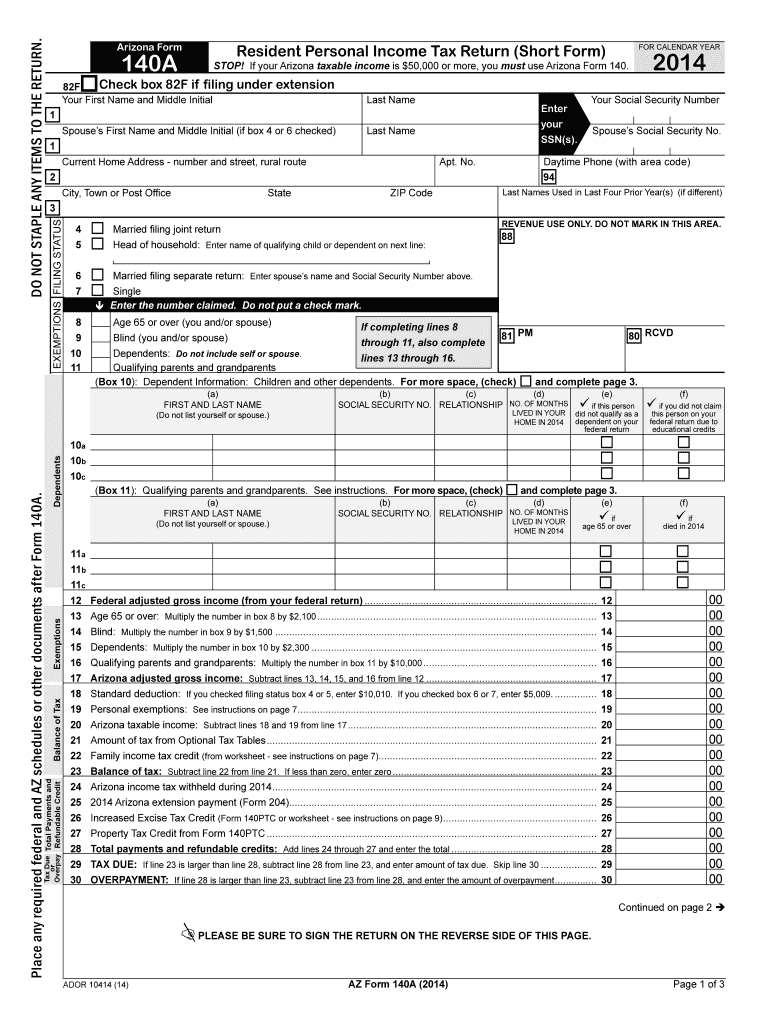

Get the free Arizona Form 140A Resident Personal Income Tax Return (Short Form) 2014

Instructions and Help about arizona form 140a resident

How to edit arizona form 140a resident

How to fill out arizona form 140a resident

Latest updates to arizona form 140a resident

All You Need to Know About arizona form 140a resident

What is arizona form 140a resident?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about arizona form 140a resident

What should I do if I realize I've made a mistake after submitting my Arizona Form 140A resident?

If you discover an error after filing your Arizona Form 140A resident, the best course of action is to submit an amended return. You can do this by completing a new Form 140A and marking it as 'Amended.' Additionally, ensure to provide a clear explanation of the changes being made to help the processing team understand your amendments.

How can I track the status of my Arizona Form 140A resident after I've filed it?

To verify the status of your Arizona Form 140A resident, you can use the Arizona Department of Revenue's online services. By entering your details into their status tracking tool, you can see if your form has been received and is in processing. Note that processing times may vary, so checking regularly can be beneficial.

What common mistakes should I avoid when filing the Arizona Form 140A resident?

Common pitfalls in filing the Arizona Form 140A resident include incorrect personal information, mathematical errors in calculations, and failure to sign the form. Always double-check your entries and consider using tax preparation software to minimize errors, as these tools can help guide you through the filing process and catch mistakes.

What should I do if I receive a notice related to my Arizona Form 140A resident?

If you receive a notice regarding your Arizona Form 140A resident, carefully read the document to understand the issue. Respond promptly and provide any requested documentation. If the notice requires further clarification or action on your part, consider consulting a tax professional to assist in addressing the matter effectively.