Get the free - tax ny

Show details

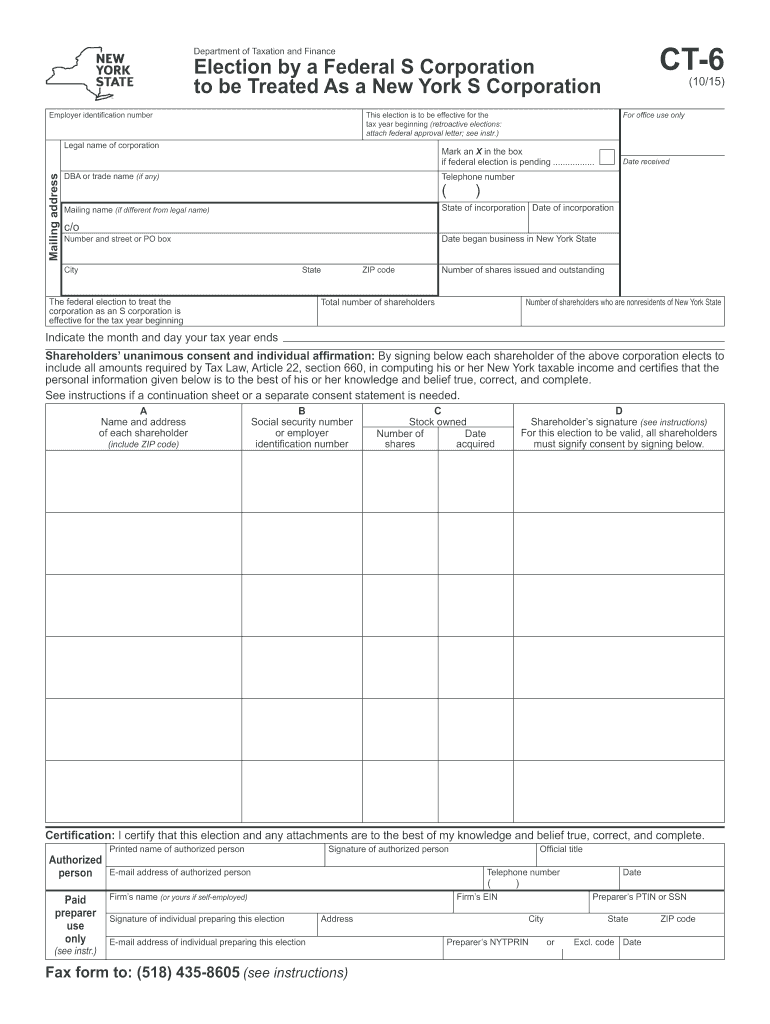

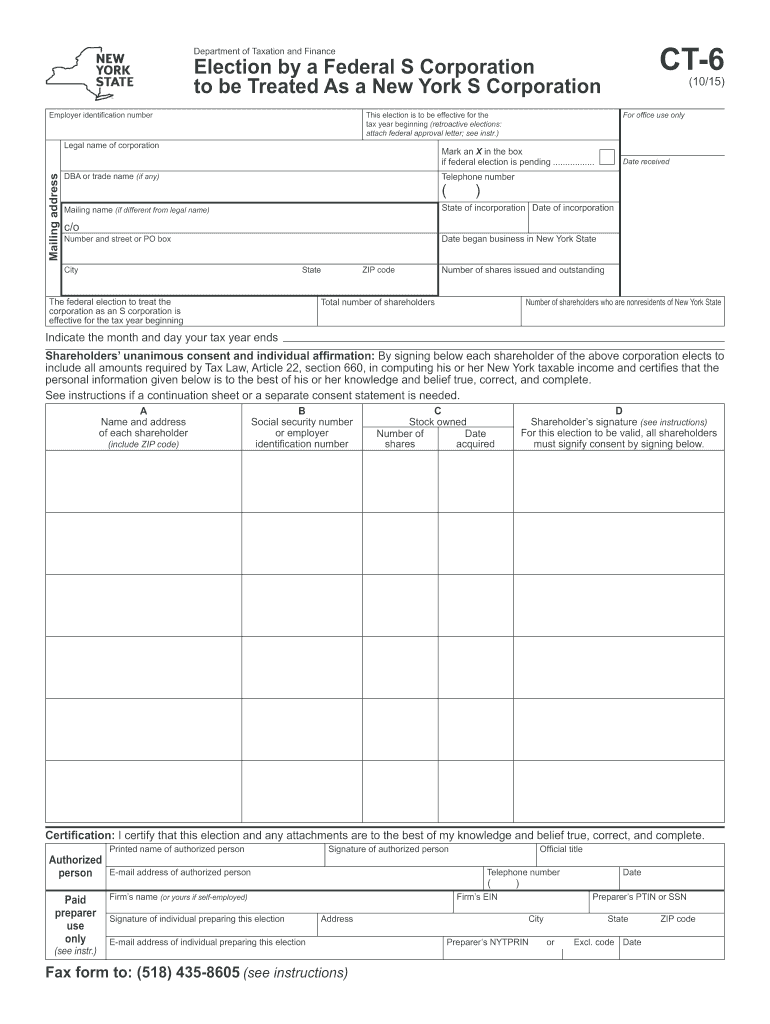

CT6Department of Taxation and FinanceElection by a Federal S Corporation to be Treated As a New York S Corporation(10/15)Employer identification numbers election is to be effective for their office

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax ny

Edit your tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax ny online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax ny. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

What is New York income tax rate?

