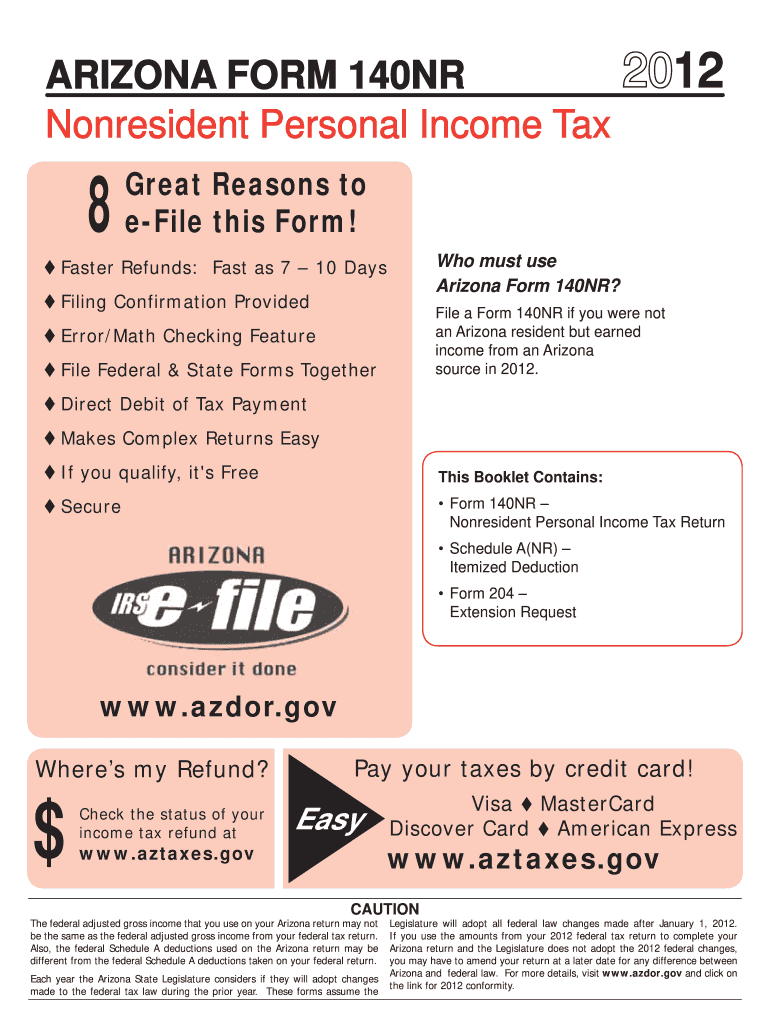

AZ DoR 140NR 2012 free printable template

Show details

Visa ? MasterCard .... tax return, AZ Form 140X, for the specific year for which the taxpayer is .... You can find your Arizona adjusted gross income on line.

pdfFiller is not affiliated with any government organization

Instructions and Help about AZ DoR 140NR

How to edit AZ DoR 140NR

How to fill out AZ DoR 140NR

Instructions and Help about AZ DoR 140NR

How to edit AZ DoR 140NR

To edit the AZ DoR 140NR tax form, obtain a blank copy of the form from the Arizona Department of Revenue's website or through reliable sources. Use a PDF editor, such as pdfFiller, to open the form and make the necessary changes. Ensure that you save the document once you complete your edits to preserve your modifications.

How to fill out AZ DoR 140NR

Filling out the AZ DoR 140NR requires a systematic approach. First, gather all relevant financial documents, including income statements and tax records. Then, follow these steps to ensure accurate completion:

01

Download the AZ DoR 140NR form from a trusted source.

02

Enter your personal information, including your name, address, and Social Security number.

03

Provide details about your income, deductions, and credits as outlined in the form.

04

Review the filled form for accuracy to avoid mistakes before submission.

About AZ DoR 140NR 2012 previous version

What is AZ DoR 140NR?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AZ DoR 140NR 2012 previous version

What is AZ DoR 140NR?

AZ DoR 140NR is the Arizona Non-Resident Individual Income Tax Return form used by non-residents earning income in Arizona. This tax form is essential for reporting income to ensure compliance with state tax regulations.

What is the purpose of this form?

The purpose of the AZ DoR 140NR form is to facilitate the filing of income tax returns for individuals who do not reside in Arizona but earn income from the state. Completing this form accurately allows non-residents to report their earnings and pay the appropriate taxes, ensuring adherence to state laws.

Who needs the form?

Non-resident individuals who have received income from sources in Arizona must complete the AZ DoR 140NR form. This includes individuals who worked in Arizona, received rental income, or had any other revenue-generating activities within the state.

When am I exempt from filling out this form?

You may be exempt from filling out the AZ DoR 140NR if your Arizona-source income is below the minimum threshold set by the Arizona Department of Revenue. Additionally, non-residents with incomes that are entirely tax-exempt under state law do not need to file this form.

Components of the form

The AZ DoR 140NR consists of various sections that require personal identification information, income details, adjustments, and tax liability calculations. It typically includes lines for reporting wages, other income types, deductions, and credits eligible for non-residents. Ensure you provide complete and accurate information in each section for successful processing.

What are the penalties for not issuing the form?

Failure to file the AZ DoR 140NR can result in monetary penalties imposed by the Arizona Department of Revenue. Non-compliance may also lead to interest on any unpaid taxes, which increases the total amount owed over time. It is vital to meet filing deadlines and adhere to state tax regulations to avoid these consequences.

What information do you need when you file the form?

When filing the AZ DoR 140NR, be prepared to provide personal information including your name, address, Social Security number, and details of Arizona-sourced income. You will also need documentation to support your claims for any deductions or credits that apply to your situation.

Is the form accompanied by other forms?

The AZ DoR 140NR form may need to be submitted with additional forms if you are claiming specific credits or deductions. Examples can include the Arizona Form 300 (Non-Resident Tax Credit) or documentation supporting the income reported. Review instructions attached to the AZ DoR 140NR for detailed requirements regarding accompanying forms.

Where do I send the form?

The AZ DoR 140NR must be mailed to the Arizona Department of Revenue. Ensure you verify the correct mailing address based on your residency status and the specific tax year to avoid delays in processing your return. Check the Arizona Department of Revenue's official website for the most current mailing information.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

I am currently reviewing how much I would actually have to use the PC Filler to see whether I need to subscribe. Thank you.

Very easy to use. Enjoy using this program.

See what our users say