Get the free Form 760IP Automatic Extension Payment

Instructions and Help about form 760ip automatic extension

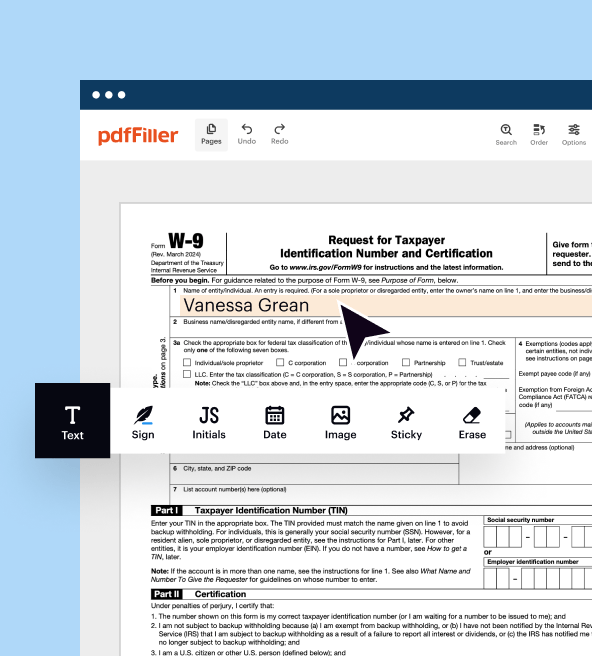

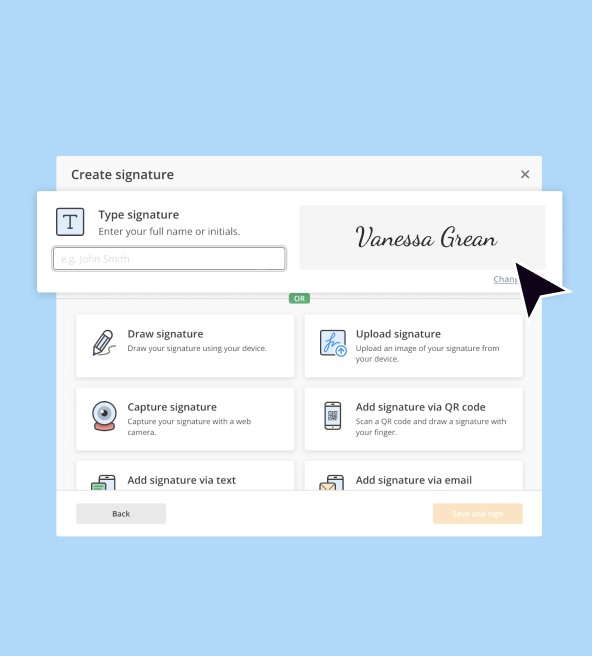

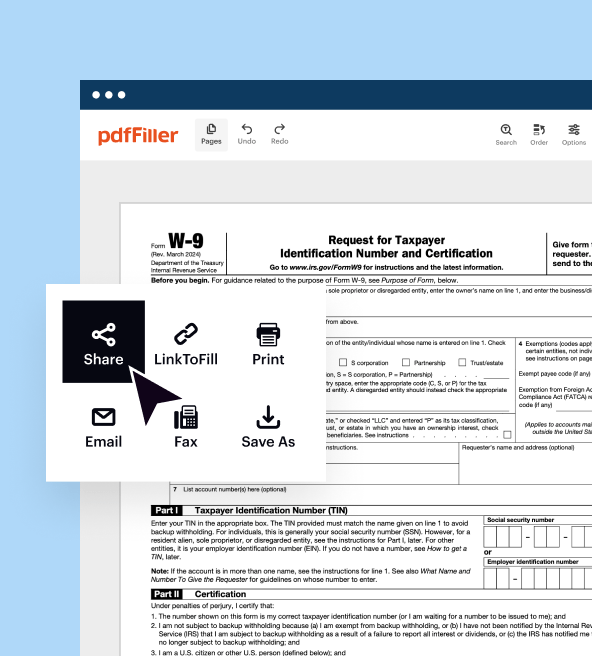

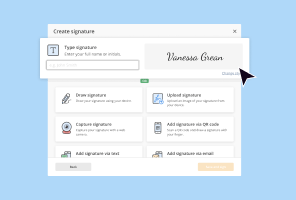

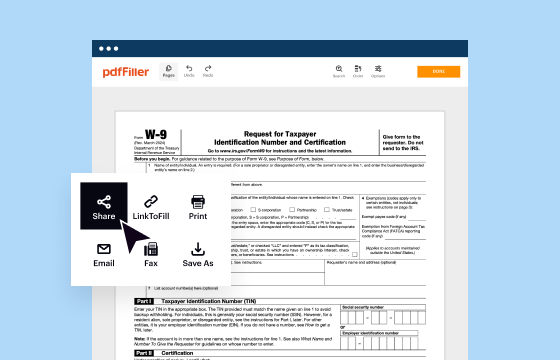

How to edit form 760ip automatic extension

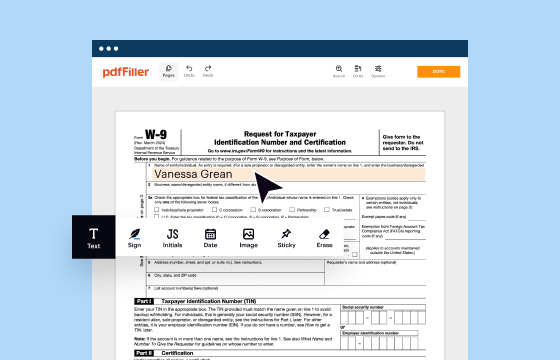

How to fill out form 760ip automatic extension

Latest updates to form 760ip automatic extension

All You Need to Know About form 760ip automatic extension

What is form 760ip automatic extension?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about form 760ip automatic extension

What should I do if I realize I made a mistake after submitting the form 760ip automatic extension?

If you discover an error after submitting your form 760ip automatic extension, you should file an amended form as soon as possible. Clearly indicate the corrections and ensure that you retain a copy of both the original and amended submissions for your records. This helps maintain accuracy in your tax documentation.

How can I track the status of my form 760ip automatic extension after submission?

To track the status of your form 760ip automatic extension, you can check the appropriate government tax agency's website for tracking tools. Keep in mind that processing times may vary, so regularly monitoring your submission can help you stay informed of its status.

What are the privacy and data security measures for my information on form 760ip automatic extension?

When filing the form 760ip automatic extension, your personal and financial information is protected under privacy laws. Make sure to use secure methods for submission, such as encrypted e-filing services. Retain all documentation in a safe format to further ensure data security.

Can a non-resident submit a form 760ip automatic extension on behalf of someone else?

Yes, a non-resident can submit a form 760ip automatic extension on behalf of another individual if they have the appropriate power of attorney (POA). Ensure that the POA documentation is in order and accompanies the submission to validate the authority.

What should I do if I receive an audit notice regarding my form 760ip automatic extension?

If you receive an audit notice related to your form 760ip automatic extension, review the notice carefully and gather all relevant documents to support your case. It's crucial to respond promptly, providing any requested information and addressing the specifics highlighted in the audit notice.