IRS 1041-ES 2016 free printable template

Instructions and Help about IRS 1041-ES

How to edit IRS 1041-ES

How to fill out IRS 1041-ES

About IRS 1041-ES 2021 previous version

What is IRS 1041-ES?

Who needs the form?

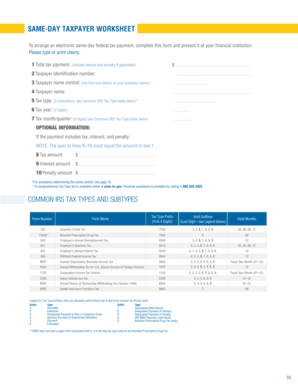

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1041-ES

What should I do if I need to correct a mistake on my 2016 form estimated?

If you discover an error after filing your 2016 form estimated, you may need to submit an amended version. It's important to check the specific guidelines provided by the IRS for correcting mistakes. Keep all documentation related to your initial submission and the corrections for your records.

How can I verify the status of my 2016 form estimated submission?

To track the status of your 2016 form estimated, you can use the IRS's online tracking tools. This allows you to see if your form has been received and whether it is being processed. If you encounter e-file rejection codes, refer to the IRS guidelines for common issues and their resolutions.

Are there special considerations for nonresidents filing the 2016 form estimated?

Yes, nonresidents may have different requirements when filing the 2016 form estimated. It's essential to understand your status and any treaty benefits that might apply. Consulting a tax professional familiar with nonresident taxation can help ensure compliance with U.S. tax laws.

What should I do if I receive a notice from the IRS after submitting my 2016 form estimated?

If you receive an IRS notice regarding your 2016 form estimated, carefully review the communication for instructions and required responses. Prepare any necessary documentation and reach out to the IRS directly if you need clarification or assistance with your case.

What are some common errors to avoid when submitting the 2016 form estimated?

Common errors when filing the 2016 form estimated include incorrect amounts, missing signatures, and Failure to include all required identification numbers. Double-check your information before submission to minimize the chances of rejection or processing delays.