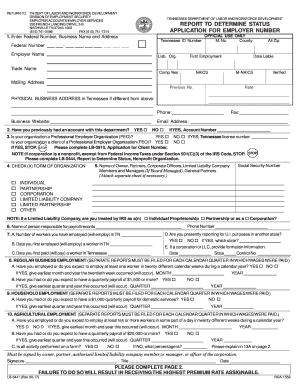

Do I need a TN employer account number?

Companies that pay employees in Tennessee must register with the Tennessee Department of Labor & Workforce Development for an Employer Number for Unemployment taxes.

How do I pay my payroll taxes in TN?

Tennessee also does not have income taxes or any local taxes, and in return, no state W-4 tax withholding form for you to process.Tennessee also allows employers to pay workers by one of the following methods: Cash. Paper check. Direct deposit. Payroll card.

What is a Tennessee employer account number?

If you are liable for unemployment insurance premiums in Tennessee, you will be assigned an eight digit employer account number (e.g., 0000-000 0). Applications may be obtained online or by calling your local Employer Accounts Office or by calling toll free (844) 224-5818 and press option 2 for Employer Taxes.

Do I need a tax ID number from Tennessee?

Outside of obtaining your Federal Tax ID (EIN) in Tennessee you will also likely need a Tennessee State Tax ID. This ID is needed to pay business taxes, state income tax and/or sales tax on items you sell. Generally the State Tax ID is used for the follow: Sales and Use Tax.

How long does it take Tennessee to approve unemployment?

Letter #2 Approval or Denial Approval - If you have certified, your waiting week was served, and you receive a letter of approval, money should be deposited in your bank account (or on the debit card) within 72 hours. Denial - If you do not agree with the agency's decision, you may file an appeal.

How do I know if my TN unemployment was approved?

To do a look-up, you will need your Claim ID. To locate this number, log into Jobs4TN, select the Unemployment Services option; then click on the Claim Summary link. The Claim Details presented will provide you with the Claim ID (Claim #) you will need.

How much does it cost to get a tax ID number in TN?

You can apply for a federal employer identification number on the IRS website. Keep in mind that you will also have to get a state tax ID number from the Tennessee Department of Revenue. EINs are provided by the IRS free of charge. If you apply online, you can get your company's EIN in about five minutes.

How do I know if my unemployment claim was approved?

You can check your claim status online at Unemployment Benefits Services or call Tele-Serv at 800-558-8321. We use information from you and your last employer to determine if you qualify.

Is a termination letter required in Tennessee?

02 of the Rules and Regulations of the Tennessee Employment Security Law, requires all employers to furnish each separated employee with a Separation Notice, LB-0489, within 24 hours of the employee's separation from employment.

How do I find my TN employer account number?

To locate your Employer Account Number: If you've filed state payroll tax returns in the past, you can find your Tennessee Employer Account Number on any previously submitted quarterly wage report. Call the Tennessee Department of Labor & Workforce Development at 615-741-2486.

How do I get a TN employer account number?

If you are liable for unemployment insurance premiums in Tennessee, you will be assigned an eight digit employer account number (e.g., 0000-000 0). Applications may be obtained online or by calling your local Employer Accounts Office or by calling toll free (844) 224-5818 and press option 2 for Employer Taxes.

What is my Tennessee employer account number?

To locate your Employer Account Number: If you've filed state payroll tax returns in the past, you can find your Tennessee Employer Account Number on any previously submitted quarterly wage report. Your Employer Account Number is an eight-digit number in the following format: X- X.

How long does it take to get approved for unemployment TN?

Approval - If you have certified, your waiting week was served, and you receive a letter of approval, money should be deposited in your bank account (or on the debit card) within 72 hours. Denial - If you do not agree with the agency's decision, you may file an appeal.

What payroll taxes do employers pay in TN?

Tennessee State Payroll Taxes New employers pay a flat rate of 2.7%.

What is a premium and wage report Tennessee?

The Tennessee Premium and Wage Reporting System (TNPAWS) allows active employers to complete the quarterly unemployment Premium and Wage Report via the Internet. TNPAWS is designed specifically for small employers.

How do I get a tax ID number in Tennessee?

Registration of sales tax is available on the Tennessee Taxpayer Access Point (TNTAP). To apply, please go to Tennessee Taxpayer Access Point (TNTAP) and select Register a New Business. For more guidance on sales and use tax account registration, please read this article.

How do I get my TNPAWS access code?

How do I get an Access Code? A. You must have an active employer account number to be eligible to use TNPAWS. The Access Code will be provided on your new number assignment letter (if you recently registered your business for Unemployment Insurance) or reactivation letter (if you recently reactivated your account).

What is TN unemployment tax rate?

Rates range from 0.01% to 2.3% for positive-rated employers and from 5% to 10% for negative-rated employers. The standard unemployment tax rate for new employers is 2.7% for fiscal 2023, unchanged from fiscal 2022.

What is tn lb 0456 0851?

TN Form LB-0456/0851, Quarterly Unemployment Premium and Wage Report. CFS supports electronically filing the UI reports online by creating a wage file to upload to the state website.