Get the free it 370 pf - tax ny

Show details

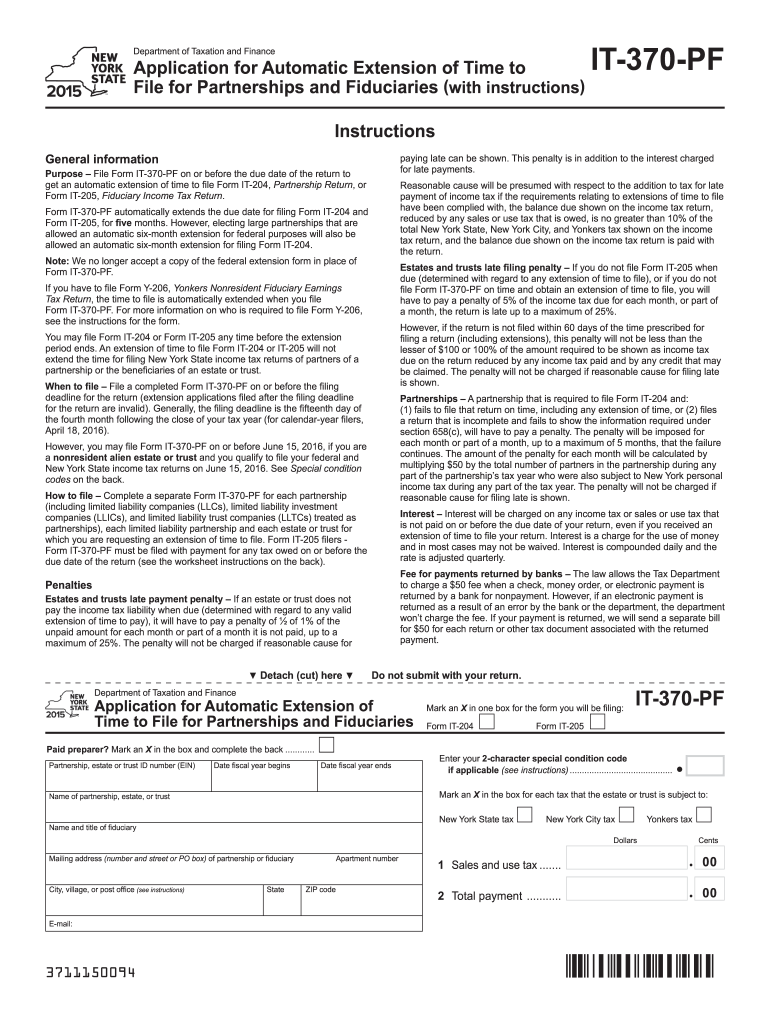

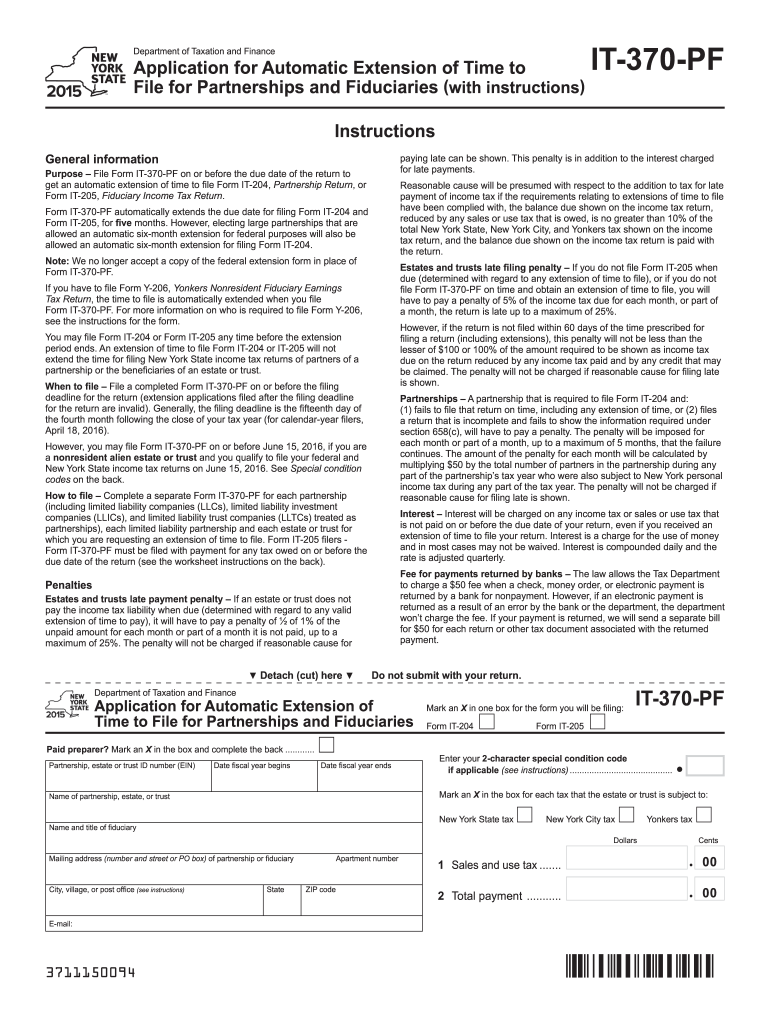

IT-370-PF. New York State Department of Taxation and Finance. Application for Automatic Extension of Time to. File for Partnerships and Fiduciaries (with ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign it 370 pf

Edit your it 370 pf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it 370 pf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing it 370 pf online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit it 370 pf. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

How much does it cost to extend taxes?

