NY IFTA-21 2015 free printable template

Show details

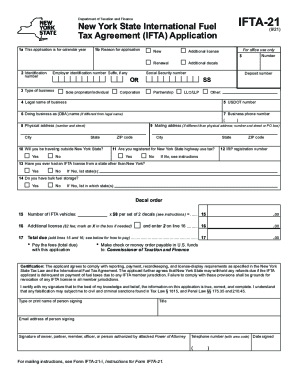

35 and 210. 45. Type or print name of person signing Title Signature of owner partner member officer or person authorized by attached Power of Attorney Telephone number with area code Date signed For mailing instructions see Form IFTA-21-I Instructions for Form IFTA-21. IFTA-21 Department of Taxation and Finance New York State International Fuel Tax Agreement IFTA Application 1a This application is for calendar year 1b Reason for application New Additional license Renewal Additional decals 2...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY IFTA-21

Edit your NY IFTA-21 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY IFTA-21 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY IFTA-21 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NY IFTA-21. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY IFTA-21 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY IFTA-21

How to fill out NY IFTA-21

01

Gather all relevant trip and fuel purchase records for the reporting period.

02

Obtain the NY IFTA-21 form from the New York State Department of Taxation and Finance website.

03

Fill in your business name and address at the top of the form.

04

Enter your IFTA account number and the reporting period for which you are filing.

05

List each jurisdiction where you operated during the reporting period.

06

Record the miles traveled and fuel purchased in each jurisdiction.

07

Calculate the total distances and total fuel used across all jurisdictions.

08

Determine the total taxable gallons and any credits from prior filings.

09

Calculate the total tax due based on the jurisdiction rates.

10

Complete any additional sections as required, sign and date the form, and submit it to the appropriate tax authority.

Who needs NY IFTA-21?

01

Any motor carrier or business that operates qualified motor vehicles in multiple jurisdictions and is part of the International Fuel Tax Agreement (IFTA) needs to file NY IFTA-21.

Fill

form

: Try Risk Free

People Also Ask about

What is IFTA Colorado?

The International Fuel Tax Agreement (IFTA) is a program that simplifies the reporting of motor fuel use taxes.

How do I get my IFTA in Minnesota?

In order to obtain an IFTA license in Minnesota you must contact the DVS IFTA office or one of the 10 deputy registrar offices. There is currently a $28 annual filing charge and an additional $2.50 for each set of decals. You are required to have one set of decals for each vehicle.

How to apply for IFTA in Washington state?

To obtain an IFTA license in Washington you must submit a completed application to the Department of Licensing. There is currently no charge for an application, however there is a $10 fee for each set of decals. Each qualified vehicle is required to have one set of decals.

What is IFTA Michigan?

Michigan IFTA The International Fuel Tax Agreement (IFTA) is an agreement among jurisdictions (United States and Canadian provinces) to simplify the reporting of the fuel use taxes by interstate carriers.

What is WA state gas tax?

We can VERIFY, no, there is not a new gas tax in Washington state.

What is the IFTA 100 MN form?

Form IFTA-100 summarizes the amount of tax due or the amount to be credited for the various fuel types computed on each Form IFTA-101 and is used to determine the total amount due/credit, including any appropriate penalty and interest. Instructions Enter the ending date of the quarter covered by this return.

What is the meaning of IFTA?

International Fuel Tax Agreement (IFTA)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in NY IFTA-21 without leaving Chrome?

NY IFTA-21 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I edit NY IFTA-21 on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit NY IFTA-21.

How do I fill out NY IFTA-21 on an Android device?

Use the pdfFiller mobile app and complete your NY IFTA-21 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is NY IFTA-21?

NY IFTA-21 is the New York International Fuel Tax Agreement (IFTA) quarterly tax return form used by commercial vehicle operators to report and pay fuel taxes on the fuel consumed within and outside the state.

Who is required to file NY IFTA-21?

Individuals and businesses that operate qualified motor vehicles within New York State and have an IFTA license are required to file NY IFTA-21.

How to fill out NY IFTA-21?

To fill out NY IFTA-21, gather your fuel purchase records, miles traveled in each jurisdiction, and follow the instructions provided on the form to complete and report the necessary information before submitting it to the state.

What is the purpose of NY IFTA-21?

The purpose of NY IFTA-21 is to report fuel use and to ensure the appropriate taxes are paid to the respective jurisdictions, thus streamlining the administration of fuel taxes across multiple states and Canadian provinces.

What information must be reported on NY IFTA-21?

NY IFTA-21 requires reporting of total miles traveled by jurisdiction, total gallons of fuel purchased, total taxable fuel used, tax owed or credit due, and any additional relevant data as per IFTA regulations.

Fill out your NY IFTA-21 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY IFTA-21 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.