Get the free 2015 mo ptc fillable forms - dor mo

Get, Create, Make and Sign 2015 mo ptc forms

How to edit 2015 mo ptc forms online

Uncompromising security for your PDF editing and eSignature needs

Instructions and Help about 2015 mo ptc forms

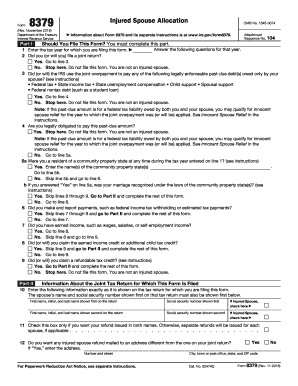

Oh, hello again so in this case I've actually gone back to an earlier return that one of my students prepared and what I've done is I've removed a lot of the income because we're going to look at a property tax credit so looking at the ages here looks like we've definitely got people who are eligible for the property tax credit because of their age, and so I'm going to type in the state information mo, and you can see that the Missouri 1040 page 1 and page 2 pops up as well as mo pts and so let's say this person lives in Boone even though it looks like they live in Palmyra, and we're going to come down here and this question of course will be defaulted to yes, and so we've got this mo pts here, and so we have to look at this and make some decisions, so the computer knows if someone's qualified because they're 65 years of age or older or one hundred percent disabled there are some boxes here for a hundred percent disabled veteran in 60 years of age and surviving spouse benefits, so there is some there are some cases where we actually have to make some decisions that's just a part of the property tax law so here we have a choice we can actually check the county or City real estate taxes or the rent and so let's do rent in this case, and you can see rent is good we can actually check both you might be in a situation where you might be in a situation where maybe you rent the land, but you pay county taxes on your mobile home and so that would be a case where you'd have both in this case we've got, and so I was going to say rent in this case we've got a married filing combined couple, and it looks like they have 200 hours worth of income, and we know that AGI, and then they're also getting 12000 and Social Security and that does count if they had any pensions not included on line one that that would go here but most of them would be veterans benefits before new directions and SS IO and different information would go here, so these are green you can see we can actually change these amounts here everything else really should flow now we have to make some choices he here check box if that applies so zero if filing statuses and go married living separate so had we chosen single or married living separate this box would kick in otherwise if you're married filing combined two thousand if he rented and did not order not own four thousand if you owned and occupied your home so these people we say they rent, so we're going to check the two thousand box, so there's a two-thousand-dollar deduction that kicks in and then waved against an if you rent it or do not occupy your home we're going to say you rented and the limit you can see is a little lower for renters okay you can see we chose rent and so that made this field here red, and so I will link from this field to a Missouri certification of rent paid, and basically we have to fill out all the red here, so we have to say are you related to your landlord most people know that check no for that landlords name...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2015 mo ptc forms in Gmail?

How do I complete 2015 mo ptc forms online?

How do I edit 2015 mo ptc forms straight from my smartphone?

What is mo ptc forms?

Who is required to file mo ptc forms?

How to fill out mo ptc forms?

What is the purpose of mo ptc forms?

What information must be reported on mo ptc forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.