Get the free Mini-Salon/Shop, Employee and Independent Contractor List ... - tdLR

Show details

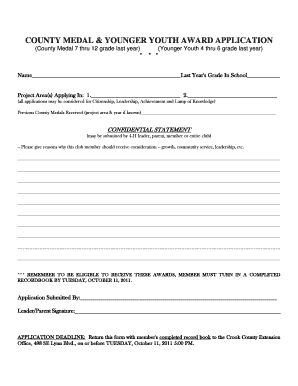

TEXAS DEPARTMENT OF LICENSING AND REGULATION FIELD OPERATIONS DIVISION MINIMAL/SHOP, EMPLOYEE AND INDEPENDENT CONTRACTOR LIST Name of Salon/Shop Salon/Shop License # Salon/Shop Type Date OWNER/MANAGER/REPRESENTATIVE,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mini-salonshop employee and independent

Edit your mini-salonshop employee and independent form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mini-salonshop employee and independent form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mini-salonshop employee and independent online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mini-salonshop employee and independent. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mini-salonshop employee and independent

How to fill out mini-salonshop employee and independent:

01

Start by gathering all the necessary information about the employee or independent contractor, such as their name, contact details, and social security number.

02

Next, determine their employment status - whether they are an employee or an independent contractor. This distinction is crucial for tax and legal purposes.

03

If the individual is an employee, fill out the relevant forms for employee taxes, such as Form W-4 for federal income tax withholding and any applicable state tax withholding forms.

04

Provide information about their wages, including their salary or hourly rate, any bonuses or commissions, and if applicable, any tips or other compensation they receive.

05

Include details about any benefits or deductions, such as health insurance, retirement plans, or any other fringe benefits offered to the employee.

06

If the individual is an independent contractor, fill out the appropriate forms, such as Form W-9, to collect their taxpayer identification number for reporting purposes.

07

Enter information about the payments made to the independent contractor, including any fees, commissions, and reimbursements, as well as the total amount paid during the tax year.

08

Additionally, provide details about any backup withholding, if applicable, and any other special circumstances relating to the contractor's tax obligations.

Who needs mini-salonshop employee and independent:

01

Small salon owners who are looking to hire individuals to work as employees within their establishment may need to fill out the mini-salonshop employee forms.

02

Salon owners who engage independent contractors to provide specific services, such as hairstyling, nail care, or spa treatments, may also need to complete the mini-salonshop independent forms.

03

Any salon owner or manager who wants to ensure compliance with relevant tax and employment regulations will benefit from properly filling out these forms.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get a salon license in Texas?

So, how long is cosmetology school in Texas? The law states that students must complete a minimum of 1,000 hours of accredited beauty school in Texas.

Can you have a home salon in Texas?

If you hold a valid cosmetology or barbering license, Texas law allows you to provide a limited range of services to customers outside of a licensed salon/shop, provided that you meet certain requirements.

What can you do without a cosmetology license in Texas?

You can own a salon without a license. That being said, you won't be able to shampoo or cut anyone's hair. You can manage your group of hairdressers and nail technicians.

What license do I need to open a hair salon in Texas?

Apply For Your Texas Salon License To operate a Texas salon, the TDLR requires you to have a Texas cosmetology salon license. If you plan to work in your salon, you'll need both a salon license and an operator license.

Do I need a license to open a hair salon in Texas?

Apply For Your Texas Salon License To operate a Texas salon, the TDLR requires you to have a Texas cosmetology salon license. If you plan to work in your salon, you'll need both a salon license and an operator license.

How do I report to TDLR?

Anyone requiring assistance with filing a complaint online may contact a TDLR customer service representative by phone at 1-800-803-9202. Please download and complete a complaint form when submitting by mail. Once a complaint is received, we will evaluate it to determine if the complaint is within our jurisdiction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get mini-salonshop employee and independent?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the mini-salonshop employee and independent in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I edit mini-salonshop employee and independent on an iOS device?

Create, modify, and share mini-salonshop employee and independent using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I complete mini-salonshop employee and independent on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your mini-salonshop employee and independent. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is mini-salonshop employee and independent?

A mini-salonshop employee refers to an individual who works in a small salon environment under the direct supervision of the owner or management, typically as a wage employee. An independent mini-salonshop worker operates their own business within the salon facility, often as a contractor, maintaining control over their own client base and schedule.

Who is required to file mini-salonshop employee and independent?

Both mini-salonshop employees and independent contractors are required to file taxes based on their earnings. Employees typically have taxes withheld by their employer, while independent contractors must report their income and pay self-employment taxes.

How to fill out mini-salonshop employee and independent?

To fill out the mini-salonshop employee and independent forms, one must provide personal information including name, address, Social Security number, and employment status. Employees will fill in details related to their employer, while independent contractors will need to include information about their business and clients.

What is the purpose of mini-salonshop employee and independent?

The purpose of mini-salonshop employee and independent forms is to accurately report income and tax obligations to the government, ensuring that both salon employees and independent contractors comply with taxation laws and regulations.

What information must be reported on mini-salonshop employee and independent?

The information that must be reported includes names, addresses, Social Security numbers, income earned, expenses related to the salon activities, and any applicable deductions or credits.

Fill out your mini-salonshop employee and independent online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mini-Salonshop Employee And Independent is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.