Filing a tax extension is free, easy and automatic: Just submit Form 4868 electronically or on paper by the filing deadline.

What happens if you miss IRS deadline 2022?

If you miss the April 18, 2023 deadline to e-file a 2022 Tax Return or you e-filed an extension by that date, you can still e-file your 2022 Taxes until October 16, 2023.

Can you still file 2022 taxes after deadline?

People can file a tax return even if they haven't yet received their letter. The IRS reminds people that there's no penalty for a refund claimed on a tax return filed after the regular April 2022 tax deadline.

What is form it-370 PF?

Application for Automatic Extension of Time to File for Partnerships and Fiduciaries; Description of Form IT-370-PF. If filed before the due date, will allow a partnership or fiduciary an extension of time to file Form IT-204, Partnership Return, or Form IT-205, Fiduciary Income Tax Return.

What happens if you miss the tax deadline 2022?

Generally, if you miss the filing due date or fail to file by the tax extension deadline, the IRS may charge a failure-to-file penalty. The penalty is based on your unpaid taxes, and the IRS charges 5% of your taxes due for every month or partial month your tax return is not filed.

Will the IRS extend the tax deadline again for 2022?

Yes, the tax deadline for people who filed extensions is coming in October. You have until Oct. 17, 2022, to file your 2021 income tax return if you requested an extension. The IRS encourages taxpayers to file electronically ASAP.

Do I need to file NY state extension?

If you owe New York income taxes by April 18, 2023, you need to submit a NY extension or tax return to avoid late filing penalties. An extension will only avoid late filing penalties until Oct. 16, 2023.

What is an IT-370?

10433: NY - Individual Extension NY-IT-370 A New York extension for an individual return can be e-filed with a federal extension, or with the main federal return.

Is New York extension automatic?

Consistent with section 657 of the Tax Law, the automatic extension may be granted for a different length of time to conform to extensions for comparable Federal forms. The application for an automatic extension must be filed on or before the date prescribed for filing the appropriate return.

How do I file an extension in New York?

If you cannot file on time, you can request an automatic extension of time to file the following forms: Form IT-201, Resident Income Tax Return. Form IT-203, Nonresident and Part-Year Resident Income Tax Return.

Does NY accept NYS extension?

Do I need to include a copy of my federal or state extension form with my city extension? New York City does not require (or desire) a copy of the Federal Form 7004, or either of the New York State extension forms IT-370 or IT-370-PF.

Do I need to file a NYS extension?

If you owe New York income taxes by April 18, 2023, you need to submit a NY extension or tax return to avoid late filing penalties. An extension will only avoid late filing penalties until Oct. 16, 2023. Note: Unless you pay all of your Taxes, or eFile your tax return by Oct.

Do you have to pay taxes when you file an extension?

An extension of time to file your return does not grant you any extension of time to pay your taxes. You should estimate and pay any owed taxes by your regular deadline to help avoid possible penalties. You must file your extension request no later than the regular due date of your return.

Is it necessary to file an extension for taxes?

Benefits of filing an extension More time and less stress means you'll be able to thoroughly review your return and ensure you're taking advantage of all the tax benefits available to you. You'll also avoid failure-to-file penalties, which can add up to 25% of the tax due.

Do I need to file a NY state extension?

If you owe New York income taxes by April 18, 2023, you need to submit a NY extension or tax return to avoid late filing penalties. An extension will only avoid late filing penalties until Oct. 16, 2023.

What is the extended tax deadline for 2022?

October 16, 2023 - Deadline to file your extended 2022 tax return. If you chose to file an extension request on your tax return, this is the due date for filing your tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send it 370 pf for eSignature?

Once your it 370 pf is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit it 370 pf in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your it 370 pf, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit it 370 pf on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign it 370 pf right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is it 370 pf?

It 370 pf is the annual information return required to be filed by private foundations with the IRS.

Who is required to file it 370 pf?

Private foundations are required to file form 370 pf with the IRS.

How to fill out it 370 pf?

Form 370 pf must be completed with detailed financial information and submitted to the IRS.

What is the purpose of it 370 pf?

The purpose of form 370 pf is to provide the IRS with information about the finances and activities of a private foundation.

What information must be reported on it 370 pf?

On form 370 pf, private foundations must report their financial data, grants given, investments, and other activities.

Fill out your it 370 pf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It 370 Pf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.