Canada RTB-27 2011 free printable template

Show details

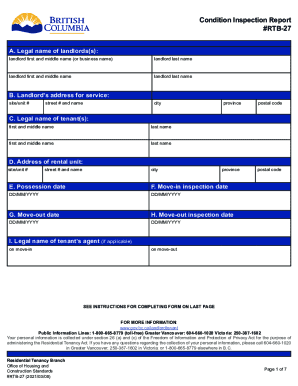

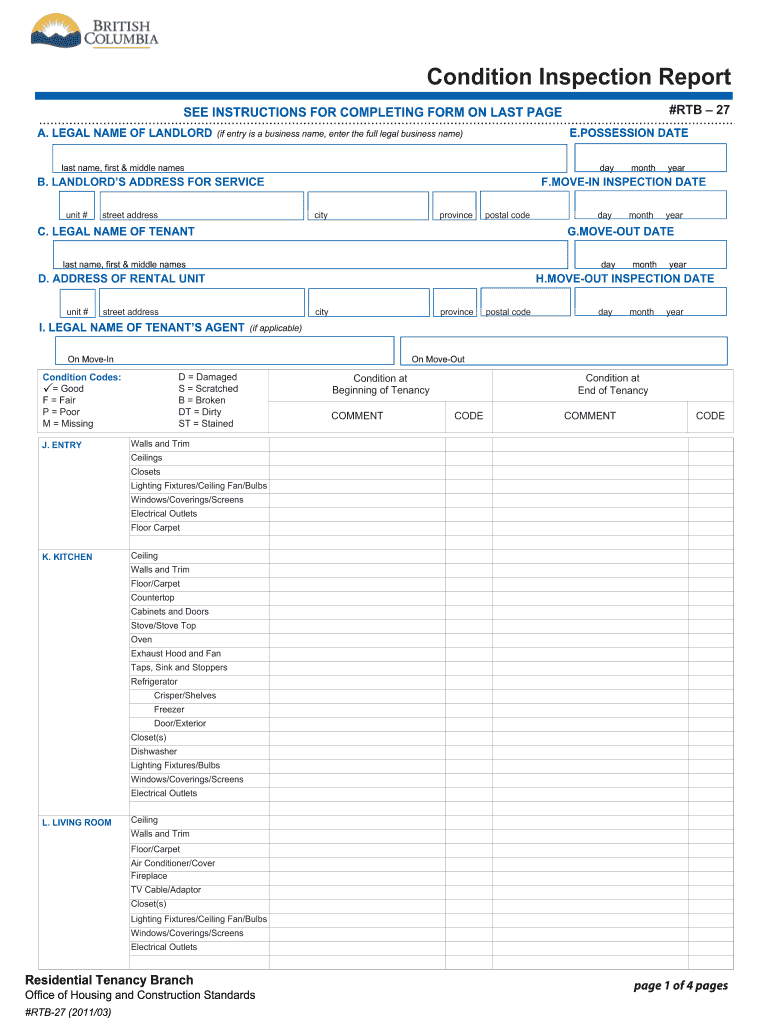

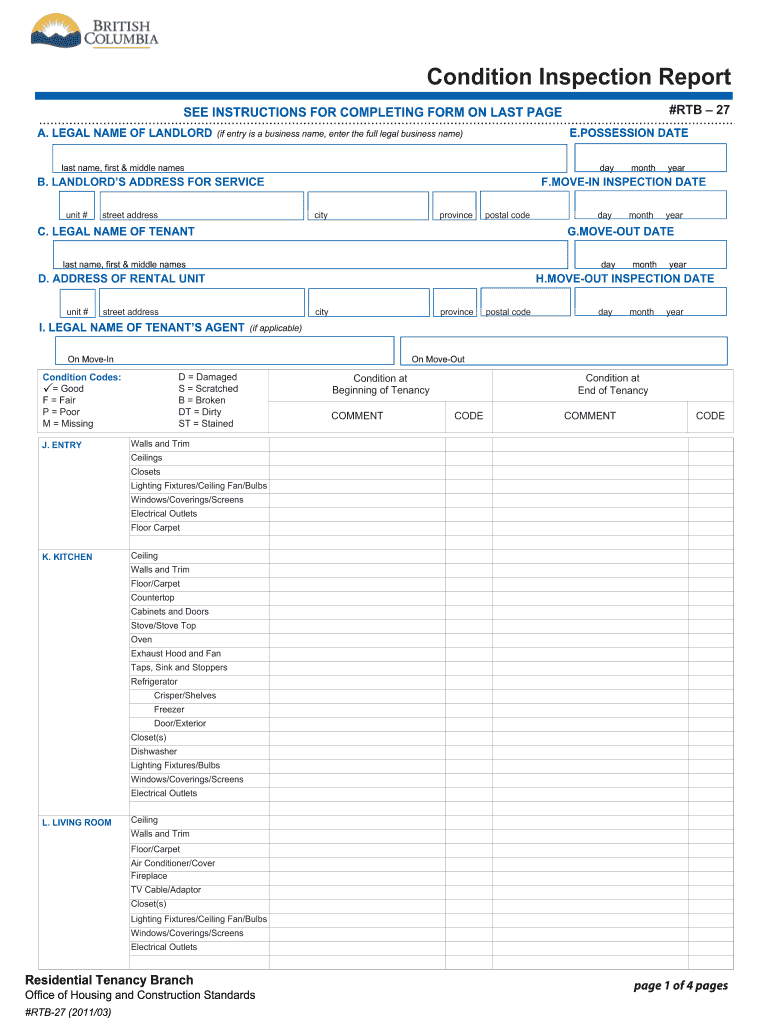

Condition Inspection Report #RTB 27 SEE INSTRUCTIONS FOR COMPLETING FORM ON LAST PAGE A. LEGAL NAME OF LANDLORD E.POSSESSION DATE (if entry is a business name, enter the full legal business name)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada RTB-27

Edit your Canada RTB-27 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada RTB-27 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada RTB-27 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Canada RTB-27. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada RTB-27 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada RTB-27

How to fill out Canada RTB-27

01

Obtain a copy of the Canada RTB-27 form from the appropriate government website or office.

02

Read the instructions carefully to understand the purpose of the form.

03

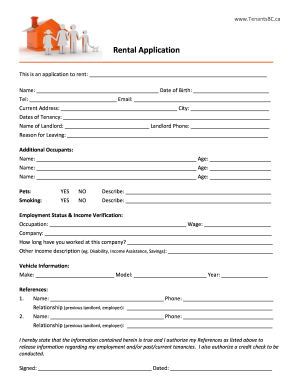

Fill out personal information such as your name, address, and contact information in the designated fields.

04

Specify the reason for submitting the RTB-27 form in the appropriate section.

05

Provide details related to the tenancy, including the address of the rental unit and the names of all tenants.

06

Include any supporting documents required along with the completed form.

07

Review the form to ensure all information is accurate and complete.

08

Submit the form to the appropriate authority as indicated in the instructions, either by mail or electronically.

Who needs Canada RTB-27?

01

Individuals who are landlords and require form RTB-27 for evictions or disputes.

02

Tenants who wish to contest a landlord's actions or need to formally document issues related to their tenancy.

03

Real estate professionals assisting clients with rental agreements and disputes in Canada.

Fill

form

: Try Risk Free

People Also Ask about

What is the interest rate of RTB28?

The RTB28 has the following terms of offering: Maturity period – 5.5 years. Fixed Interest rate – 5.75% per annum. Frequency of Interest Payments – quarterly.

How does RTB-28 work?

The RTB-28 is a five-and-a-half-year bond designed for retail investors as a low-risk and higher-yielding savings instrument. Proceeds of the issuance will help strengthen the country's agriculture sector, infrastructure, and education and healthcare systems, among others.

