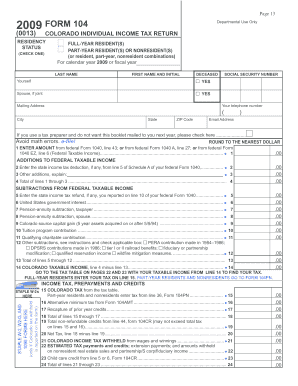

CO DoR 104 2014 free printable template

Show details

*17010419999*

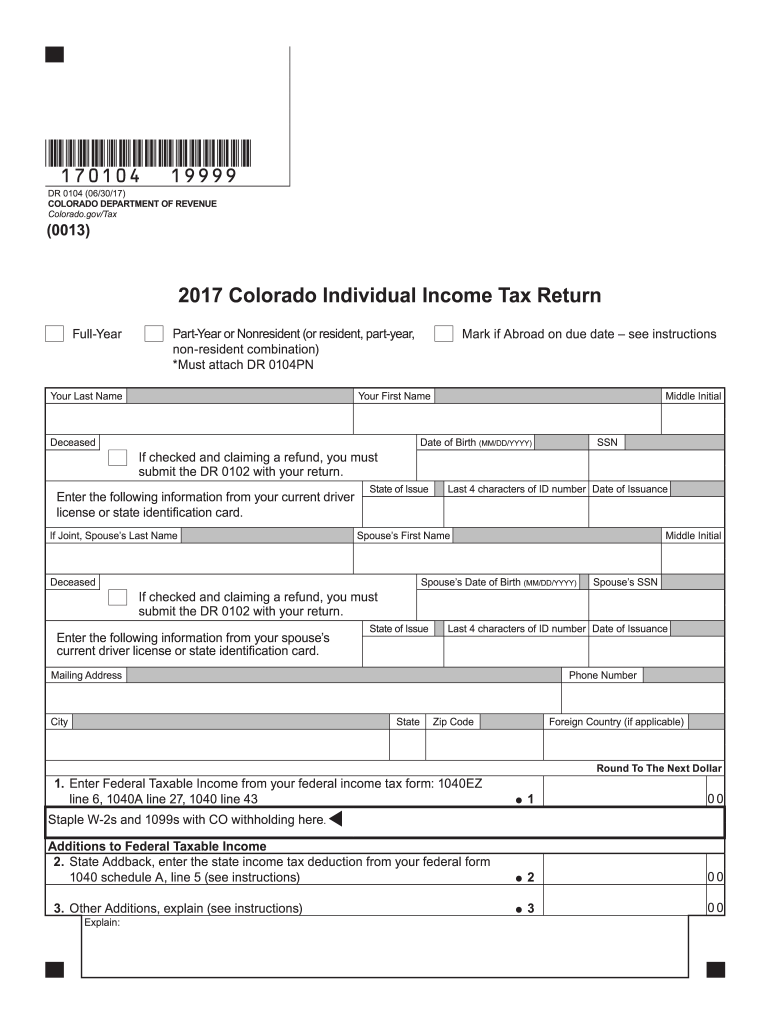

DR 0104 (06/30/17)

COLORADO DEPARTMENT OF REVENUE

Colorado.gov/Tax(0013)2017 Colorado Individual Income Tax Return

FullYearPartYear or Nonresident (or resident, part year,

nonresident

pdfFiller is not affiliated with any government organization

Instructions and Help about CO DoR 104

How to edit CO DoR 104

How to fill out CO DoR 104

Instructions and Help about CO DoR 104

How to edit CO DoR 104

Editing the CO DoR 104 form can be done easily using PDF editing tools. You can use pdfFiller to make necessary adjustments such as adding information or correcting errors before submission. Simply upload your document to the platform, make your edits, and save your changes.

How to fill out CO DoR 104

Filling out the CO DoR 104 form involves several key steps to ensure accuracy and compliance with tax filing requirements. First, gather all relevant information you will need, such as your business details and income data. Then, follow these steps:

01

Download the CO DoR 104 form from the Colorado Department of Revenue website or access it through pdfFiller.

02

Enter your identifying information, including your name, address, and taxpayer identification number.

03

Fill in the financial details relevant to the tax period being reported.

04

Double-check all entries for accuracy before submitting.

About CO DoR previous version

What is CO DoR 104?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CO DoR previous version

What is CO DoR 104?

The CO DoR 104 form is a tax form used in Colorado to report individual income tax obligations. It serves as the state's primary income tax return for individuals and is a critical document for residents and non-residents earning income within the state.

What is the purpose of this form?

The purpose of the CO DoR 104 form is to calculate and report state income taxes owed by individuals and to claim any refunds if applicable. This form consolidates various income sources and provides a comprehensive overview of an individual's tax liabilities.

Who needs the form?

Individuals residing in Colorado or earning income from Colorado sources are required to use the CO DoR 104 form to report their income and calculate state taxes. This includes full-time residents, part-time residents, and non-residents with income from Colorado.

When am I exempt from filling out this form?

You are exempt from filling out the CO DoR 104 form if your income does not meet the taxable threshold set by Colorado state law. Additionally, certain types of income, such as specific government benefits or retirement income, may also exempt you from filing.

Components of the form

The CO DoR 104 form includes several essential components, such as personal identification information, income sources, adjustments to income, and calculation of taxes owed. Understanding each component can help ensure that you complete the form correctly and submit it on time.

What are the penalties for not issuing the form?

Failing to issue the CO DoR 104 form by the due date can result in penalties and interest on any taxes owed. The state of Colorado may impose fines, and prolonged failure to file can lead to additional legal ramifications, including collection actions.

What information do you need when you file the form?

When filing the CO DoR 104 form, you need to gather specific information, including:

01

Your Social Security Number or Individual Taxpayer Identification Number.

02

All income documentation, including W-2s and 1099s.

03

Details of any deductions or credits you plan to claim.

04

Your bank account information if you're expecting a refund and wish to opt for direct deposit.

Is the form accompanied by other forms?

The CO DoR 104 form may need to be accompanied by other forms, depending on your specific circumstances, such as tax credits or special deductions. It's crucial to identify if additional documents are necessary to avoid delays in processing your return.

Where do I send the form?

Submit the CO DoR 104 form to the Colorado Department of Revenue. You can mail it to the address provided in the form instructions or submit it electronically through the state’s online filing system or via pdfFiller for additional convenience.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

pdf filler has allowed me to easily upload and edit pdf documents...as the technology improves it will be a standard use software for most users.

Where has PDFfiller been my whole life?!?! LOVE IT!

See what our users say