NY CRTSBH89 1997-2025 free printable template

Show details

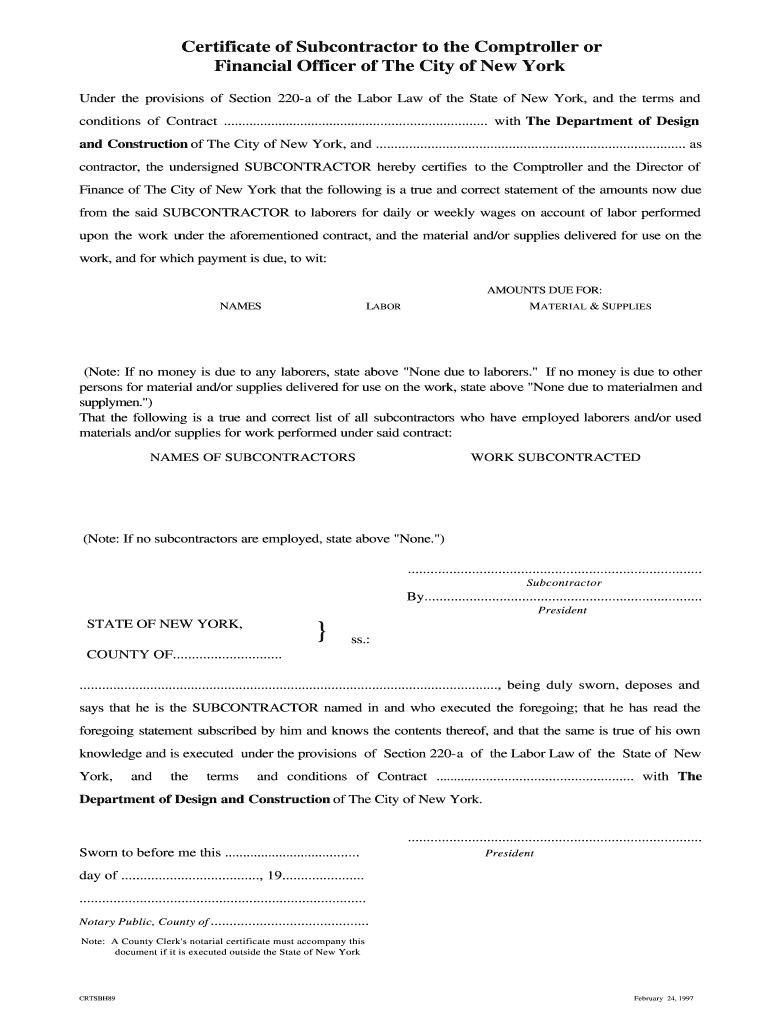

Certificate of Subcontractor to the Comptroller or Financial Officer of The City of New York Under the provisions of Section 220-a of the Labor Law of the State of New York and the terms and conditions of Contract. with The Department of Design and Construction of The City of New York and. as contractor the undersigned SUBCONTRACTOR hereby certifies to the Comptroller and the Director of Finance of The City of New York that the following is a true and correct statement of the amounts now due...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign certificate subcontractor comptroller form

Edit your certificate subcontractor comptroller form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your subcontractor certificate format form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit certificate of subcontractor online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit subcontractor certificate form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sub contractor certificate form

How to fill out NY CRTSBH89

01

Gather all required personal information including your name, address, and Social Security number.

02

Obtain the NY CRTSBH89 form from the official New York State website or relevant department.

03

Carefully read the instructions provided on the form to understand the requirements.

04

Fill out the form with accurate information, ensuring all fields are completed as instructed.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed form to the appropriate agency, either by mail or electronically, as per the guidelines.

Who needs NY CRTSBH89?

01

Individuals applying for certain benefits or tax credits related to state residency or personal status.

02

Residents of New York State who meet specific eligibility criteria outlined in the state regulations.

03

Taxpayers who have had changes in residency or other qualifying circumstances that require documentation.

Fill

sub contract agreement format in word

: Try Risk Free

People Also Ask about

How do I write a subcontractor agreement?

8 things a subcontractor agreement should include Business information. Include names, businesses names, and contact information for both the subcontractor and the hiring contractor. Scope of work. Payment terms. Change orders. Licensing and insurance coverage. Dispute resolution. Termination clause. Flow-down provisions.

How do I onboard a new subcontractor?

Remember the six-steps in the subcontractor onboarding process: Execute Subcontractor Contract Agreements. Document Proof of Insurance and Bonding. Schedule Pre-Mobilization Meetings. Schedule Labor and Materials Deployment. Acquire Submittals. Subcontractor/Worker Orientations.

What is the difference between 1099 and subcontractor?

You issue a Form W-2 to an employee. A subcontractor is a worker who is not your employee. You give a Form 1099 to a subcontractor showing the amounts you paid him. The subcontractor is responsible for keeping his or her own records and paying his or her own income and self-employment taxes.

What is the difference between IC and subcontractor?

Subcontractor vs Independent contractor is a difference in an employment relationship with a laborer. Independent contractors are employed and paid directly by the employer while subcontractors are employed by an independent contractor and are paid by them.

Does IC mean independent contractor?

What is an independent contractor? An independent contractor (IC) is self-employed and provides services to another business. They hold the responsibility to declare their income and submit self-employment taxes to the IRS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete NY CRTSBH89 online?

pdfFiller has made filling out and eSigning NY CRTSBH89 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make changes in NY CRTSBH89?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your NY CRTSBH89 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for the NY CRTSBH89 in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your NY CRTSBH89 in minutes.

What is NY CRTSBH89?

NY CRTSBH89 is a form used by certain tax filers in New York to report specific tax-related information.

Who is required to file NY CRTSBH89?

Individuals and entities that meet certain income thresholds or have specific tax obligations as outlined by New York State are required to file NY CRTSBH89.

How to fill out NY CRTSBH89?

To fill out NY CRTSBH89, taxpayers should follow the instructions provided on the form, ensuring all required fields are completed accurately and relevant documentation is attached.

What is the purpose of NY CRTSBH89?

The purpose of NY CRTSBH89 is to collect information necessary for New York State to assess taxes owed and ensure compliance with state tax laws.

What information must be reported on NY CRTSBH89?

NY CRTSBH89 requires reporting information such as taxpayer identification details, income amounts, deductions, and any other relevant financial data as specified in the instructions.

Fill out your NY CRTSBH89 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY crtsbh89 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.