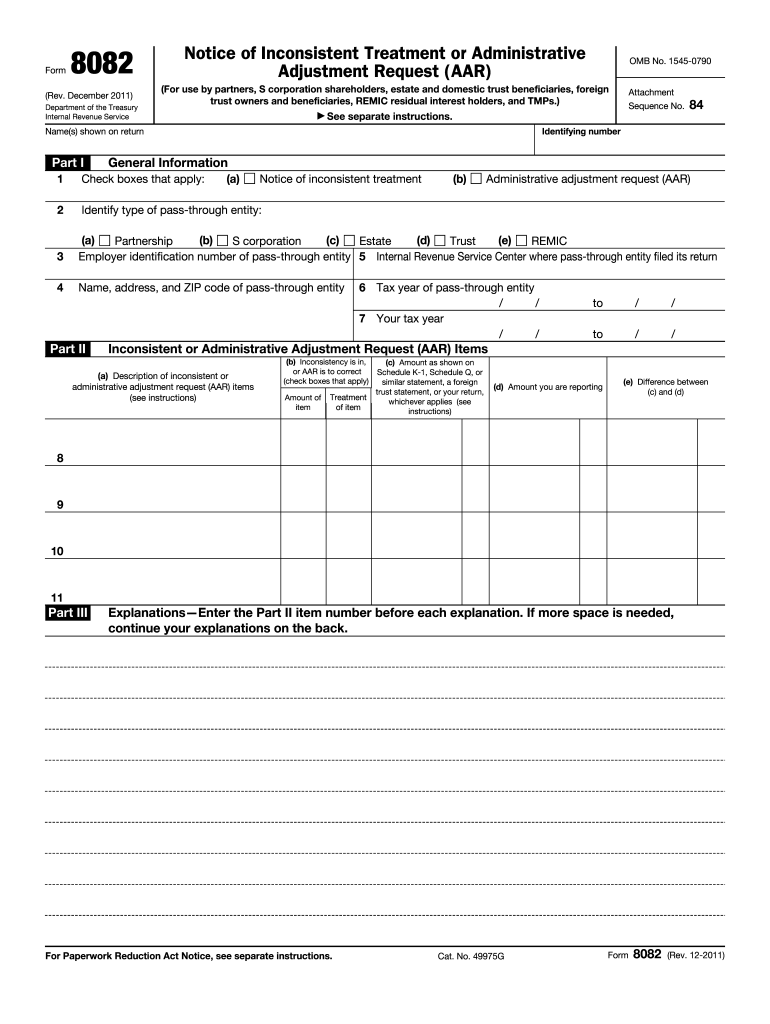

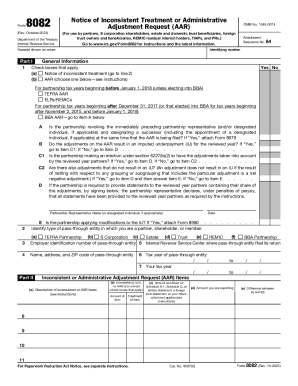

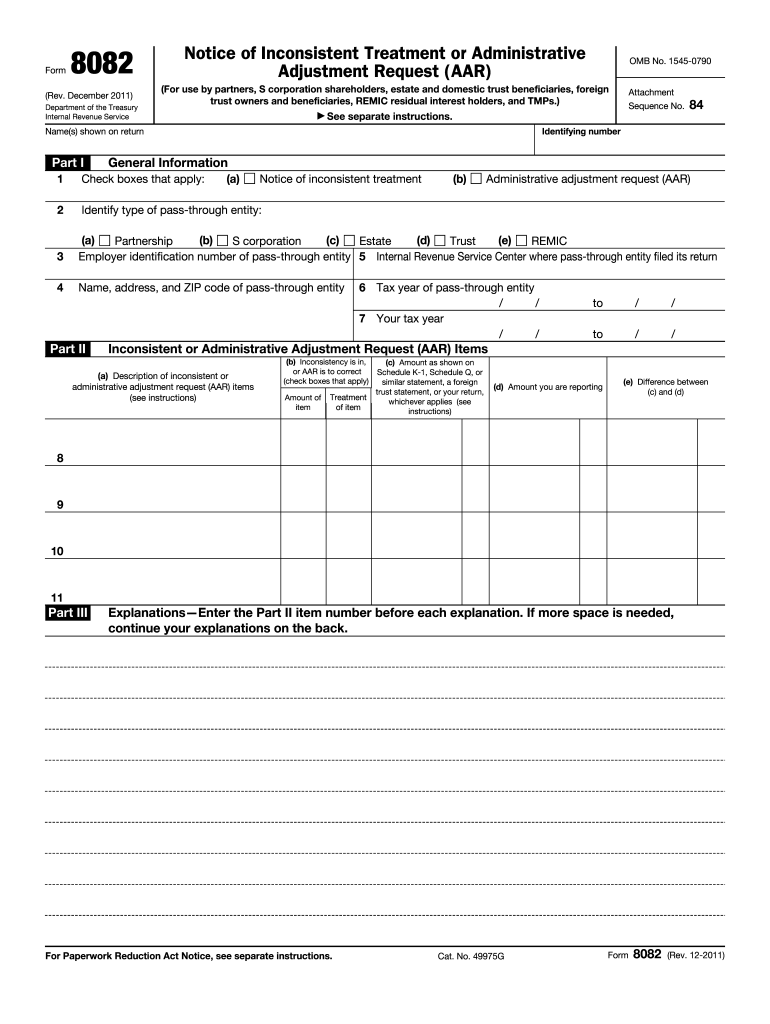

IRS 8082 2011 free printable template

Get, Create, Make and Sign IRS 8082

How to edit IRS 8082 online

Uncompromising security for your PDF editing and eSignature needs

IRS 8082 Form Versions

How to fill out IRS 8082

How to fill out IRS 8082

Who needs IRS 8082?

Instructions and Help about IRS 8082

Welcome to e-filing a return this ispart of course two steps to completeyour first tax returnmy name is MB Raimondi I am a CPA fromTrumbull Connecticut a long time ProSeries user and a long time teacher ofIntuit products Pro Series as well asother products and very happy to be herewith youin this video you'll learn how toprepare return for efile convert andtransmit a return and check efile statusin another video we talked about settingyour options when filling out youroptions you would have filled out thefirm and preparer information in yourfirm's ef'n number to make sure yourreturn is ready to be e filed reviewyour federal information worksheet thee-file section first you make sure thefederal and applicable states are Merckfor efile you do choose the states fromthe federal information worksheet notthe state worksheets when you mark areturn for a file it activates thee-file related forms also it helps onthe diagnostic and error checking tohelp ensure that your efile return isaccepted the last thing that you want todo before you efile is make sure you runthe final review as the last check forboth federal and States and then whenyou've done that you will either printthe whole return or the e-file signatureforms go over the return with yourclients and have them sign the signatureforms if your in the return you canclick on the little EF Center whichbrings you back to your home base viewbut it's the EF center of the home baseview there are three tabs across the topof the EF Center you can view all ofyour returnsyou can view pending