IRS 2106-EZ 2014 free printable template

Show details

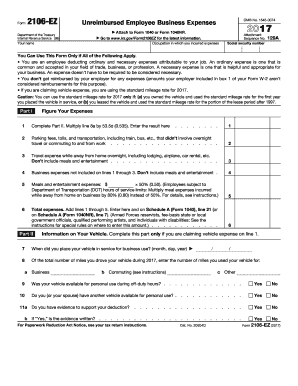

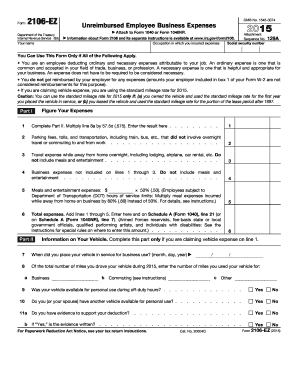

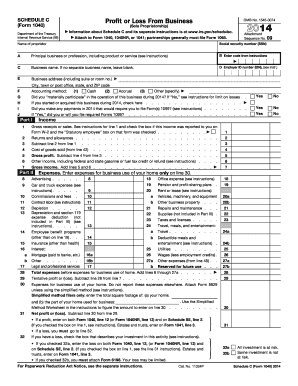

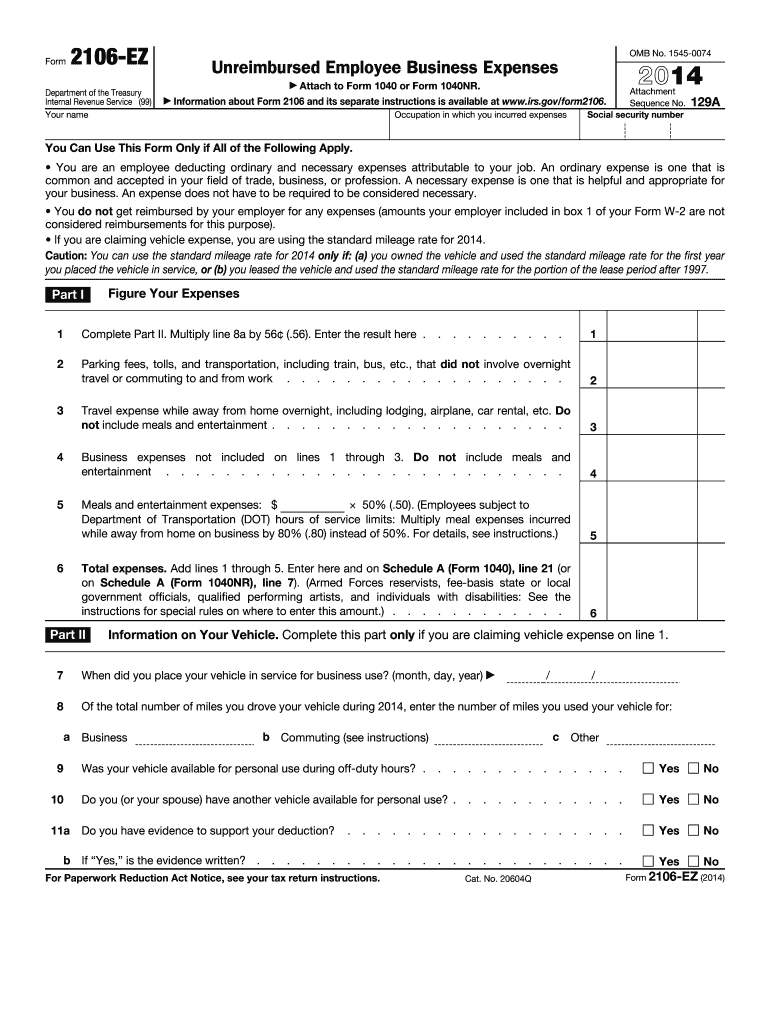

Cat. No. 20604Q Form 2106-EZ 2014 This Page Left Intentionally Blank Page 3 Section references are to the Internal Revenue Code. What s New Standard mileage rate. The 2014 rate for business use of your vehicle is 56 cents a mile. Purpose of Form You can use Form 2106-EZ instead of Form 2106 to claim your unreimbursed employee business expenses if you meet all the requirements listed above Part I of the form. Recordkeeping You cannot deduct expenses for travel including meals unless you used the...standard meal allowance entertainment gifts or use of a car or other listed property unless you keep records to prove the time place business purpose business relationship for entertainment and gifts and amounts of these expenses. Form 2106-EZ Department of the Treasury Internal Revenue Service 99 Your name OMB No* 1545-0074 Unreimbursed Employee Business Expenses Attach to Form 1040 or Form 1040NR* Information about Form 2106 and its separate instructions is available at www*irs*gov/form2106....Attachment Sequence No* Social security number Occupation in which you incurred expenses You Can Use This Form Only if All of the Following Apply. You are an employee deducting ordinary and necessary expenses attributable to your job. An ordinary expense is one that is common and accepted in your field of trade business or profession* A necessary expense is one that is helpful and appropriate for your business. An expense does not have to be required to be considered necessary. You do not get...reimbursed by your employer for any expenses amounts your employer included in box 1 of your Form W-2 are not considered reimbursements for this purpose. If you are claiming vehicle expense you are using the standard mileage rate for 2014. Caution You can use the standard mileage rate for 2014 only if a you owned the vehicle and used the standard mileage rate for the first year you placed the vehicle in service or b you leased the vehicle and used the standard mileage rate for the portion of the...lease period after 1997. Part I Figure Your Expenses Complete Part II. Multiply line 8a by 56. 56. Enter the result here. Parking fees tolls and transportation including train bus etc* that did not involve overnight travel or commuting to and from work. Travel expense while away from home overnight including lodging airplane car rental etc* Do not include meals and entertainment. Business expenses not included on lines 1 through 3. Do not include meals and entertainment. Meals and entertainment...expenses 50. 50. Employees subject to Department of Transportation DOT hours of service limits Multiply meal expenses incurred while away from home on business by 80. 80 instead of 50. For details see instructions. Total expenses. Add lines 1 through 5. Enter here and on Schedule A Form 1040 line 21 or on Schedule A Form 1040NR line 7. Armed Forces reservists fee-basis state or local government officials qualified performing artists and individuals with disabilities See the instructions for...special rules on where to enter this amount.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 2106-EZ

How to edit IRS 2106-EZ

How to fill out IRS 2106-EZ

Instructions and Help about IRS 2106-EZ

How to edit IRS 2106-EZ

Editing IRS 2106-EZ involves careful attention to ensure all information is accurate. Use reliable tools like pdfFiller that allow you to edit the form directly. You can fill in the necessary fields and make any adjustments before finalizing your submission.

