Get the free fha identity of interest

Show details

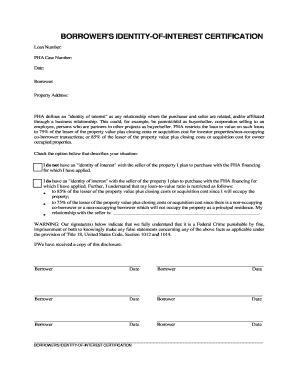

FHA Identity of Interest Certification Borrower(s): Sergio Bern ales Broker/Lender: Cardinal Financial Company, Limited Partnership 3701 Arc Corporate Drive Suite 200 Charlotte, NC 28226 17496 SW

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fha identity of interest

Edit your fha identity of interest form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fha identity of interest form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fha identity of interest online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fha identity of interest. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fha identity of interest

How to fill out FHA identity of interest:

01

Obtain a copy of the FHA identity of interest form from the lender or download it from the FHA website.

02

Carefully read and understand the instructions provided with the form to ensure accurate completion.

03

Provide the necessary personal information such as name, address, contact details, and social security number.

04

Indicate the nature of the relationship that creates an identity of interest, such as being a family member or business partner.

05

Clearly list any previous or current business or financial relationships with the other party involved in the transaction.

06

Include details of any potential conflicts of interest that may arise from the transaction.

07

Sign and date the form once you have reviewed it for accuracy and completeness.

Who needs FHA identity of interest:

01

Borrowers or individuals applying for an FHA-insured loan who have an identity of interest with the seller or any other party involved in the transaction.

02

Sellers who are related to the buyer or have a business relationship that creates an identity of interest.

03

Lenders or loan officers who are processing an FHA loan and need to ensure compliance with FHA regulations regarding identity of interest transactions.

Fill

form

: Try Risk Free

People Also Ask about

What is an FHA number example?

On the Lender Query by Case Number page (Figure ), type the 10-digit FHA case number in the FHA Case Number field, separating the first three digits from the remaining digits with a dash (-). Example: 123-4567890.

How do I add a sponsor to my FHA connection?

On the Add a Lender pop-up page, type the lender's 10-digit FHA ID in the Lender ID field. Select HUD Approved Lender or Sponsored Originator EIN from the drop-down list in the Lender Type field. Type the lender's or sponsored originator's name in the Lender Name field and click OK.

Is there interest on an FHA loan?

FHA loans usually have below-market interest rates. That means they're lower, on average, than comparable conventional loans. Today's 30-year FHA loan rates start at 6.125% (6.576% APR) for a borrower with strong credit*. By comparison, conventional mortgage rates begin at 6.25% (6.254% APR) for a similar loan.

What is the FHA rule?

What Are FHA Flipping Rules? If you plan to purchase a flipped home with an FHA loan, you must abide by the FHA 90-day flipping rule. This rule states that a person selling a flipped home must own the home for more than 90 days before home buyers can purchase the property.

What is the FHA 1% rule?

Simply put, if your loan is not in a repayment plan that will completely pay off your student loan at the end of a fixed-term (fully amortized payment) you have to use the 1% rule. The 1% rule is when the underwriter uses 1% of your student loan balance as a “payment” when calculating your debt to income ratios.

What is the FHA sponsor identifier?

Nine-digit Employer Identification Number (EIN) of the mortgage banker or broker that originated the mortgage and was established as a sponsored originator by an FHA-approved lender. FHA's unique 10-digit identifier for the FHA-approved lender acting as a sponsor or agent for the mortgage originator.

What is an endorsed FHA case number?

Endorsed Case: Loan that was endorsed for FHA mortgage insurance. FHA Case Number: Unique 10-digit number assigned to a loan through Case Number Assignment on the FHA Connection. A loan assigned a number is called a case. MIP: Abbreviation for mortgage insurance premium.

Who sponsors FHA loans?

Government Mortgagee: Federal, state, or municipal government agencies, a Federal Reserve Bank, a Federal Home Loan Bank, the Federal Home Loan Mortgage Corporation (FHLMC, or Freddie Mac), or the Federal National Mortgage Association (FNMA, or Fannie Mae).

What is the FHA 5% rule?

If you have outstanding collections, your lender may want evidence that you've entered into a repayment plan. If this evidence cannot be obtained, then your lender will have to calculate a monthly payment of 5% of the outstanding balance and calculate that amount into your debt-to-income ratio.

What is the FHA formula?

Instead, you multiply the base loan amount by the mortgage insurance rate, and divide by 12. For example, an FHA loan of $482,500 with a 3.5 percent down payment comes with a mortgage insurance rate of 85 basis points, or . 85 percent. The calculation for annual premium is as follows: $482,500 * .

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find fha identity of interest?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the fha identity of interest in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I sign the fha identity of interest electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your fha identity of interest in seconds.

Can I edit fha identity of interest on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute fha identity of interest from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is fha identity of interest?

FHA identity of interest refers to a relationship between an individual or entity involved in a real estate transaction and another party, typically the borrower, where there is a financial interest or close personal relationship that may influence the transaction.

Who is required to file fha identity of interest?

Any party involved in an FHA-insured mortgage transaction, including borrowers, lenders, and real estate agents, must file FHA identity of interest if there is a significant relationship that could affect the transaction.

How to fill out fha identity of interest?

To fill out the FHA identity of interest form, individuals must provide detailed information about their relationship with the borrower, including names, addresses, roles in the transaction, and any other relevant details that clarify the nature of the interest.

What is the purpose of fha identity of interest?

The purpose of FHA identity of interest is to ensure transparency in real estate transactions, mitigate conflicts of interest, and allow the FHA to assess potential risks associated with parties who may have a vested interest in the transaction.

What information must be reported on fha identity of interest?

The information required on the FHA identity of interest form includes names of all parties involved, their relationship to the borrower, addresses, and any specifics about their interest in the transaction that may influence the lending process.

Fill out your fha identity of interest online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fha Identity Of Interest is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.