returns or acceptedreturns most likely you are going to beworking in the penreturns if you click a little arrow tothe right hand side of your page youwill get the steps to take to e-fileand we've already done steps 1 through 3now we need to select the returns thatneed to be filed notice that the federaland the state are two separate returnsyou can hold down your control key oryour shift key and you can be filemultiple returns at one time then go upto e-fileon your top menu bar and select convertand transmit returns under theelectronic filing option if you'vepassed the final review you probablywon't have any problem and if there is aproblem you'll get messaging telling youwhat the problem is when the returntransmission is complete a log will bedisplayed to inform you of the resultsyou know that it's been successfullysubmitted for electronic filing when yousee that green thumbs up the pro-seriesEF status column will now display thereturn received by Intuit and will laterupdate to display a return sent to theIRS or the return sent to the state nowevery return will receive anacknowledgement either accepted orrejected you can check theacknowledgments manually by going up toa file on your top menu bar check EF andbank product acknowledgments or you canset the program to check for theacknowledgments automatically using thetask scheduler that we showed...

People Also Ask about

Can form 8082 be filed electronically?

Who has to file form 8082?

How do I check the status of my 8832 form?

What is proof of filing form 8832?

What happens if an LLC does not file form 8832?

What is a form 8082?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 8082 in Gmail?

How can I fill out IRS 8082 on an iOS device?

How do I complete IRS 8082 on an Android device?

What is IRS 8082?

Who is required to file IRS 8082?

How to fill out IRS 8082?

What is the purpose of IRS 8082?

What information must be reported on IRS 8082?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.