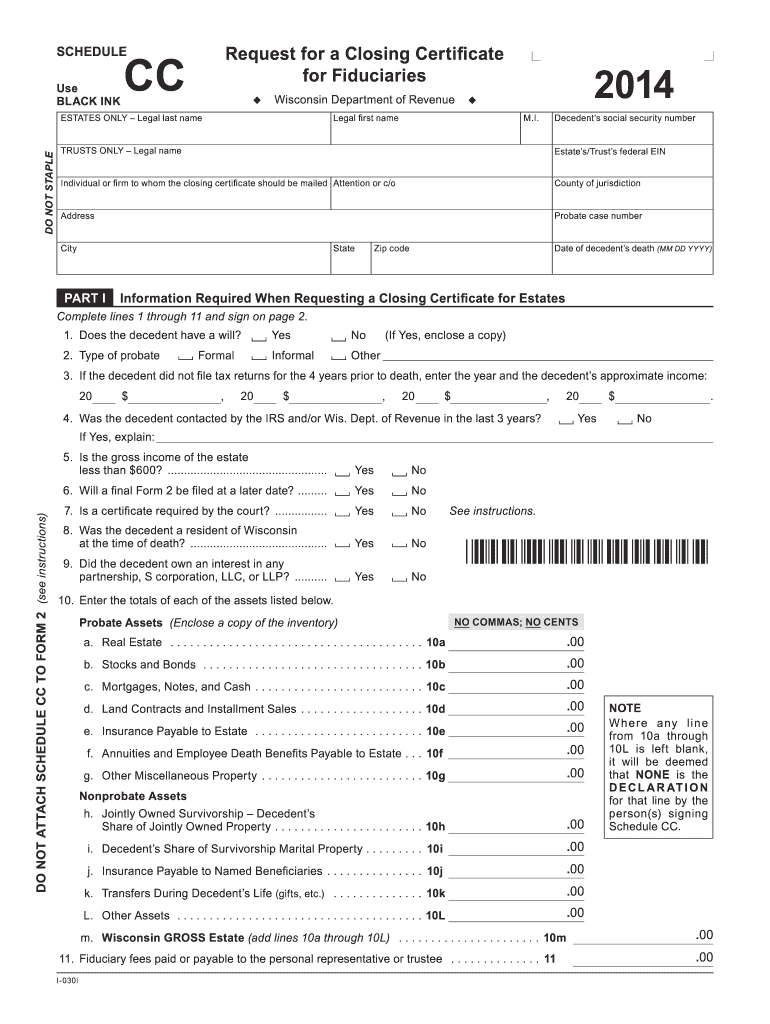

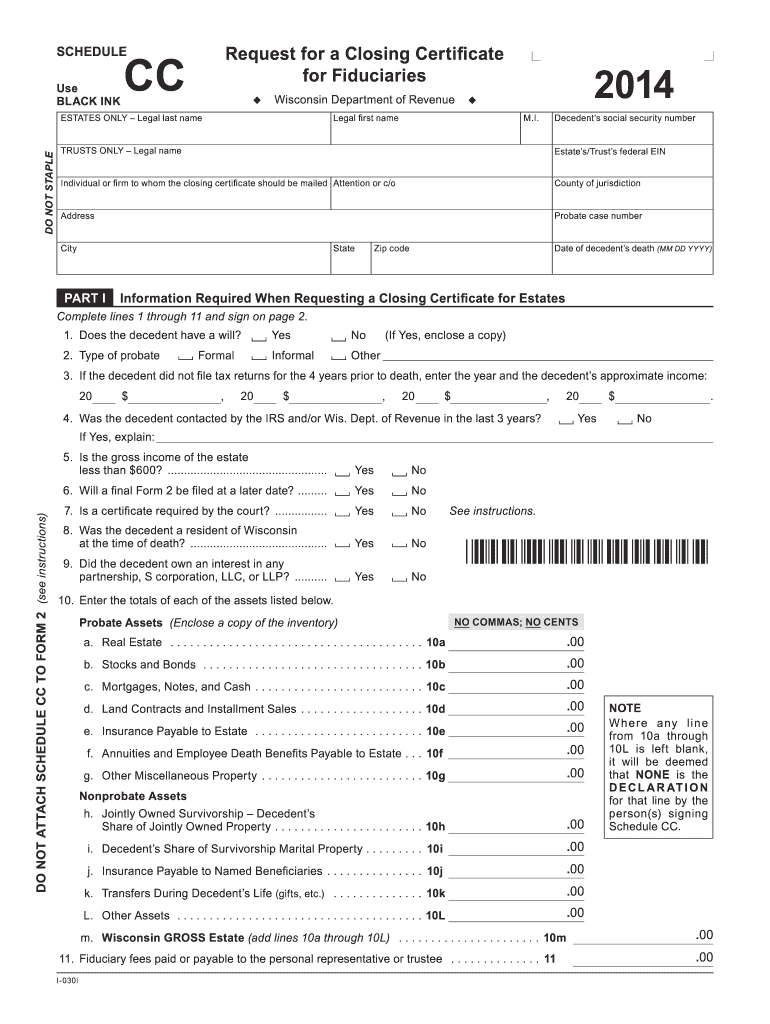

WI DoR Schedule CC 2014 free printable template

Get, Create, Make and Sign WI DoR Schedule CC

Editing WI DoR Schedule CC online

Uncompromising security for your PDF editing and eSignature needs

WI DoR Schedule CC Form Versions

How to fill out WI DoR Schedule CC

How to fill out WI DoR Schedule CC

Who needs WI DoR Schedule CC?

Instructions and Help about WI DoR Schedule CC

Hey everyone this is Josh with job business solutions, and today we're going to a short video on filling out a Schedule C is used to report your business income it is mostly for people who are sole proprietors meaning you don't you never set up any business entity, and it's also for people who are an in an LLC and their that it's called a single-member LLC meaning you're the only member you don't have any partners so if that's the case you'll also put this on your Schedule C is just a form in your personal tax return it's going to take all the information it's going to summarize it here, and it's going to bring one number over to your 1040 to go either offset or add to your income from other sources like w-2s that kind of stuff, so it's a lot of people find this form pretty confusing after you see if it's pretty straightforward, so it starts out it wants to know the name of the proprietor which is you so in this case put my name social security number zero zero zero zero okay and principle business or profession including product or service, so this is kind of what you do for this example we'll use my business we'll say tax preparer the business code it's a six-digit code and the sort of industry has their own code if you're using tax software they're going to give you kind of drop-down menu to choose from if you're trying to fill this out by hand which I strongly recommend you don't but if you do just go to google and google the business code for whatever business code for retail sales and something will come up it'll give you a code you can use so let's just make up a six-digit number here business name if you never set up a business entity this could just be your name in which case you won't fill this out if you did register with the state as an official business you're going to put your actual name here in my case it will be JD be business solutions your employer ID number that's going to be the 9-digit code you used you registered with the IRS with there is a