IRS 8082 2011 free printable template

Show details

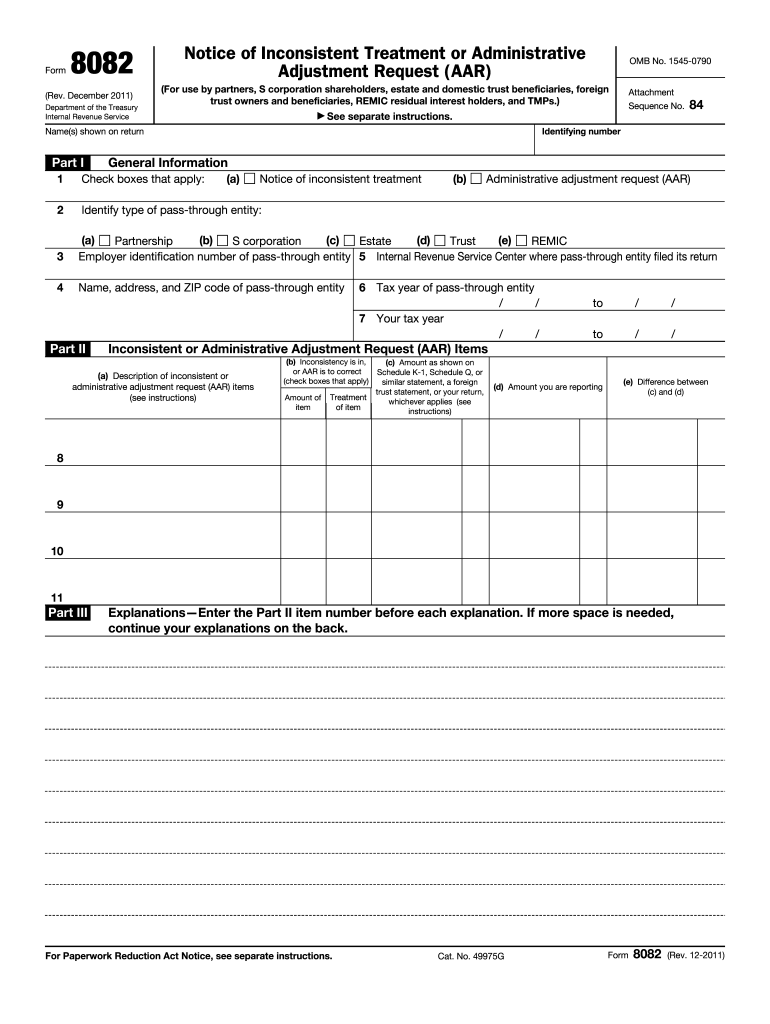

For Paperwork Reduction Act Notice see separate instructions. Cat. No. 49975G Rev. 12-2011 Form 8082 Rev. 12-2011 Page. Form Rev* December 2011 Department of the Treasury Internal Revenue Service Notice of Inconsistent Treatment or Administrative Adjustment Request AAR For use by partners S corporation shareholders estate and domestic trust beneficiaries foreign trust owners and beneficiaries REMIC residual interest holders and TMPs. See Attachment Sequence No* separate instructions....

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8082

Edit your IRS 8082 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8082 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 8082 online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS 8082. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8082 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8082

How to fill out IRS 8082

01

Obtain IRS Form 8082 from the IRS website or directly from the IRS.

02

Fill out your personal information in the upper section, including your name, address, and identification number.

03

Indicate the tax year for which you are filing the form.

04

Complete Part I by providing information on the partnership, S corporation, or trust you are involved with.

05

If applicable, list any tax issues or items that require clarification in Part II.

06

Ensure you include all necessary attachments, supporting documents, or explanations as required.

07

Review the form for completeness and accuracy.

08

Sign and date the form before submission.

09

Send the completed form to the address specified in the form instructions.

Who needs IRS 8082?

01

Taxpayers who are reporting inconsistent or unclear tax positions related to partnerships, S Corporations, or trusts.

02

Individuals who need to notify the IRS about their tax treatment or reasoning behind certain positions taken on their return.

03

Anyone who receives a notice from the IRS requesting further explanation regarding tax matters involving these entities.

Fill

form

: Try Risk Free

People Also Ask about

Can form 8082 be filed electronically?

Form 8082 is electronically fillable however, it does not have a separate export option. By following the instructions below, you will suppress the export of Form 1065 pages 1-5 for electronic filing. Only Form 8082 and the amended K-1s will be exported.

Who has to file form 8082?

Partners, S corporation shareholders, beneficiaries of an estate or trust, owners of a foreign trust, or residual interest holders in a real estate mortgage investment conduit (REMIC) file this form if they wish to report items differently than the way they were reported to them on Schedule K-1, Schedule Q, or a

How do I check the status of my 8832 form?

The IRS will accept or deny your Form 8832 filing request within 60 days. The acceptance or denial letter will go to the address you listed when completing your form. If 60 days go by and you don't hear anything, call the IRS at 1-800-829-0115 or send a letter to the service center to check on the status of the form.

What is proof of filing form 8832?

If the IRS questions whether Form 8832 was filed, an acceptable proof of filing is: A certified or registered mail receipt (timely postmarked) from the U.S. Postal Service, or its equivalent from a designated private delivery service; Form 8832 with an accepted stamp; Form 8832 with a stamped IRS received date; or.

What happens if an LLC does not file form 8832?

An LLC that is not automatically classified as a corporation and does not file Form 8832 will be classified, for federal tax purposes under the default rules. An LLC that has one member will be classified as a “disregarded entity.” A disregarded entity is one that is disregarded as an entity separate from its owner.

What is a form 8082?

Use Form 8082 to notify the IRS of any inconsistency between your tax treatment of an item and the way the pass-through entity treated and reported the same item on its return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 8082 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your IRS 8082 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I fill out IRS 8082 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your IRS 8082 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I complete IRS 8082 on an Android device?

On Android, use the pdfFiller mobile app to finish your IRS 8082. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is IRS 8082?

IRS 8082 is a form used to notify the Internal Revenue Service (IRS) of a modification to a partnership or S Corporation item that affects a previously filed partnership or S Corporation return. It serves as a way to report items for which an election is being made or a change is being implemented.

Who is required to file IRS 8082?

Taxpayers who are partners in a partnership or shareholders in an S Corporation are required to file IRS 8082 if they need to report a significant modification to the return or if they have to make an election related to specific tax matters.

How to fill out IRS 8082?

To fill out IRS 8082, tax filers need to provide their identifying information, specify the type of election or item modification, and include any necessary accompanying schedules or explanations. The form should be completed according to the instructions provided by the IRS for that specific tax year.

What is the purpose of IRS 8082?

The purpose of IRS 8082 is to inform the IRS about changes or modifications to partnership or S Corporation items that may affect their tax status or obligations. It ensures compliance with tax regulations and facilitates proper processing of returns.

What information must be reported on IRS 8082?

The information that must be reported on IRS 8082 includes the taxpayer's name, address, identifying number, details about the election being made or the item being changed, and any relevant tax year information. Additionally, specific explanations or supporting documents may be requested.

Fill out your IRS 8082 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8082 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.