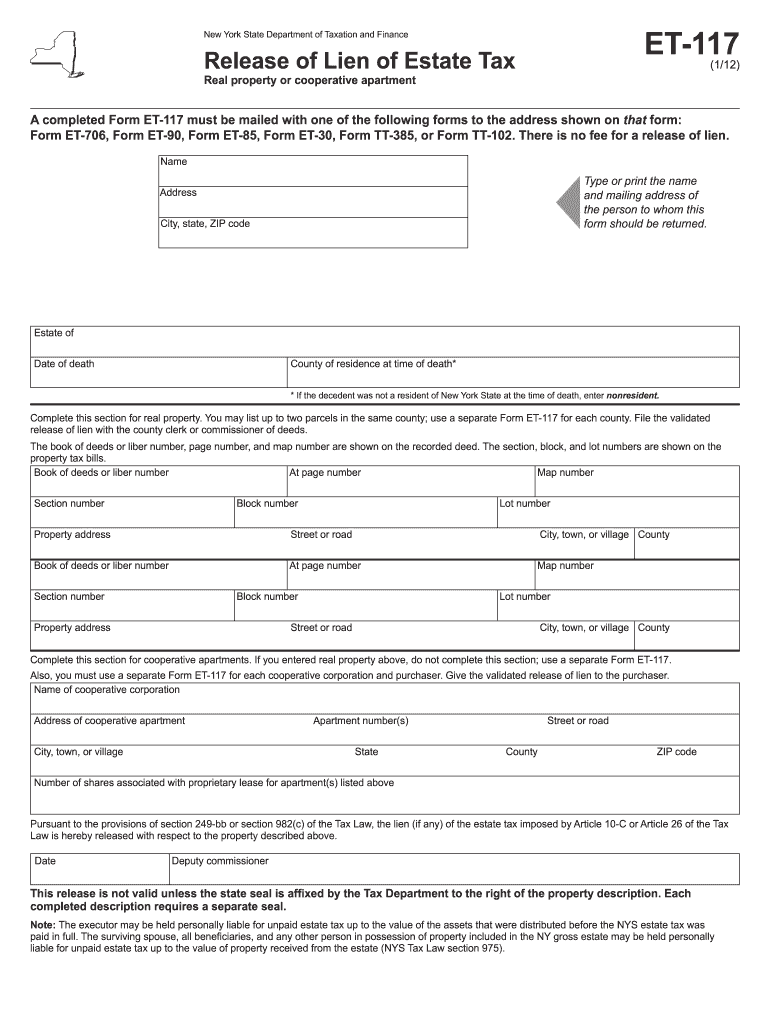

Who needs ET-117 form?

Official representatives or relatives of dead person must file ET-117 form to release lien.

What is for ET-117 form?

When owner of property dies, Tax Law places a lien on real estate and other real property for securing payments of estate tax due. Estate tax lien will be effective as of date of death of decedent.

For making transfer of real property from estate, release of lien must be requested and received. Do that with help of New York State Tax Department.

Release of lien used as authorization for transferring of real property, which is located in New York only.

Applications are free for filing.

Release of lien is required anyway and no matter, how much costs property.

Never forget that applicant must not schedule closing until the form with stamp would be received.

Average time of processing this and related forms is 3 or 4 weeks. Here is a hint how to save some time and act more flexible:

-

Add to time up to 10 days for mailing and collecting information

-

Don’t miss any detail or document. Each new document will make processing longer.

Is ET-117 Form accompanied by other forms?

ET-117 is accompanied by following forms:

-

ET-706

-

ET-90

-

ET-85

-

ET-30

-

TT-385 or TT-102

Time of expiration will be noted in the document.

How do I feel out ET-117 Form?

To feel out this form, you must place there such data:

-

Data of person, to whom this form will be returned

-

Info about owner of real estate and his date of death

-

Note legal information about property

-

Date and deputy commissioner.

Where do I send ET-117 Form?

Completed form must be sent to:

NYS ESTATE TAX

PROCESSING CENTER

PO BOX 15167

ALBANY NY 12212-5167