chance that you never did this if you're not a corporation, so you'll know if you did it you registered with the state or with the IRS, and they sent you a nine-digit number two digits — than seven more digits there we go coming out quite right, but that's the gist of it your business address whether you have a separate office there's just in your home you can put the address in here where you do business okay so those that's the easy part other than the business code everything else is very straightforward and the business code again you can just get by googling your industry business code for whatever industry you're in Part F here accounting method this will definitely throw a lot of people off so there's's basically two choices don't worry about the other there's very low chance you're in the other you're either a cash business or an accrual business most of you who are watching this video who are coming to our website are cash businesses so what that means is you record your...

People Also Ask about

What forms do I need for taxes 2022?

How much money can you inherit without being taxed?

How much can I inherit from my parents tax free?

How much can you inherit without paying taxes in Wisconsin?

Can I pay my Wisconsin taxes with a credit card?

What are 4 things you need to file your taxes?

What does the Wisconsin Department of Revenue do?

Do you have to pay taxes on inheritance money in Wisconsin?

What are downsides to paying your taxes with a credit card?

Why would I get mail from Wisconsin Department of Revenue?

How can you find out if someone has filed a tax refund using your Social Security number?

How much inheritance is tax free in Wisconsin?

Why did I get a letter from the IRS about my identity?

How can I pay my income tax by credit card?

What are 5 things you will need to file your taxes?

Can a person pay a taxes with a credit card?

How do I find out if someone filed taxes in my name?

What documents do I need to file my taxes 2022?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send WI DoR Schedule CC for eSignature?

Can I sign the WI DoR Schedule CC electronically in Chrome?

How can I edit WI DoR Schedule CC on a smartphone?

What is WI DoR Schedule CC?

Who is required to file WI DoR Schedule CC?

How to fill out WI DoR Schedule CC?

What is the purpose of WI DoR Schedule CC?

What information must be reported on WI DoR Schedule CC?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.