Get the free j 51 guidebook

Show details

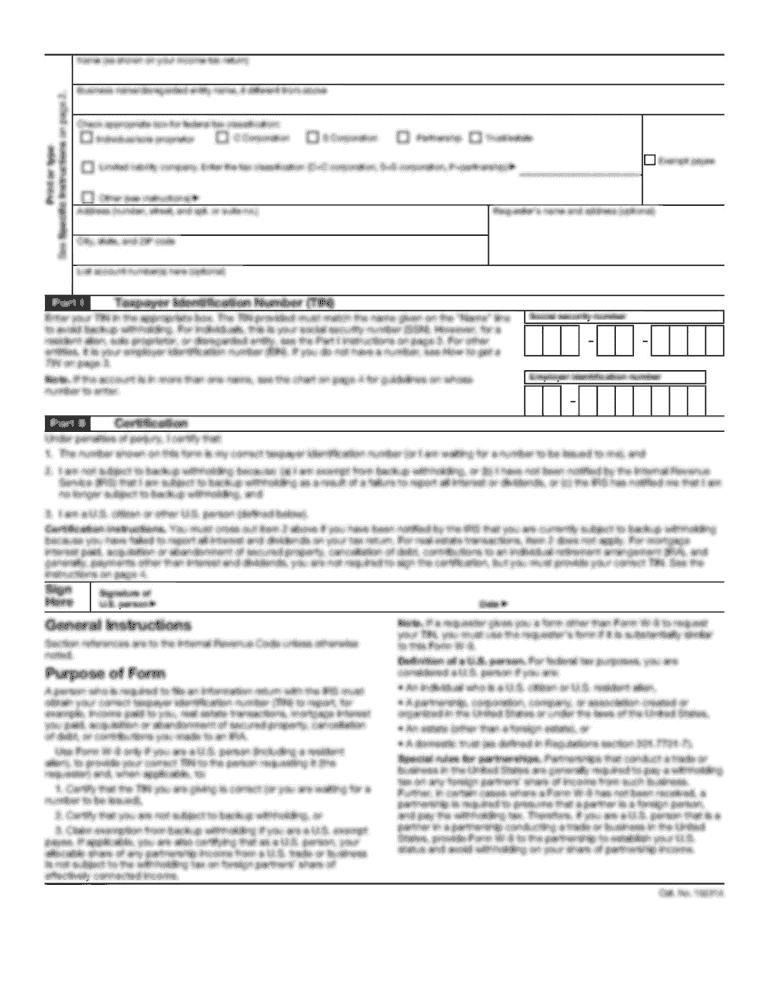

The J 51 Programs provides real estate tax been?ts to owners of residential real property who perform rehabilitation work on their pr0perties. The. Program also ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign j 51 guidebook form

Edit your j 51 guidebook form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your j 51 guidebook form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit j 51 guidebook form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit j 51 guidebook form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

What is the J-51 tax benefit?

The J-51 tax incentive is an as-of-right tax exemption and abatement for residential rehabilitation or conversion to multiple dwellings. The statutory deadline for completion of work eligible for J-51 benefits is June 29, 2022. Any work completed after that date is not currently eligible for the J-51 benefits.

What is the j51 tax abatement in NY?

What Is the J-51 Tax Abatement? The J-51 tax abatement is an exclusive tax benefit given to some building owners in New York City. To be eligible for this benefit, you must have renovated your structure or plan to convert an industrial or commercial structure into a residential building.

What is the difference between 421a and j51?

Similar to a 421a, the J-51 abatement is to promote the development of multiple-dwelling affordable housing, however a J-51 is more complex given its structure and is more focused on the renovation of rundown residential properties or the conversion of commercial structures in to residential structures.

What is j51 abatement nyc?

J-51 is a property tax exemption and abatement for renovating a residential apartment building. The benefit varies depending on the building's location and the type of improvements.

What is the difference between j51 and 421a?

Similar to a 421a, the J-51 abatement is to promote the development of multiple-dwelling affordable housing, however a J-51 is more complex given its structure and is more focused on the renovation of rundown residential properties or the conversion of commercial structures in to residential structures.

How does NYC property tax abatement work?

Owners of cooperative units and condominiums who meet the eligibility requirements for the Cooperative and Condominium Property Tax Abatement can have their property taxes reduced. The amount of the abatement is based on the average assessed value of the residential units in the development.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is j 51 guidebook?

The J-51 Guidebook provides information and guidance for property owners seeking tax benefits under the J-51 program in New York City.

Who is required to file j 51 guidebook?

Property owners in New York City who wish to apply for tax benefits under the J-51 program are required to file the J-51 Guidebook.

How to fill out j 51 guidebook?

To fill out the J-51 Guidebook, property owners must provide detailed information about their property, including construction history, current condition, and planned renovations.

What is the purpose of j 51 guidebook?

The purpose of the J-51 Guidebook is to help property owners understand the requirements and benefits of the J-51 program and to assist them in applying for tax benefits.

What information must be reported on j 51 guidebook?

Property owners must report information such as building size, number of units, construction history, current condition, and planned renovations on the J-51 Guidebook.

Where do I find j 51 guidebook form?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the j 51 guidebook form in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an eSignature for the j 51 guidebook form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your j 51 guidebook form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out j 51 guidebook form using my mobile device?

Use the pdfFiller mobile app to fill out and sign j 51 guidebook form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your j 51 guidebook form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

J 51 Guidebook Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.