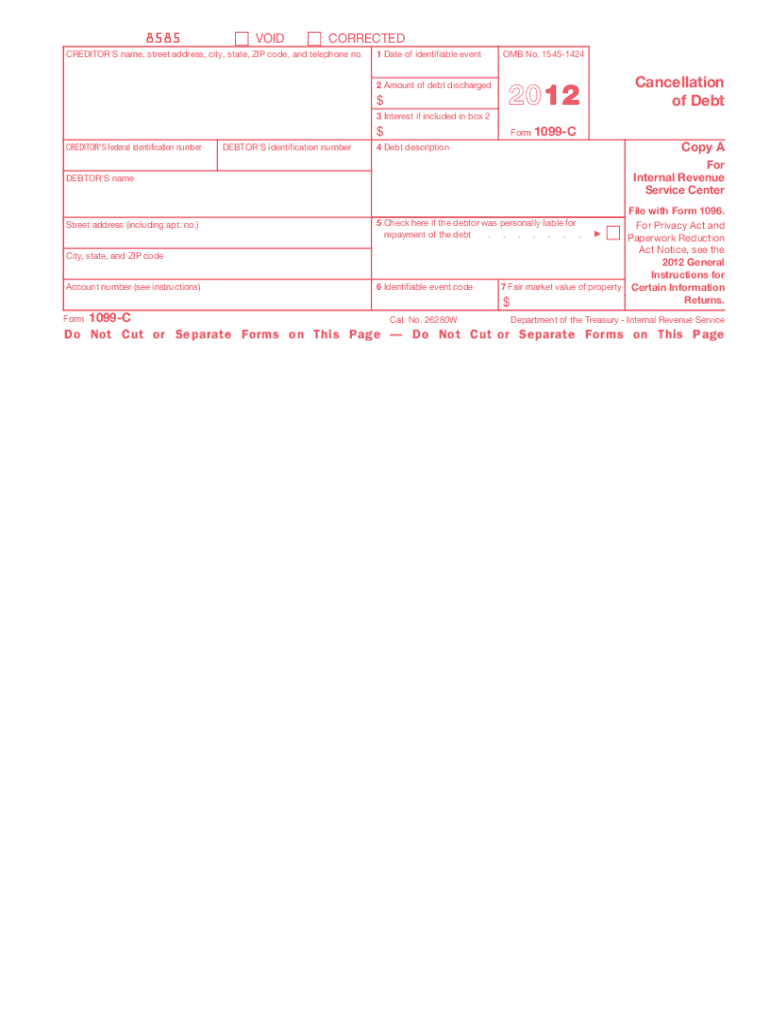

IRS 1099-C 2012 free printable template

Instructions and Help about IRS 1099-C

How to edit IRS 1099-C

How to fill out IRS 1099-C

About IRS 1099-C 2012 previous version

What is IRS 1099-C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-C

What should I do if I realize I made a mistake on my filed 2012 1099 c form?

If you discover an error after filing the 2012 1099 c form, it's important to submit a corrected version promptly. You will need to check the IRS guidelines for the correct procedures to amend the form. Amending the 2012 1099 c form ensures that the accurate information is reported to the IRS.

How can I verify the status of my submitted 2012 1099 c form?

To verify the status of your submitted 2012 1099 c form, you can contact the IRS directly or use their online tools if available. Check for common e-file rejection codes that could indicate issues with your submission, and ensure that you have filed all necessary corrections, if applicable.

What if a foreign payee is involved in my 2012 1099 c form filing?

When dealing with foreign payees on your 2012 1099 c form, ensure that the correct tax identification number or Form W-8 is obtained for reporting purposes. Special considerations apply to nonresidents, so it's advisable to consult IRS guidelines or a tax professional for compliance.

Can I e-file my 2012 1099 c form, and what are the technical requirements?

E-filing the 2012 1099 c form is permitted, but make sure your software is compatible with IRS specifications. It's essential to keep the technical requirements in mind, including proper file formats and security measures to protect sensitive data during the filing process.

What should I prepare if I receive an audit notice regarding my 2012 1099 c form?

If you receive an audit notice concerning your 2012 1099 c form, prepare to provide supporting documentation, such as proof of the reported transactions and correspondence related to your filings. Respond promptly with the necessary information to address the concerns raised by the IRS.

See what our users say