NJ IFTA Quarterly Tax Return 2015 free printable template

Show details

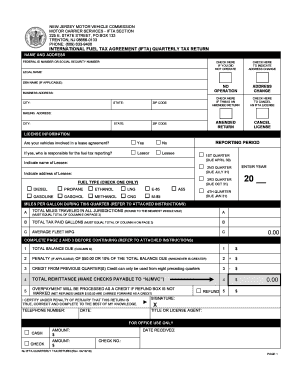

NJ IFTA QUARTERLY TAX RETURN Rev. 02/11/15 PAGE 1 LICENSE NAME D JURISDICTION IFTA LICENSE NUMBER E TOTAL IFTA MILES SEE INSTRUCTIONS F TOTAL TAXABLE G TAXABLE GALS. CONSUMED COLUMN F LINE C H YEAR I J TAX NET TAXABLE PAID GALLONS GALLONS RATE QTR K L TAX DUE/ CREDIT EARNED INTEREST DUE M COLUMN K COLUMN L AK Alaska AL AR Arkansas AZ CA CO CT DC DE FL GA IA ID IL IN SUR SURCHARGE KS KY LA MA MD ME MI MN MO MS MT NC ND NE NH NJ NM NV NY OH SUB TOTALS PAGE 2 OK OR PA RI SC SD TN TX UT VA VT WA...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ IFTA Quarterly Tax Return

Edit your NJ IFTA Quarterly Tax Return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ IFTA Quarterly Tax Return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NJ IFTA Quarterly Tax Return online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NJ IFTA Quarterly Tax Return. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ IFTA Quarterly Tax Return Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ IFTA Quarterly Tax Return

How to fill out NJ IFTA Quarterly Tax Return

01

Gather your vehicle information including the number of miles traveled and fuel purchased for each jurisdiction.

02

Download the NJ IFTA Quarterly Tax Return form from the New Jersey Division of Taxation website.

03

Fill in your name, address, and IFTA account number in the designated sections of the form.

04

Report the total miles traveled by each vehicle in the appropriate jurisdictions for the quarter.

05

Enter the total gallons of fuel purchased in each jurisdiction.

06

Calculate the total miles and fuel for all vehicles and jurisdictions.

07

Use the provided tables to calculate tax due based on the miles traveled and fuel purchased.

08

Review the form to ensure all information is accurate and complete.

09

Submit the form along with any payment, if applicable, by the due date.

Who needs NJ IFTA Quarterly Tax Return?

01

Motor carriers who operate vehicles in multiple jurisdictions.

02

Businesses that transport goods across state lines using qualified motor vehicles.

03

Owners of commercial vehicles that meet the weight thresholds specified by IFTA regulations.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my IFTA stickers in NJ?

The request must be on company letterhead. Please include your Taxpayer ID Number, Company Name, and a check for $10.00 per set of stickers. You may also apply in person at our Trenton Regional office as long as the IFTA account has already been renewed for the current year.

How do I contact the IFTA in NJ?

Call 609-633-9400, option # 1.

How do I open an IFTA account in NJ?

Creating a New Account can only be done through the mail or by coming in person to IFTA as we require payment of $10.00 per vehicle prior to the account being processed. If you choose to do this through the mail, please include a copy of your proof for the Federal Tax ID number and your check or money order.

How do I file my NJ IFTA online?

How to complete a tax return online Customer log in/Enter the system. Enter your customer number and pin number. Click IFTA tab at the top. Click Quarterly Tax Return, click submit. Enter reporting period information, click submit twice. Enter total miles traveled and fuel purchased.

How much is IFTA in NJ?

New New Jersey IFTA Fuel Tax Accounts You can submit a New Jersey application by mail or in person to the Motor Vehicle Commission. There is a $10 fee for each set of decals. You will need one set per qualified vehicle. You should receive the decals in 1-2 weeks.

How do I get my IFTA in New Jersey?

To receive your New Jersey IFTA license you must submit an application along with proof of principal place of business to the New Jersey Motor Vehicle Commission. All credentials from New Jersey are updated on an annual basis. Decals are currently $10 and each qualified vehicle is required to have one set.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NJ IFTA Quarterly Tax Return online?

pdfFiller makes it easy to finish and sign NJ IFTA Quarterly Tax Return online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make changes in NJ IFTA Quarterly Tax Return?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your NJ IFTA Quarterly Tax Return to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out NJ IFTA Quarterly Tax Return on an Android device?

Use the pdfFiller Android app to finish your NJ IFTA Quarterly Tax Return and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is NJ IFTA Quarterly Tax Return?

The NJ IFTA Quarterly Tax Return is a tax document that interstate carriers in New Jersey use to report and pay fuel taxes on the miles driven in different jurisdictions.

Who is required to file NJ IFTA Quarterly Tax Return?

All motor carriers who operate heavy vehicles across state lines or who travel in more than one jurisdiction are required to file the NJ IFTA Quarterly Tax Return.

How to fill out NJ IFTA Quarterly Tax Return?

To fill out the NJ IFTA Quarterly Tax Return, you should gather records of miles driven and fuel purchased in each state, complete the return with this information, and submit it along with the calculated tax due.

What is the purpose of NJ IFTA Quarterly Tax Return?

The purpose of the NJ IFTA Quarterly Tax Return is to ensure proper reporting and payment of fuel taxes owed by carriers based on their fuel consumption and mileage across different jurisdictions.

What information must be reported on NJ IFTA Quarterly Tax Return?

The NJ IFTA Quarterly Tax Return requires reporting of total miles driven, fuel purchases in each jurisdiction, and the tax liability for the period.

Fill out your NJ IFTA Quarterly Tax Return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ IFTA Quarterly Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.