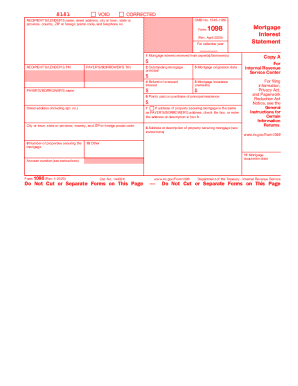

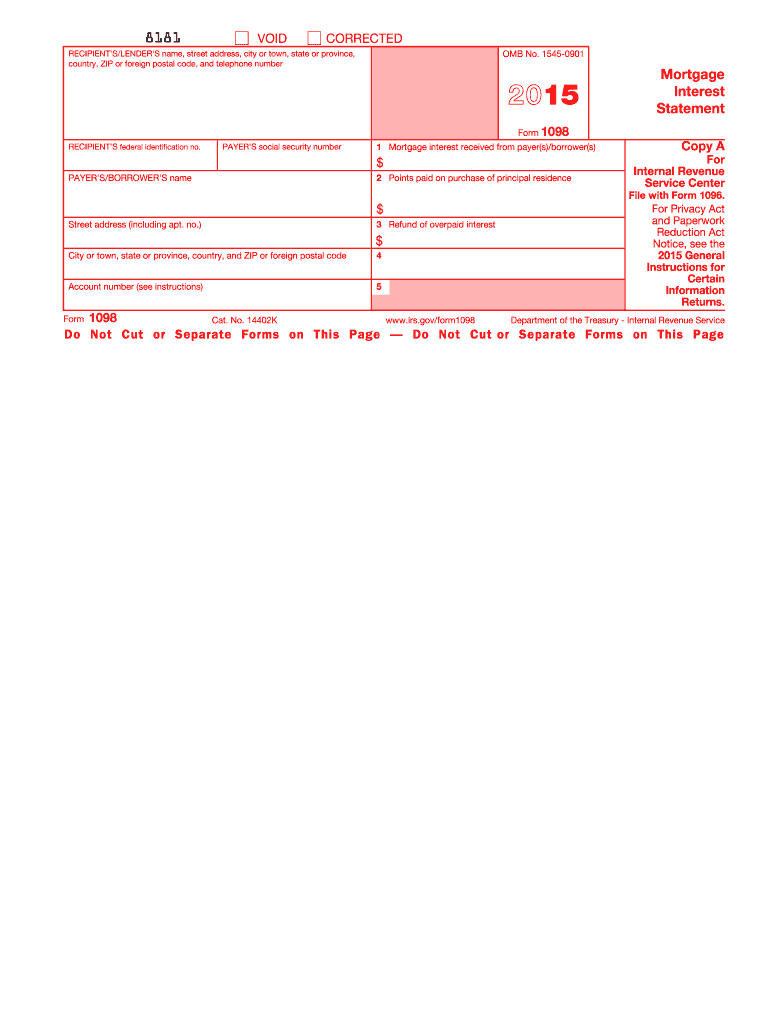

IRS 1098 2015 free printable template

Instructions and Help about IRS 1098

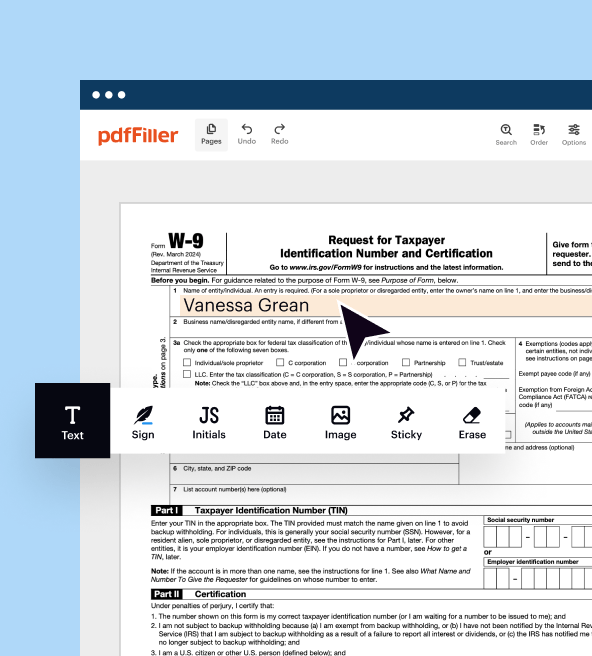

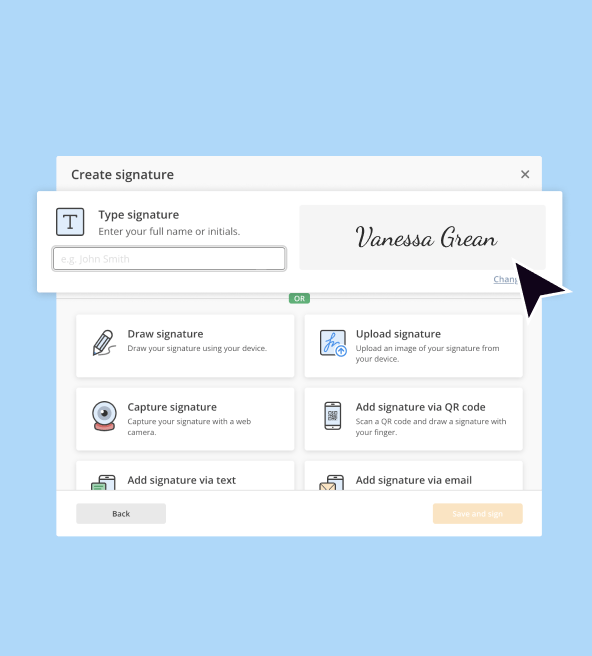

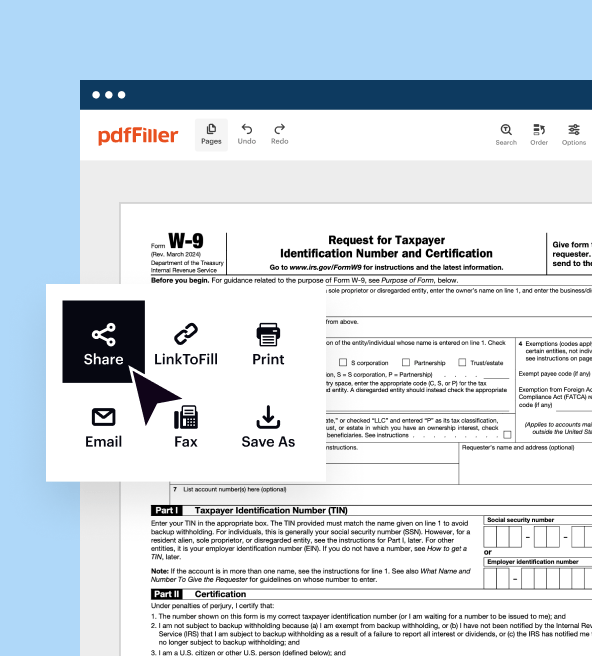

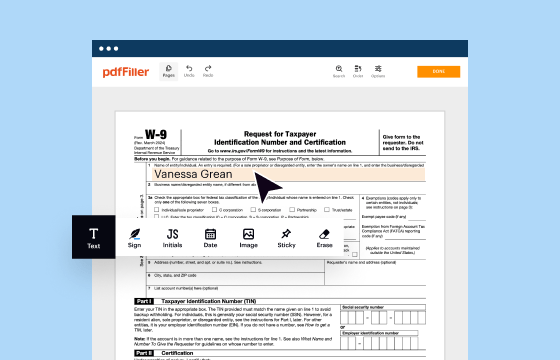

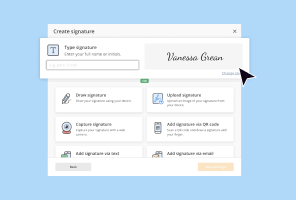

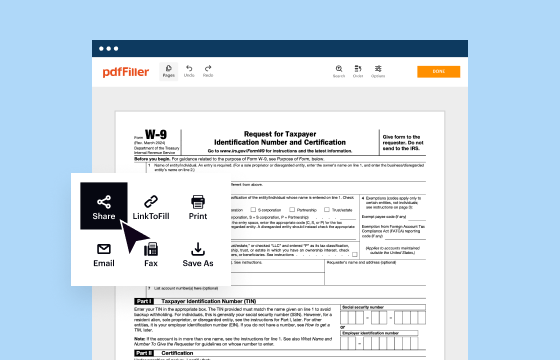

How to edit IRS 1098

How to fill out IRS 1098

About IRS previous version

What is IRS 1098?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1098

What should I do if I realize I've made an error after submitting my IRS 1098?

If you identify a mistake on your IRS 1098 after submission, you will need to file a corrected form. This involves completing a new IRS 1098 with the correct information and marking it as amended. It's crucial to submit this correction promptly to avoid potential penalties and ensure that the recipients have the accurate data for their tax filings.

How can I verify that my IRS 1098 has been received and processed by the IRS?

To verify the status of your IRS 1098, you can check online through the IRS e-file status tool if you submitted electronically. You may also contact the IRS directly for assistance. Keep in mind that e-file rejection codes can provide insights if your form wasn't successfully processed, and it’s important to address any issues indicated by these codes.

What should I keep in mind regarding privacy and data security when handling IRS 1098 forms?

When handling IRS 1098 forms, it's important to prioritize privacy and data security. Ensure that any sensitive information is stored securely and that electronic transmissions are conducted over secure channels. Familiarize yourself with the record retention periods prescribed by the IRS to maintain compliance while safeguarding personal data.

Are there special considerations when filing an IRS 1098 for nonresident payees?

Filing an IRS 1098 for nonresident payees can involve specific considerations such as tax treaty benefits or withholding obligations. It's advisable to review the IRS guidelines on nonresident filing requirements and consult with a tax professional to ensure compliance when dealing with foreign entities.

What common errors might occur when filing the IRS 1098, and how can I avoid them?

When filing the IRS 1098, common errors include incorrect recipient information and failure to report all applicable payments. To avoid these mistakes, double-check all entries for accuracy and ensure you are familiar with the correct reporting requirements. Using software designed for e-filing can also help reduce errors through automated checks.