Get the free 112 BOOK 2022 Booklet Includes: Instructions DR 0112 Related Forms - colorado

Show details

(12/18/17)112BookBooklet Includes: Instructions DR 0112 Related Forms Corporation Colorado C Corporation Income Tax Filing Guides book includes:DR 0112 2017 Colorado C Corporation Income Tax Returner

We are not affiliated with any brand or entity on this form

Instructions and Help about 112 book 2022 booklet

How to edit 112 book 2022 booklet

How to fill out 112 book 2022 booklet

Instructions and Help about 112 book 2022 booklet

How to edit 112 book 2022 booklet

To edit the 112 book 2022 booklet, users can utilize pdfFiller's editing functionalities. Upload the form onto the platform, allowing for text modifications or corrections as needed. Remember to save the edited version securely to ensure your changes are preserved.

How to fill out 112 book 2022 booklet

Filling out the 112 book 2022 booklet requires careful attention to detail. Gather all necessary information beforehand, including financial details relevant to the tax year. Utilize pdfFiller’s tools to input data directly onto the form, ensuring clarity and accuracy before submission.

Latest updates to 112 book 2022 booklet

Latest updates to 112 book 2022 booklet

The 112 book 2022 booklet may have undergone revisions to reflect changes in tax laws or IRS guidelines. Ensure you are using the most current version by visiting the official IRS website or consulting updated resources.

All You Need to Know About 112 book 2022 booklet

What is 112 book 2022 booklet?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About 112 book 2022 booklet

What is 112 book 2022 booklet?

The 112 book 2022 booklet refers to a specific tax form used for reporting certain income, deductions, and tax obligations for the 2022 tax year. This form is essential for compliance with U.S. tax laws and assists the IRS in processing individual tax liabilities.

What is the purpose of this form?

The purpose of the 112 book 2022 booklet is to provide a structured format for taxpayers to report relevant financial information accurately. It assists in determining tax liabilities and ensures proper documentation of earnings, deductions, and credits.

Who needs the form?

Individuals and businesses who meet specific income thresholds or have particular tax reporting requirements must complete the 112 book 2022 booklet. It is particularly relevant for self-employed individuals and certain corporations while also serving those claiming additional deductions or credits.

When am I exempt from filling out this form?

You may be exempt from filling out the 112 book 2022 booklet if your income is below the required filing threshold for the year or if you qualify for certain exemptions based on age or other factors. Always verify your eligibility against IRS guidelines.

Components of the form

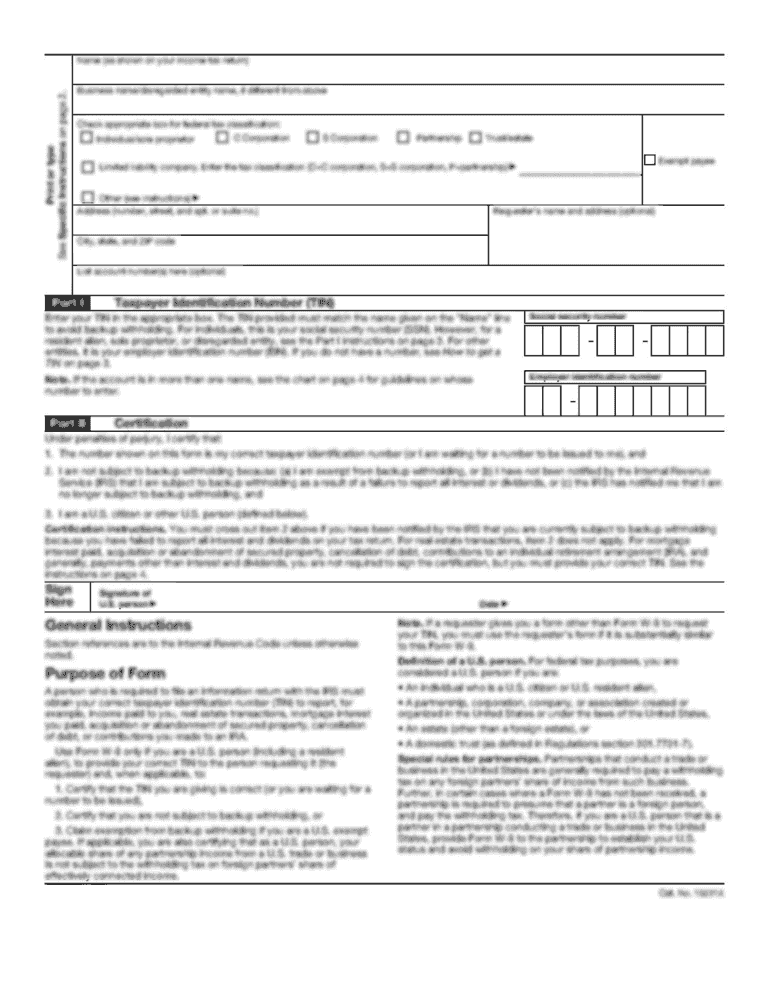

The components of the 112 book 2022 booklet include personal information sections, income reporting fields, and specific lines for various deductions and credits. Accurate completion of each section is critical to ensure proper tax computation and avoid potential penalties.

What are the penalties for not issuing the form?

Failing to issue the 112 book 2022 booklet can result in various penalties, including fines imposed by the IRS. Additionally, delays in filing may incur interest on owed taxes, compounding the financial impact on the filer.

What information do you need when you file the form?

When filing the 112 book 2022 booklet, gather essential information such as social security numbers, income statements, prior year tax documents, and any pertinent documentation related to deductions or credits claimed. Providing accurate details supports a smoother filing process and compliance.

Is the form accompanied by other forms?

In many cases, the 112 book 2022 booklet may need to be submitted with additional forms, depending on your tax situation. Common accompanying forms may include the Schedule C, Schedule SE, or other specific tax forms related to income, deductions, or credits.

Where do I send the form?

The destination for sending the 112 book 2022 booklet depends on your location and the nature of the filing (individual or business). Generally, completed forms should be mailed to designated IRS processing centers based on the corresponding instructions provided by the IRS.

See what our users say