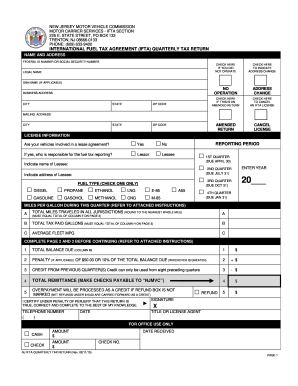

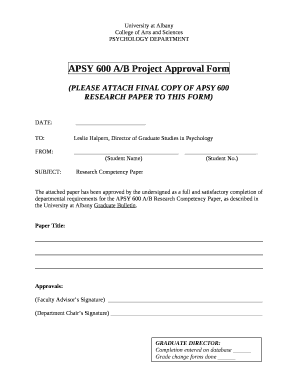

NJ IFTA Quarterly Tax Return 2018-2026 free printable template

Show details

00 ARE CARRIED FORWARD AS A CREDIT SIGNATURE I CERTIFY UNDER PENALTY OF PERJURY THAT THIS RETURN IS TRUE CORRECT AND COMPLETE TO THE BEST OF MY KNOWLEDGE. TELEPHONE NUMBER DATE REFUND X TITLE OR LICENSE AGENT FOR OFFICE USE ONLY CASH CHECK DATE RECEIVED AMOUNT NJ IFTA QUARTERLY TAX RETURN Rev. 04/18/18 CHECK NO. PAGE 1 D JURISDICTION E TOTAL IFTA MILES SEE INSTRUCTIONS F TOTAL TAXABLE G TAXABLE GALS. CONSUMED COLUMN F LINE C H I YEAR J TAX NET TAXABLE PAID GALLONS GALLONS RATE K TAX DUE/...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nj fuel tax ifta form

Edit your 460549971 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new jersey fuel quarterly form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nj fuel ifta online online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit nj ifta get form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ IFTA Quarterly Tax Return Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nj international fuel agreement form

How to fill out NJ IFTA Quarterly Tax Return

01

Gather all necessary documents, including mileage logs, fuel receipts, and vehicle information.

02

Complete the identification section, providing your name, address, and account number.

03

Enter the total miles traveled in New Jersey and other jurisdictions in the appropriate sections.

04

Calculate the total gallons of fuel purchased in New Jersey and other jurisdictions.

05

Determine the total taxable fuel gallons and apply the correct tax rates.

06

Calculate the total tax due and subtract any credits for taxes paid in other jurisdictions.

07

Review your entries for accuracy to ensure compliance.

08

Sign and date the return before submitting it along with any payment due.

Who needs NJ IFTA Quarterly Tax Return?

01

Any motor carrier or operator of commercial vehicles that travel through or into New Jersey and report fuel usage for interstate travel.

Fill

tax ifta return form

: Try Risk Free

People Also Ask about nj ifta return form

What is the IFTA audit in NJ?

New Jersey IFTA Audits IFTA New Jersey audits are used to verify compliance and base jurisdictions are required to audit 3% of the IFTA accounts in their state per year. The licensee will be contacted in writing at least 30 days prior to the audit and must make the required records available at the time of the audit.

How do I get my IFTA stickers in NJ?

The request must be on company letterhead. Please include your Taxpayer ID Number, Company Name, and a check for $10.00 per set of stickers. You may also apply in person at our Trenton Regional office as long as the IFTA account has already been renewed for the current year.

How do I contact the IFTA in NJ?

Call 609-633-9400, option # 1.

How do I open an IFTA account in NJ?

Creating a New Account can only be done through the mail or by coming in person to IFTA as we require payment of $10.00 per vehicle prior to the account being processed. If you choose to do this through the mail, please include a copy of your proof for the Federal Tax ID number and your check or money order.

How do I get my IFTA in New Jersey?

To receive your New Jersey IFTA license you must submit an application along with proof of principal place of business to the New Jersey Motor Vehicle Commission. All credentials from New Jersey are updated on an annual basis. Decals are currently $10 and each qualified vehicle is required to have one set.

How do I file my NJ IFTA online?

How to complete a tax return online Customer log in/Enter the system. Enter your customer number and pin number. Click IFTA tab at the top. Click Quarterly Tax Return, click submit. Enter reporting period information, click submit twice. Enter total miles traveled and fuel purchased.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my new jersey fuel ifta in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your new jersey ifta form and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I get NJ IFTA Quarterly Tax Return?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the NJ IFTA Quarterly Tax Return in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit NJ IFTA Quarterly Tax Return on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign NJ IFTA Quarterly Tax Return on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is NJ IFTA Quarterly Tax Return?

The NJ IFTA Quarterly Tax Return is a tax form filed by interstate carriers to report the fuel use tax owed to New Jersey as part of the International Fuel Tax Agreement (IFTA).

Who is required to file NJ IFTA Quarterly Tax Return?

Any interstate motor carrier that operates qualified motor vehicles in New Jersey and is registered under the International Fuel Tax Agreement (IFTA) must file the NJ IFTA Quarterly Tax Return.

How to fill out NJ IFTA Quarterly Tax Return?

To fill out the NJ IFTA Quarterly Tax Return, gather records of fuel purchases and mileage for each jurisdiction traveled during the quarter, compute the total fuel purchased, total miles traveled, and fill out the form according to the guidance provided by the New Jersey Division of Taxation.

What is the purpose of NJ IFTA Quarterly Tax Return?

The purpose of the NJ IFTA Quarterly Tax Return is to ensure that fuel taxes are accurately reported and paid to the respective states and provinces based on the fuel consumption and kilometers traveled in each jurisdiction.

What information must be reported on NJ IFTA Quarterly Tax Return?

The NJ IFTA Quarterly Tax Return must report details such as total miles traveled in each jurisdiction, total gallons of fuel purchased, and the total tax due based on the state's fuel tax rates.

Fill out your NJ IFTA Quarterly Tax Return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ IFTA Quarterly Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.