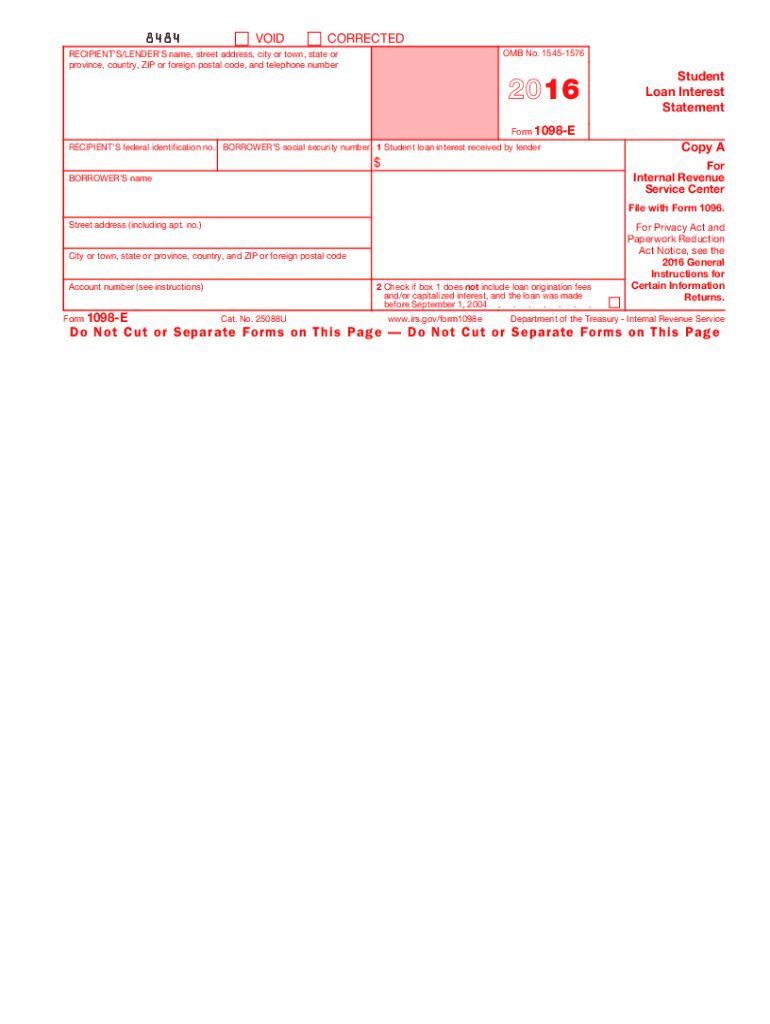

IRS 1098-E 2016 free printable template

Instructions and Help about IRS 1098-E

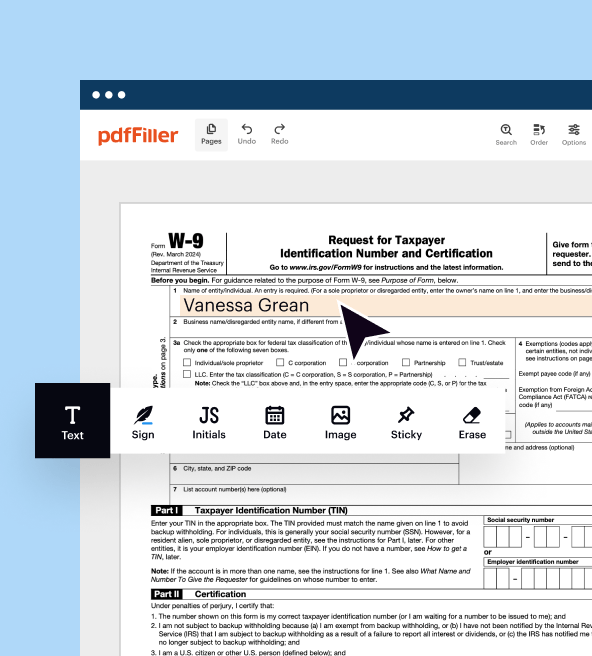

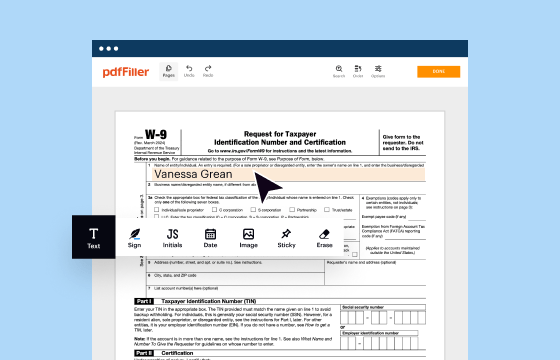

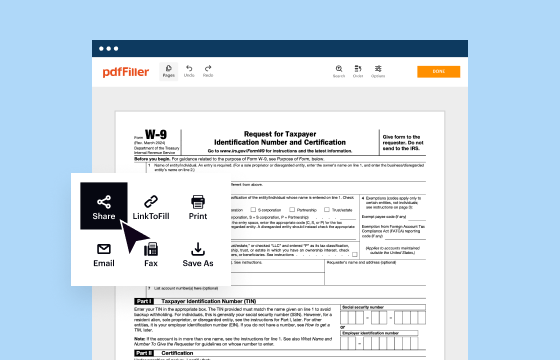

How to edit IRS 1098-E

How to fill out IRS 1098-E

About IRS 1098-E 2016 previous version

What is IRS 1098-E?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

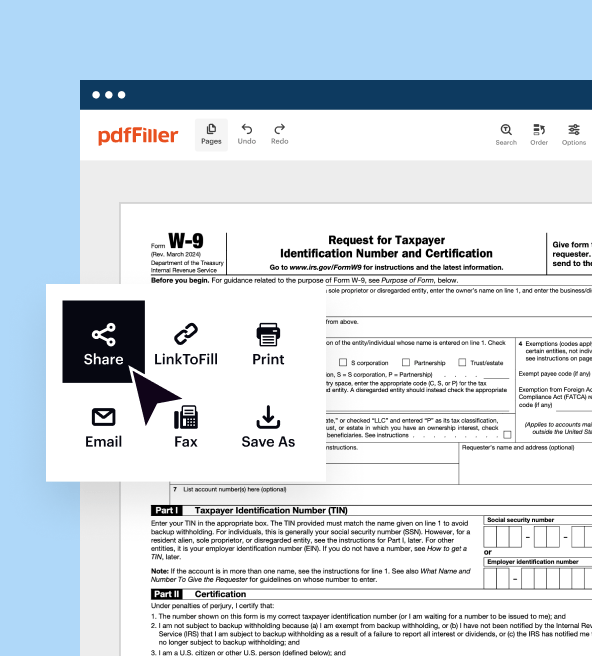

Where do I send the form?

FAQ about IRS 1098-E

What should I do if I find an error after submitting the 1098 e form 2016?

If you identify an error after filing the 1098 e form 2016, you must file an amended version to correct it. Make sure to clearly mark it as amended and provide accurate information to avoid complications. Filing an amendment promptly helps ensure compliance with IRS guidelines and can prevent potential penalties.

How can I verify the status of my submitted 1098 e form 2016?

