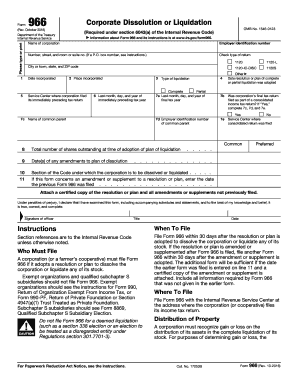

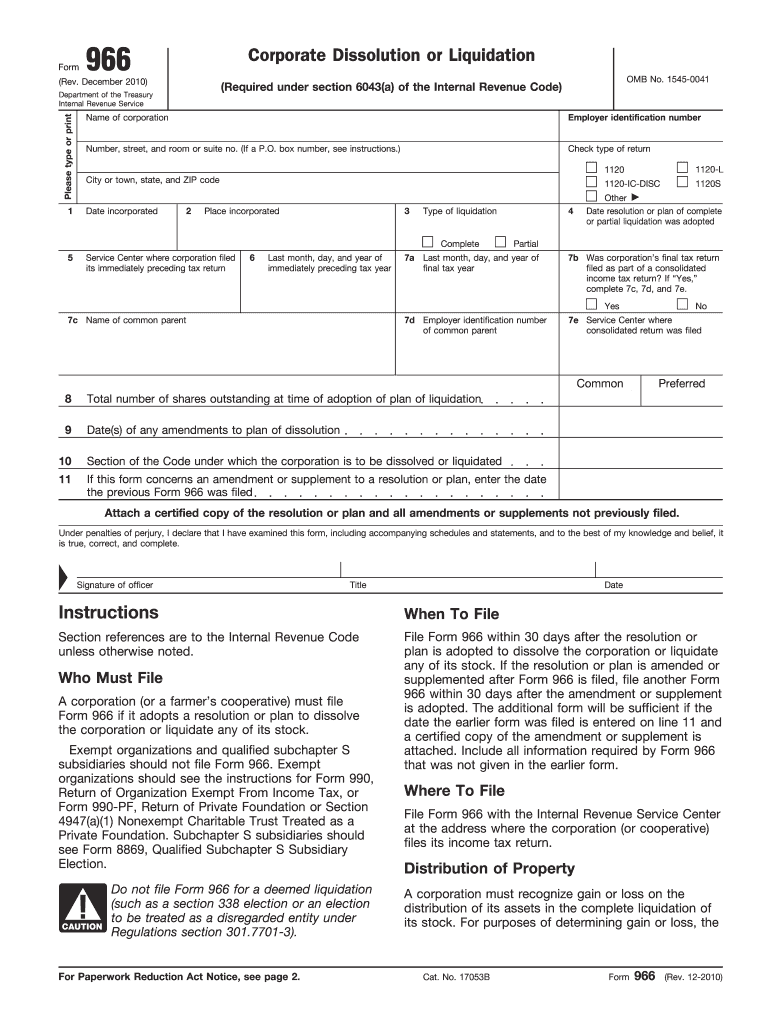

IRS 966 2010 free printable template

Instructions and Help about IRS 966

How to edit IRS 966

How to fill out IRS 966

About IRS previous version

What is IRS 966?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 966

What should I do if I realize I've made a mistake on my form 966 2010 after submitting it?

If you find an error on your form 966 2010 post-filing, you can submit an amended version. Be sure to clearly indicate that it's a correction and include any necessary documentation to support the changes. Follow the specific instructions for amendment to ensure that your corrections are processed efficiently.

How can I track the status of my form 966 2010 after filing?

To verify the receipt and processing of your form 966 2010, you can check the online tracking service provided by the IRS. Common e-file rejection codes can indicate why your submission was denied, so be sure to familiarize yourself with these codes and correct any issues to successfully resubmit.

What records should I retain after filing my form 966 2010?

It's important to keep copies of your filed form 966 2010 and related documentation for at least three years after the due date or filing date. This record retention period helps you respond to any audits or inquiries from the IRS and ensures compliance with legal requirements.

Are there special considerations for nonresidents or foreign payees regarding form 966 2010?

Nonresidents and foreign payees must adhere to specific filing guidelines for form 966 2010, especially concerning taxation laws. If you are filing on behalf of such individuals, ensure to provide proper documentation and any relevant tax identification numbers to facilitate the process.

What should I consider if I receive a notice or letter regarding my form 966 2010 submission?

If you receive a notice from the IRS about your form 966 2010, review it carefully for any specific instructions or requests for additional documentation. Prepare to respond promptly, gathering necessary information to clarify the issue or confirm your compliance with IRS regulations.

See what our users say