What is the interest rate of RTB 26?

Retail Treasury Bonds 26 | BPI. Invest your money for 5.5 years in bonds and earn 4.625%** interest per year. Minimum investment of Php 5,000. Essentially risk-free as the bond is a direct obligation of the Republic.

What is RTB 28?

The RTB-28 constitutes direct, unconditional, unsubordinated, and general obligations of the Republic and shall at all times rank pari passu and without any preference among themselves.

How to buy RTB 27?

1. Visit any BPI branch during the Offer Period and request the forms to invest in RTB-27. Be sure to bring a photocopy of one (1) valid government-issued I.D.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Canada RTB-27 from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your Canada RTB-27 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send Canada RTB-27 for eSignature?

Once your Canada RTB-27 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete Canada RTB-27 on an Android device?

Complete your Canada RTB-27 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is Canada RTB-27?

Canada RTB-27 is a tax form used for reporting certain types of income and tax credits in Canada.

Who is required to file Canada RTB-27?

Individuals or entities that have received specific types of income, such as dividends or interest, and wish to claim related deductions or credits are required to file Canada RTB-27.

How to fill out Canada RTB-27?

To fill out Canada RTB-27, you will need to provide your personal information, details of the income you received, and any eligible deductions or credits you are claiming, following the instructions provided with the form.

What is the purpose of Canada RTB-27?

The purpose of Canada RTB-27 is to ensure proper reporting of tax obligations related to specific income types and to facilitate the claim of applicable deductions and credits.

What information must be reported on Canada RTB-27?

The information that must be reported on Canada RTB-27 includes details of the income earned, the sources of that income, any relevant deductions or credits, and personal identification information.

Fill out your Canada RTB-27 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada RTB-27 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.