To check the status of your submitted 1098 e form 2016, you can contact the IRS directly or use their online tracking tools, if available. Keep your Confirmation Number handy for more efficient assistance. This will help you confirm whether your submission was received and is being processed.

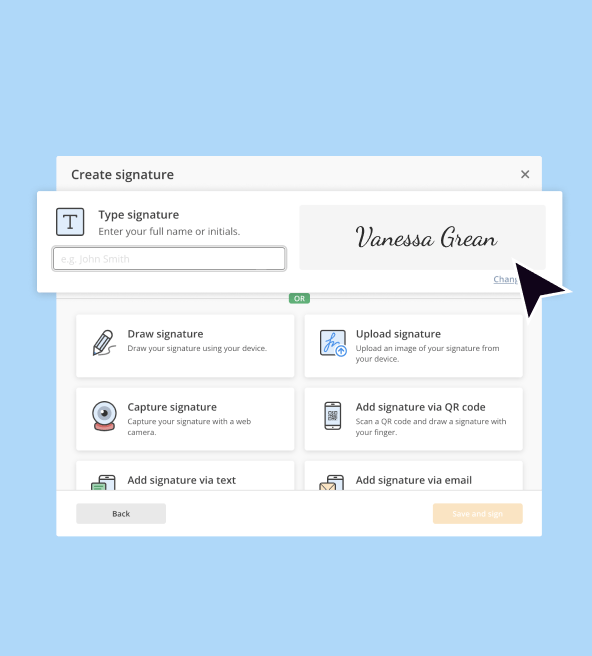

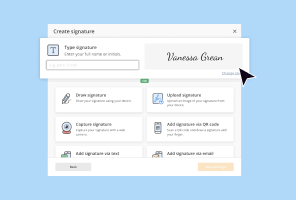

Are e-signatures acceptable for submitting the 1098 e form 2016?

Yes, e-signatures are accepted for submitting the 1098 e form 2016, provided that they meet IRS requirements for authenticity. Ensure that your e-signature software complies with the necessary security protocols to protect sensitive information. This allows for seamless electronic submission and maintains compliance with e-filing standards.

What should I do if my e-filed 1098 e form 2016 is rejected?

If your e-filed 1098 e form 2016 is rejected, carefully review the rejection code provided by the IRS. Address the specific errors mentioned and resubmit your form as soon as possible to avoid additional penalties. Keeping thorough records of your submissions can help you respond quickly to any IRS notices.