New York state income tax rates are 4%, 4.5%, 5.25%, 5.9%, 5.97%, 6.33%, 6.85%, 9.65%, 10.3% and 10.9%. New York state income tax brackets and income tax rates depend on taxable income and filing status.

How much is $70000 after taxes in NYC?

If you make $70,000 a year living in the region of New York, USA, you will be taxed $17,361. That means that your net pay will be $52,639 per year, or $4,387 per month.

What is the sales tax in all 50 states?

How to Use This Chart StateState RateArkansas6.500%California7.250% Note that the true California state sales tax rate is 6%. There is a statewide county tax of 1.25% and therefore, the lowest rate anywhere in California is 7.25%. We have listed the combined state/county rate as the state rate to eliminate confusion.50 more rows

How do I figure in 6% sales tax?

Calculating sales tax on a product or service is straightforward: Simply multiply the cost of the product or service by the tax rate. For example, if you operate your business in a state with a 6% sales tax and you sell chairs for $100 each, you would multiply $100 by 6%, which equals $6, the total amount of sales tax.

How do I calculate NY sales tax?

How to calculate NYC sales tax? To calculate the amount of sales tax to charge in New York City, use this simple formula: Sales tax = total amount of sale x sales tax rate (in this case 8%).

What is the formula for calculating sales tax?

What is the sales tax formula? Sales tax rate = Sales tax percent / 100. Sales tax = List price x Sales tax rate.

What is the NYS sales tax rate 2022?

Introduction. Sales and use tax rates in New York State reflect a combined statewide rate of 4%, plus the local rate in effect in the jurisdiction (city, county, or school district) where the sale or other transaction or use occurs.

What is nyc income tax rate 2022?

NYC Tax Brackets 2022 New York City income tax rates are 3.078%, 3.762%, 3.819%, and 3.876%, depending on which bracket you are in. Where you fall within these brackets depends on your filing status and how much you earn annually.

How to calculate tax?

What is the sales tax formula? Sales tax rate = Sales tax percent / 100. Sales tax = List price x Sales tax rate.

How much percent is tax?

For the 2022 tax year, there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your tax bracket is determined by your filing status and taxable income.

How much is NY sales tax 2022?

The City Sales Tax rate is 4.5%, NY State Sales and Use Tax is 4% and the Metropolitan Commuter Transportation District surcharge of 0.375% for a total Sales and Use Tax of 8.875 percent.

Is NYS sales tax 8%?

Introduction. Sales and use tax rates in New York State reflect a combined statewide rate of 4%, plus the local rate in effect in the jurisdiction (city, county, or school district) where the sale or other transaction or use occurs.

How do I calculate NYS sales tax?

How to calculate NYC sales tax? To calculate the amount of sales tax to charge in New York City, use this simple formula: Sales tax = total amount of sale x sales tax rate (in this case 8%).

How much is tax in NY?

The City Sales Tax rate is 4.5%, NY State Sales and Use Tax is 4% and the Metropolitan Commuter Transportation District surcharge of 0.375% for a total Sales and Use Tax of 8.875 percent.

What is 8% sales tax as a decimal?

Convert the sales tax percentage into a decimal figure. For example, if the sales tax rate is 8%, the decimal figure will be . 08.

What is nyc sales tax rate 2022?

The minimum combined 2022 sales tax rate for New York, New York is 8%. This is the total of state, county and city sales tax rates. The New York sales tax rate is currently 4%. The County sales tax rate is 4%.

How is 8.25% sales tax calculated?

Sales Tax Calculation Formulas Sales tax rate = sales tax percent / 100. Sales tax = list price * sales tax rate. Total price including tax = list price + sales tax, or. Total price including tax = list price + (list price * sales tax rate), or. Total price including tax = list price * ( 1 + sales tax rate)

How much is tax in nyc?

The City Sales Tax rate is 4.5%, NY State Sales and Use Tax is 4% and the Metropolitan Commuter Transportation District surcharge of 0.375% for a total Sales and Use Tax of 8.875 percent.

What is the new income tax rate 2022?

Income tax on earned income is charged at three rates: the basic rate, the higher rate and the additional rate. For 2022/23 these three rates are 20%, 40% and 45% respectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax ny for eSignature?

To distribute your tax ny, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I fill out the tax ny form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign tax ny. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit tax ny on an Android device?

The pdfFiller app for Android allows you to edit PDF files like tax ny. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is tax ny?

Tax NY is the state income tax system for New York.

Who is required to file tax ny?

Residents of the state of New York and non-residents who have income sourced in New York are required to file tax NY.

How to fill out tax ny?

Tax NY can be filled out either online, through tax software, or by mailing in a paper form.

What is the purpose of tax ny?

The purpose of tax NY is to generate revenue for the state government to fund public services and infrastructure.

What information must be reported on tax ny?

Tax NY requires individuals to report their income, deductions, credits, and any taxes already paid.

Fill out your tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.