How to fill out IRS 2106-EZ

Filling out IRS 2106-EZ requires collecting relevant data related to employee business expenses. Follow these steps to ensure proper completion:

01

Obtain the most recent version of IRS 2106-EZ.

02

Gather documentation supporting your expenses, such as receipts and invoices.

03

Enter your personal information, including name and Social Security number.

04

Detail your vehicle expenses, providing miles driven and any parking fees.

05

Review all entries for accuracy before submitting.

About IRS 2106-EZ 2014 previous version

What is IRS 2106-EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 2106-EZ 2014 previous version

What is IRS 2106-EZ?

IRS 2106-EZ was a tax form used by employees to report business-related expenses that were not reimbursed by an employer. This form simplifies the process of detailing deductions for certain expenses, providing an easier path for eligible employees to claim these costs on their tax returns.

What is the purpose of this form?

The purpose of IRS 2106-EZ is to allow employees to claim deductions for expenses incurred during the course of their employment. These deductions typically include vehicle expenses and certain travel-related costs. The form helps to reduce taxable income for eligible employees, thus potentially lowering tax liabilities.

Who needs the form?

Employees who incur unreimbursed business expenses while conducting work-related activities need to use IRS 2106-EZ. This includes situations where employees use their personal vehicle for work purposes or pay out-of-pocket for business-related travel.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 2106-EZ if your employer reimburses you for all business expenses or if you are not an employee but rather a self-employed individual. Additionally, specific exemptions apply based on taxpayer classification or the nature of the employment agreement.

Components of the form

The IRS 2106-EZ consists of several key components, including personal information fields, sections for detailing vehicle expenses, and a summary area for total deductions. It is designed to facilitate the reporting and ensuring all necessary data is accurately recorded.

What are the penalties for not issuing the form?

Failing to issue IRS 2106-EZ can result in penalties, such as disallowance of claimed deductions. Additionally, the IRS may impose fines for inaccuracies in filed documents or negligence in reporting required expenses. It's crucial to file the form correctly to avoid these financial consequences.

What information do you need when you file the form?

When filing IRS 2106-EZ, you need various pieces of information, including your name, Social Security number, the total mileage driven for business, and details on parking fees and tolls. Accurate documentation backing these claims will further support your filing and potential deductions.

Is the form accompanied by other forms?

IRS 2106-EZ is used independently and does not require other forms when filed. However, the information may be relevant to your overall tax return, particularly in conjunction with Form 1040, where you report total income and deductions.

Where do I send the form?

When submitting IRS 2106-EZ, you should include it with your annual tax return and send it to the address specified in the instructions of Form 1040. The specific mailing address may vary based on your state of residence and whether you are enclosing a payment.

See what our users say