CA DE 1430 2015 free printable template

Show details

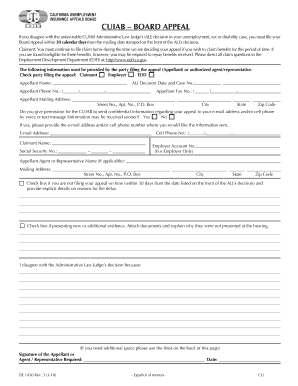

CU IAB BOARD APPEAL If you disagree with the unfavorable CU IAB Administrative Law Judge s (ALJ) decision in your unemployment, tax or disability case (except disability overpayment cases), you must

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA DE 1430

Edit your CA DE 1430 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA DE 1430 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA DE 1430 online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CA DE 1430. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA DE 1430 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA DE 1430

How to fill out CA DE 1430

01

Begin by downloading the CA DE 1430 form from the California Employment Development Department website.

02

Enter your personal information, including your name, address, and Social Security number.

03

Provide details about your employment status, including your last employer's information.

04

Fill in the reason for your unemployment and any other required information about your financial situation.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form at the designated space.

07

Submit the form electronically or mail it to the appropriate EDD office as indicated in the instructions.

Who needs CA DE 1430?

01

Individuals who are applying for unemployment benefits in California.

02

Workers who have lost their job through no fault of their own and meet the eligibility criteria.

03

People who need to report additional information regarding their unemployment claims.

Fill

form

: Try Risk Free

People Also Ask about

What does it mean when it says appeal on EDD payment?

The Office of Appeals sent you the Notice of Hearing because: The Employment Development Department (EDD) made a decision about benefits; A party disagreed with EDD's decision and filed an appeal. The parties are typically the claimant who claims benefits, the employer, and EDD; and. You are a party to the appeal.

What happens if you lose EDD appeal?

If your appeal is denied, you will receive a notice from the CUIAB and will continue to receive notices for the collection of the overpayment. For more information, visit California Unemployment Insurance Appeals Board.

What happens after EDD appeal?

After your hearing, the Office of Appeals will mail the ALJ's written decision to you and your employer. It may take several weeks for the Office of Appeals to prepare the decision. The decision will include information about filing a second-level appeal.

What happens after EDD appeal decision?

After You File an Appeal The ALJ will issue a written decision to the employer and employee. The decision will include information about filing a second level appeal to the California Unemployment Insurance Appeals Board.

How do I fix my EDD disqualification?

You have the right to appeal the EDD's decision to reduce or deny you benefits. You must submit your appeal in writing within 30 days of the mailing date on the Notice of Determination and/or Ruling (DE 1080CZ) or Notice of Overpayment (DE 1444).

What do I write in my EDD appeal form?

Provide details as to why you believe you are eligible for EDD benefits. Include any pertinent information. Attach any important documents to your appeal, and list what they are here and what they are pertinent. In conclusion, I believe I do meet the EDD's unemployment eligibility requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the CA DE 1430 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your CA DE 1430 in seconds.

How do I edit CA DE 1430 on an iOS device?

Create, edit, and share CA DE 1430 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Can I edit CA DE 1430 on an Android device?

You can make any changes to PDF files, like CA DE 1430, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is CA DE 1430?

CA DE 1430 is a form used by businesses in California to report employee wages and withholding information to the state Employment Development Department (EDD).

Who is required to file CA DE 1430?

Employers who are subject to California payroll tax laws and have employees in the state are required to file CA DE 1430.

How to fill out CA DE 1430?

To fill out CA DE 1430, employers need to provide the details of employee wages, withholding amounts, and identifying information such as the employer's name and identification number.

What is the purpose of CA DE 1430?

The purpose of CA DE 1430 is to ensure proper reporting of employee wages and withholding tax to facilitate the collection of state payroll taxes.

What information must be reported on CA DE 1430?

Information that must be reported on CA DE 1430 includes employee names, Social Security Numbers, total wages paid, and the amounts withheld for taxes.

Fill out your CA DE 1430 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA DE 1430 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.